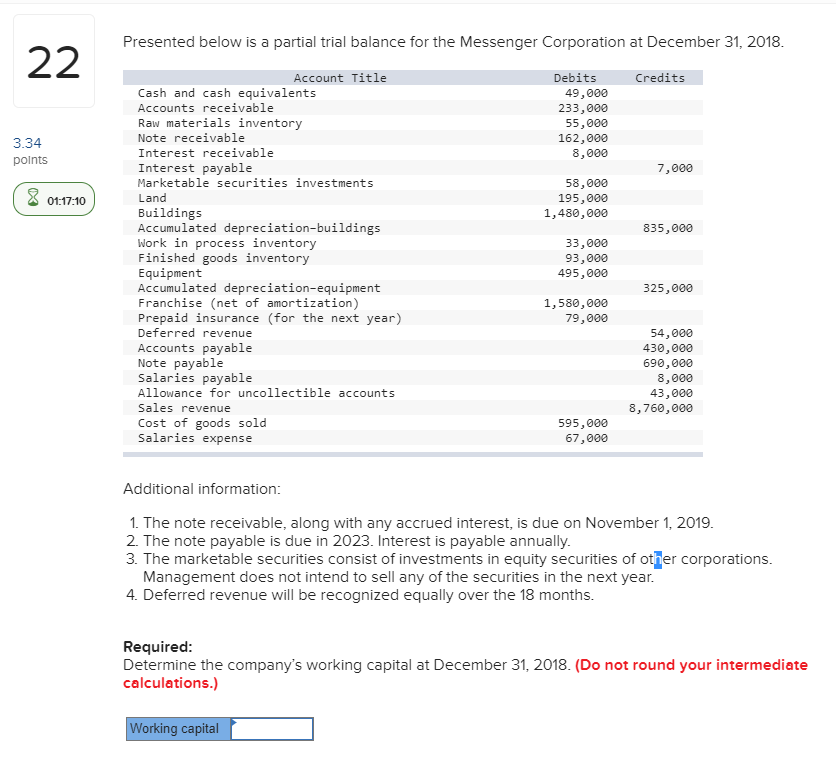

Question: Presented below is a partial trial balance for the Messenger Corporation at December 31, 2018. 22 Account Title Debits Credits Cash and cash equivalents Accounts

Presented below is a partial trial balance for the Messenger Corporation at December 31, 2018. 22 Account Title Debits Credits Cash and cash equivalents Accounts receivable Raw materials inventory Note receivable 49,000 233,000 55,000 162,000 8,000 3.34 Interest receivable polnts Interest payable 7,000 Marketable securities investments 58,000 195,000 Land 01:17:10 Buildings Accumulated depreciation-buildings Work in process inventory Finished goods inventory Equipment Accumulated depreciation-equipment Franchise (net of amortization) Prepaid insurance (for the next year) Deferred revenue 1,480,000 835,000 33,000 93,000 495,000 325,000 1,580,000 79,000 54,000 430,000 690,000 8,000 Accounts payable Note payable Salaries payable Allowance for uncollectible accounts 43,000 Sales revenue Cost of goods sold 8,760,000 595,000 67,000 Sala expense Additional information: 1. The note receivable, along with any accrued interest, is due on November 1, 2019. 2. The note payable is due in 2023. Interest is payable annually. 3. The marketable securities consist of investments in equity securities of otner corporations. Management does not intend to sell any of the securities in the next year. 4. Deferred revenue will be recognized equally over the 18 months. Required: Determine the company's working capital at December 31, 2018. (Do not round your intermediate calculations.) Working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts