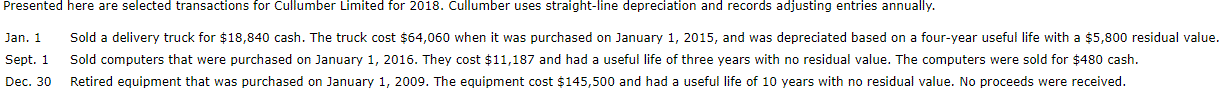

Question: Presented here are selected transactions for Cullumber Limited for 2018. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sept. 1 Dec. 30

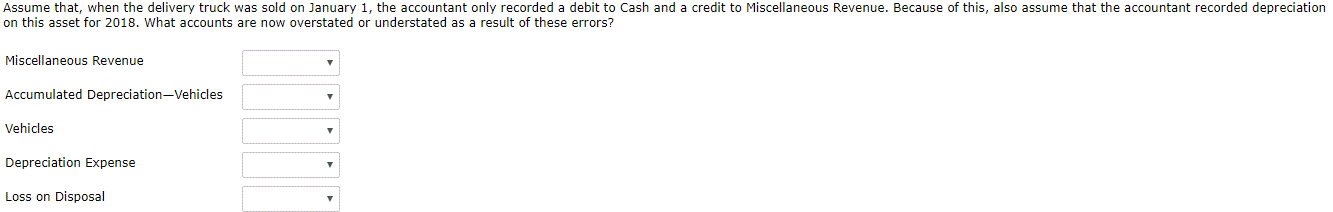

Presented here are selected transactions for Cullumber Limited for 2018. Cullumber uses straight-line depreciation and records adjusting entries annually. Jan. 1 Sept. 1 Dec. 30 Sold a delivery truck for $18,840 cash. The truck cost $64,060 when it was purchased on January 1, 2015, and was depreciated based on a four-year useful life with a $5,800 residual value. Sold computers that were purchased on January 1, 2016. They cost $11,187 and had a useful life of three years with no residual value. The computers were sold for $480 cash. Retired equipment that was purchased on January 1, 2009. The equipment cost $145,500 and had a useful life of 10 years with no residual value. No proceeds were received. Assume that, when the delivery truck was sold on January 1, the accountant only recorded a debit to Cash and a credit to Miscellaneous Revenue. Because of this, also assume that the accountant recorded depreciation on this asset for 2018. What accounts are now overstated or understated as a result of these errors? Miscellaneous Revenue Accumulated Depreciation-Vehicles Vehicles Depreciation Expense Loss on Disposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts