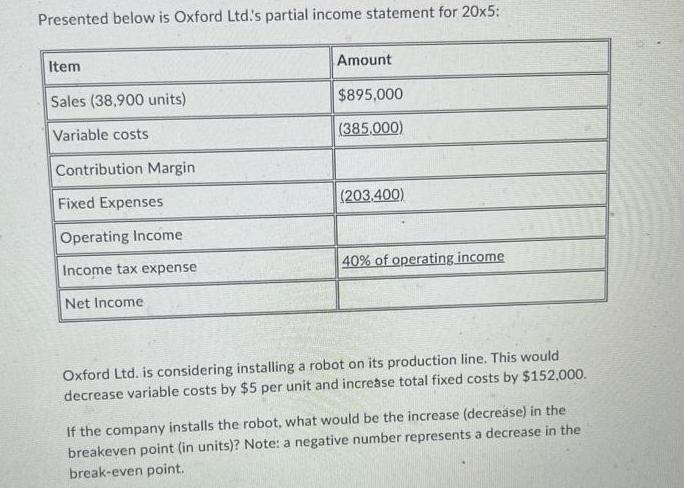

Question: Presented below is Oxford Ltd.'s partial income statement for 20x5: Item Sales (38,900 units) Variable costs Contribution Margin Fixed Expenses Operating Income Income tax

Presented below is Oxford Ltd.'s partial income statement for 20x5: Item Sales (38,900 units) Variable costs Contribution Margin Fixed Expenses Operating Income Income tax expense Net Income Amount $895,000 (385,000) (203,400) 40% of operating income Oxford Ltd. is considering installing a robot on its production line. This would decrease variable costs by $5 per unit and increase total fixed costs by $152,000. If the company installs the robot, what would be the increase (decrease) in the breakeven point (in units)? Note: a negative number represents a decrease in the break-even point.

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

To calculate the missing values in the partial income statement for Oxford Ltd for 20x5 we can use t... View full answer

Get step-by-step solutions from verified subject matter experts