Question: Presented below is an audit report prepared and signed by Ross Ewage, Chartered Professional Accountant. He completed the audit on January 5, 2020 and issued

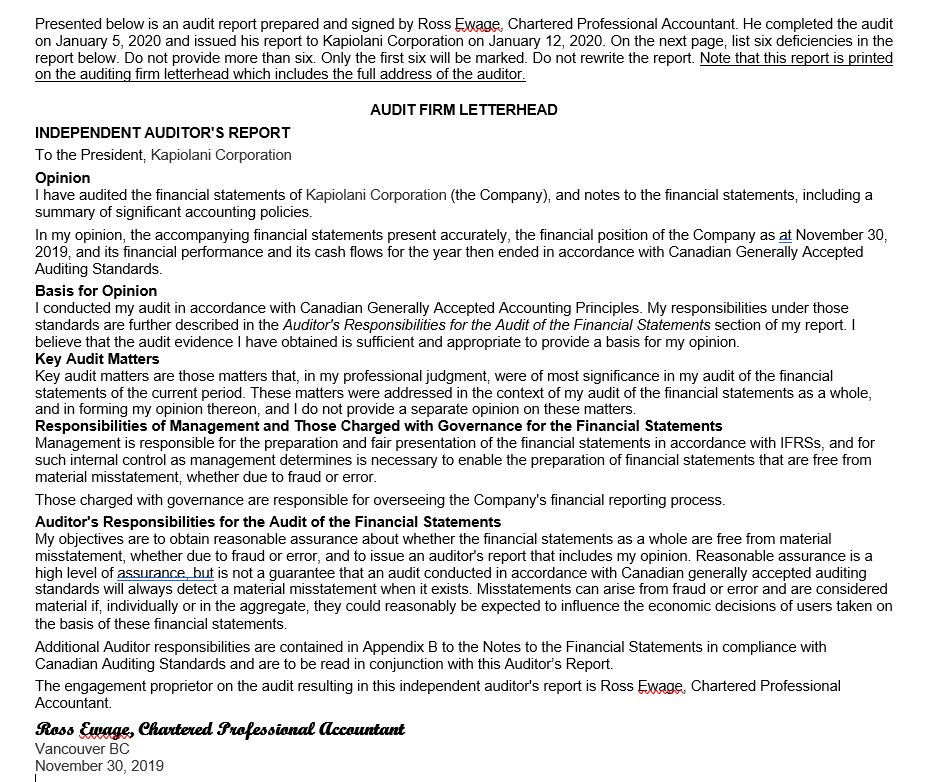

Presented below is an audit report prepared and signed by Ross Ewage, Chartered Professional Accountant. He completed the audit on January 5, 2020 and issued his report to Kapiolani Corporation on January 12, 2020. On the next page, list six deficiencies in the report below. Do not provide more than six. Only the first six will be marked. Do not rewrite the report. Note that this report is printed on the auditing firm letterhead which includes the full address of the auditor. AUDIT FIRM LETTERHEAD INDEPENDENT AUDITOR'S REPORT To the President, Kapiolani Corporation Opinion I have audited the financial statements of Kapiolani Corporation (the Company), and notes to the financial statements, including a summary of significant accounting policies. In my opinion, the accompanying financial statements present accurately, the financial position of the Company as at November 30, 2019, and its financial performance and its cash flows for the year then ended in accordance with Canadian Generally Accepted Auditing Standards. Basis for Opinion I conducted my audit in accordance with Canadian Generally Accepted Accounting Principles. My responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of my report. I believe that the audit evidence I have obtained is sufficient and appropriate to provide a basis for my opinion. Key Audit Matters Key audit matters are those matters that, in my professional judgment, were of most significance in my audit of the financial statements of the current period. These matters were addressed in the context of my audit of the financial statements as a whole, and in forming my opinion thereon, and I do not provide a separate opinion on these matters. Responsibilities of Management and Those Charged with Governance for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with IFRSs, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Those charged with governance are responsible for overseeing the Company's financial reporting process. Auditor's Responsibilities for the Audit of the Financial Statements My objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes my opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements. Additional Auditor responsibilities are contained in Appendix B to the Notes to the Financial Statements in compliance with Canadian Auditing Standards and are to be read in conjunction with this Auditor's Report. The engagement proprietor on the audit resulting in this independent auditor's report is Ross Ewage, Chartered Professional Accountant Ross Ewage, Chartered Srofessional Accountant Vancouver BC November 30, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts