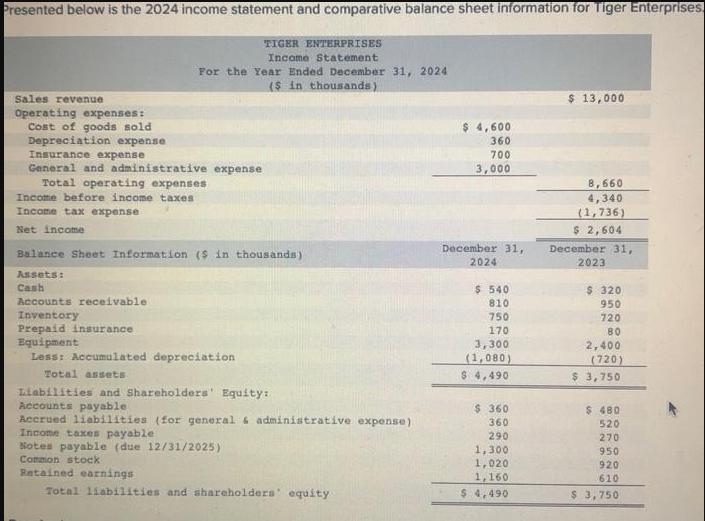

Question: Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Sales revenue Operating expenses: Cost of goods sold Depreciation

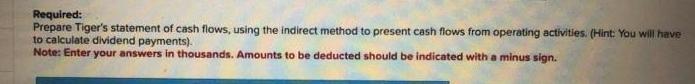

Presented below is the 2024 income statement and comparative balance sheet information for Tiger Enterprises. Sales revenue Operating expenses: Cost of goods sold Depreciation expense For the Year Ended December 31, 2024 ($ in thousands) Insurance expense General and administrative expense TIGER ENTERPRISES Income Statement Total operating expenses Income before income taxes Income tax expense Net income Balance Sheet Information ($ in thousands) Assets: Cash Accounts receivable Inventory Prepaid insurance Equipment Less: Accumulated depreciation Total assets Liabilities and Shareholders' Equity: Accounts payable Accrued liabilities (for general & administrative expense) Income taxes payable Notes payable (due 12/31/2025) Common stock Retained earnings Total liabilities and shareholders' equity $4,600 360 700 3,000 December 31, 2024 $ 540 810 750 170 3,300 (1,080) $ 4,490 $360 360 290 1,300 1,020 1,160 $ 4,490 $ 13,000 8,660 4,340 (1,736) $ 2,604 December 31, 2023 $ 320 950 720 80 2,400 (720) $ 3,750 $ 480 520 270 950 920 610 $3,750 Required: Prepare Tiger's statement of cash flows, using the indirect method to present cash flows from operating activities. (Hint: You will have to calculate dividend payments). Note: Enter your answers in thousands. Amounts to be deducted should be indicated with a minus sign. Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: ($ in thousands) Net cash flows from operating activities Cash flows from investing activities: Net cash flows from investing activities Cash flows from financing activities: Net cash flows from financing activities Net increase in cash Cash, January 1. Cash, December 31

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

TIGER ENTERPRISES Statement of Cash Flows For the Year Ended December 31 2024 in thousa... View full answer

Get step-by-step solutions from verified subject matter experts