Question: Presented below is the 2018 income statement and comparative balance sheet information for Tiger Enterprises. Required: Prepare Tigers statement of cash flows, using the indirect

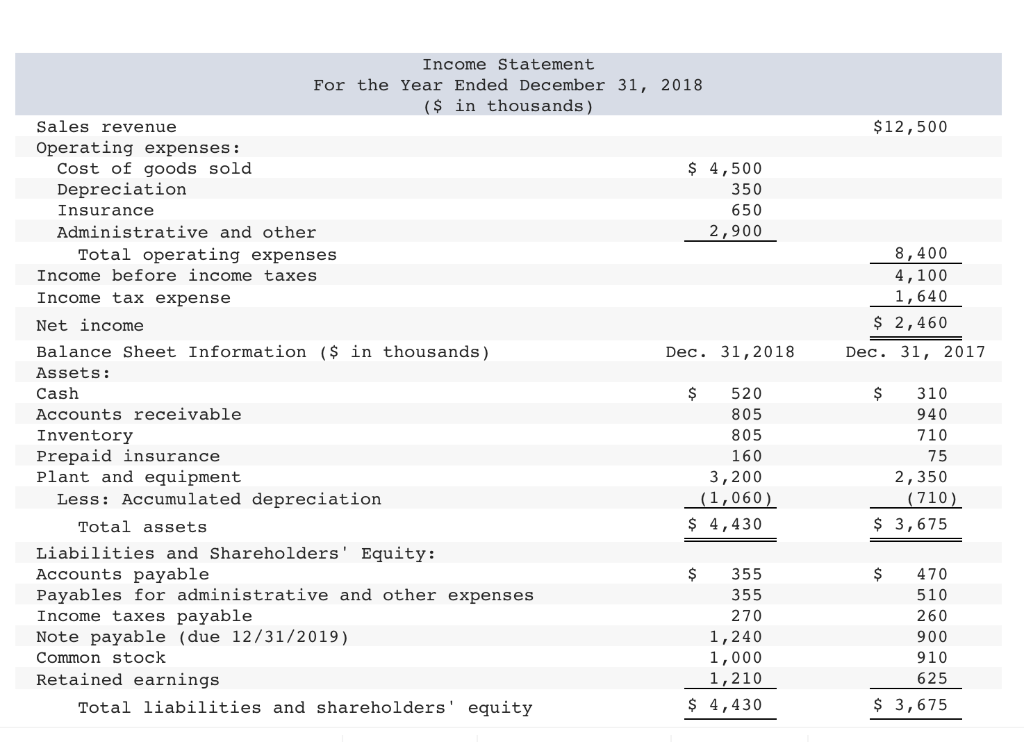

Presented below is the 2018 income statement and comparative balance sheet information for Tiger Enterprises.

Required: Prepare Tigers statement of cash flows, using the indirect method to present cash flows from operating activities. (Hint: You will have to calculate dividend payments). (Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign.)

Income Statement For the Year Ended December 31, 2018 ($ in thousands) Sales revenue $12,500 Operating expenses: $ 4,500 350 650 2,900 Cost of goods sold Depreciation Insurance Administrative and other 8,400 4,100 1,640 $ 2,460 Total operating expenses Income before income taxes Income tax expense Net income Balance Sheet Information ($ in thousands) Assets: Cash Accounts receivable Inventory Prepaid insurance Plant and equipment Dec. 31,2018 Dec. 31, 2017 $ 520 805 805 160 3,200 (1,060 $ 310 940 710 75 2,350 710 Less: Accumulated depreciation Total assets $ 4,43 $ 3,675 Liabilities and Shareholders' Equity: Accounts payable Payables for administrative and other expenses Income taxes payable Note payable (due 12/31/2019) Common stock Retained earnings $355 355 270 1,240 1,000 1,210 $ 4,430 $ 470 510 260 900 910 625 $ 3,675 Total liabilities and shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts