Question: Presented here are selected transactions for Cullumber Limited for 2018. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery truck

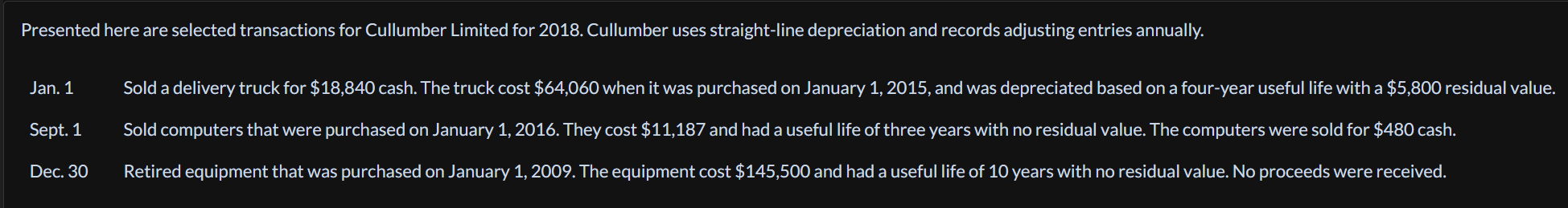

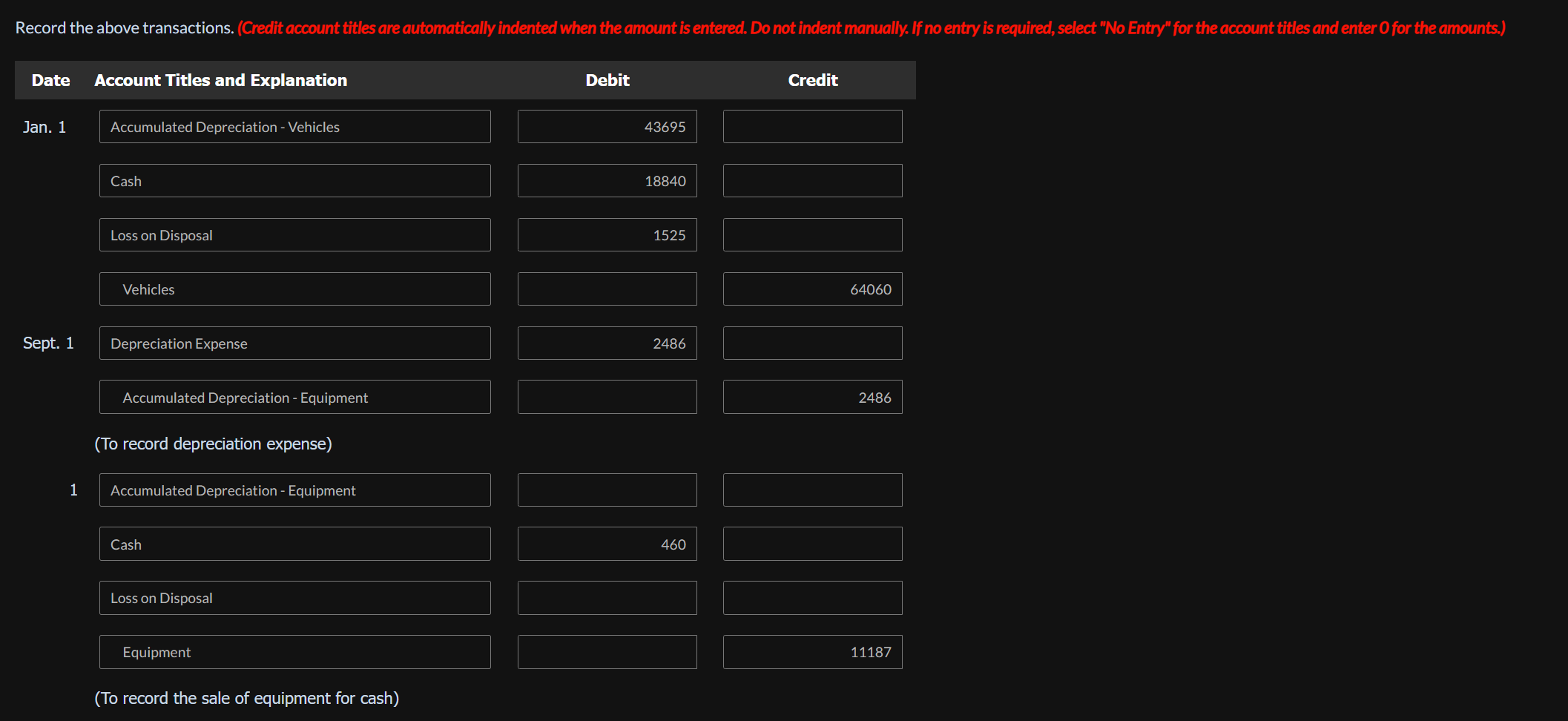

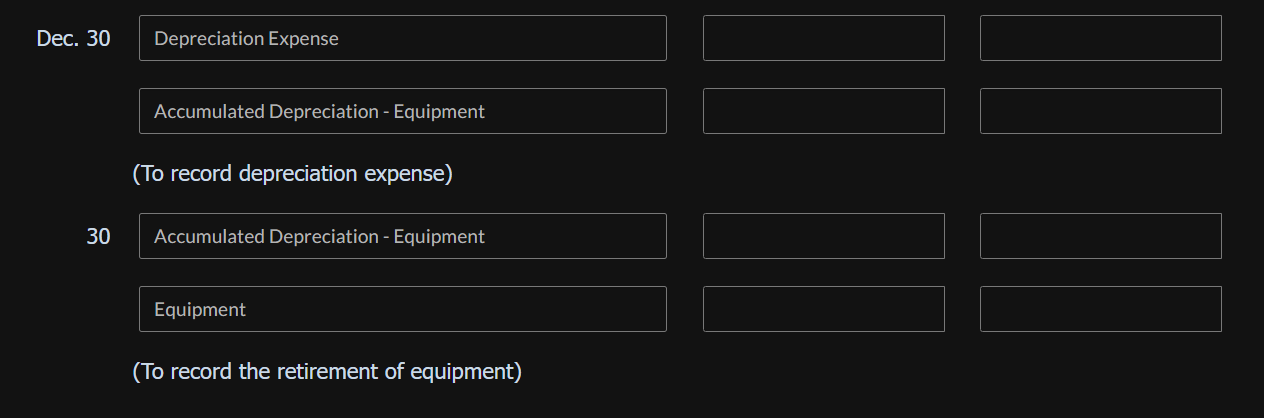

Presented here are selected transactions for Cullumber Limited for 2018. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sold a delivery truck for $18,840 cash. The truck cost $64,060 when it was purchased on January 1,2015 , and was depreciated based on a four-year useful life with a $5,800 residual value. Sept. 1 Sold computers that were purchased on January 1,2016 . They cost $11,187 and had a useful life of three years with no residual value. The computers were sold for $480 cash. Dec. 30 Retired equipment that was purchased on January 1,2009 . The equipment cost $145,500 and had a useful life of 10 years with no residual value. No proceeds were received. (To record depreciation expense) 1 Accumulated Depreciation - Equipment Cash Loss on Disposal Equipment 11187 (To record the sale of equipment for cash) Dec. 30 Depreciation Expense Accumulated Depreciation - Equipment (To record depreciation expense) 30 Accumulated Depreciation - Equipment Equipment (To record the retirement of equipment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts