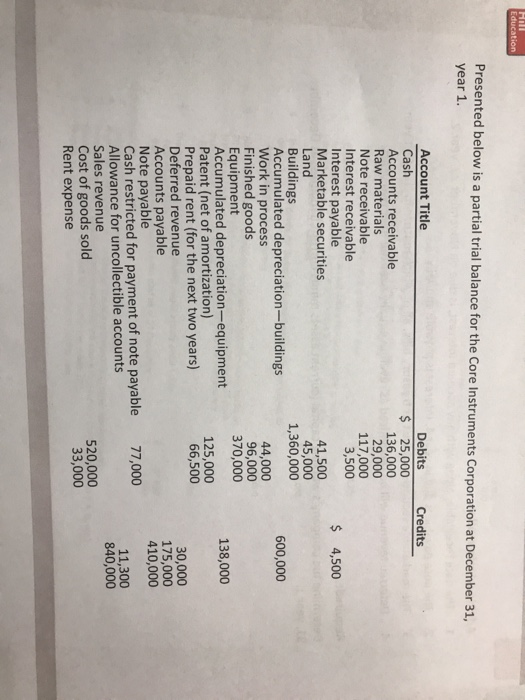

Question: Presented below is a partial trial balance for the Core Instruments Corporation at December 31, year 1. Account Title Cash Accounts receivable Raw materials Note

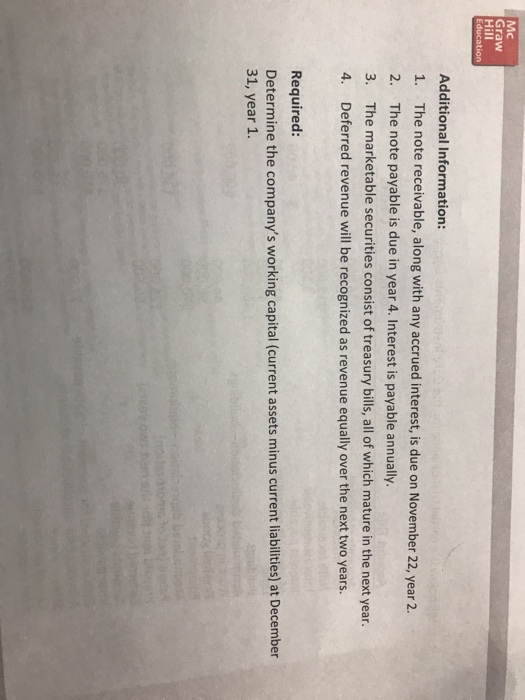

Presented below is a partial trial balance for the Core Instruments Corporation at December 31, year 1. Account Title Cash Accounts receivable Raw materials Note receivable Interest receivable Interest payable Marketable securities Land Buildings Accumulated depreciation-buildings Work in process Finished goods Equipment Accumulated depreciation-equipment Patent (net of amortization) Prepaid rent (for the next two years) Deferred revenue Accounts payable Note payable Cash restricted for payment of note payable Allowance for uncollectible accounts Sales revenue Debits Credits 25,000 136,000 29,000 117,000 3,500 4,500 41,500 45,000 1,360,000 600,000 44,000 96,000 370,000 2 138,000 125,000 66,500 30,000 175,000 410,000 77,000 11,300 Cost of goods sold Rent expense 520,000 33,000 9 Mc Graw Hill Education Additional Information: 1. The note receivable, along with any accrued interest, is due on November 22, year 2. 2. The note payable is due in year 4. Interest is payable annually. 3. The marketable securities consist of treasury bills, all of which mature in the next year. 4. Deferred revenue will be recognized as revenue equally over the next two years. Required: Determine the company's working capital (current assets minus current liabilities) at December 31, year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts