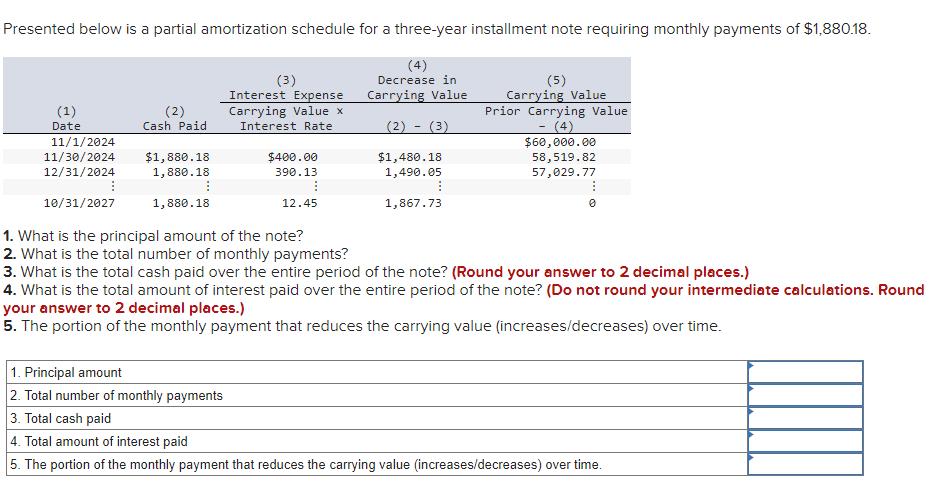

Question: Presented below is a partial amortization schedule for a three-year installment note requiring monthly payments of $1,880.18. (1) Date 11/1/2024 11/30/2024 12/31/2024 10/31/2027 (2)

Presented below is a partial amortization schedule for a three-year installment note requiring monthly payments of $1,880.18. (1) Date 11/1/2024 11/30/2024 12/31/2024 10/31/2027 (2) Cash Paid $1,880.18 1,880.18 1,880.18 (3) Interest Expense Carrying Value x Interest Rate $400.00 390.13 (4) Decrease in Carrying Value - (2) (3) $1,480.18 1,490.05 12.45 1,867.73 (5) Carrying Value Prior Carrying Value - (4) $60,000.00 58,519.82 57,029.77 1. What is the principal amount of the note? 2. What is the total number of monthly payments? 3. What is the total cash paid over the entire period of the note? (Round your answer to 2 decimal places.) 4. What is the total amount of interest paid over the entire period of the note? (Do not round your intermediate calculations. Round your answer to 2 decimal places.) 5. The portion of the monthly payment that reduces the carrying value (increases/decreases) over time. 1. Principal amount 2. Total number of monthly payments 3. Total cash paid 4. Total amount of interest paid 5. The portion of the monthly payment that reduces the carrying value (increases/decreases) over time.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts