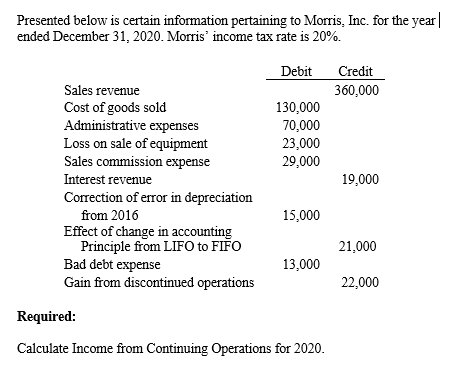

Question: Presented below is certain information pertaining to Morris, Inc. for the year| ended December 31, 2020. Morris' income tax rate is 20%. Debit Credit 360,000

Presented below is certain information pertaining to Morris, Inc. for the year| ended December 31, 2020. Morris' income tax rate is 20%. Debit Credit 360,000 130,000 70,000 23,000 29,000 Sales revenue Cost of goods sold Administrative expenses Loss on sale of equipment Sales commission expense Interest revenue Correction of error in depreciation from 2016 Effect of change in accounting Principle from LIFO to FIFO Bad debt expense Gain from discontinued operations 19,000 15,000 21,000 13,000 22,000 Required: Calculate Income from Continuing Operations for 2020

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock