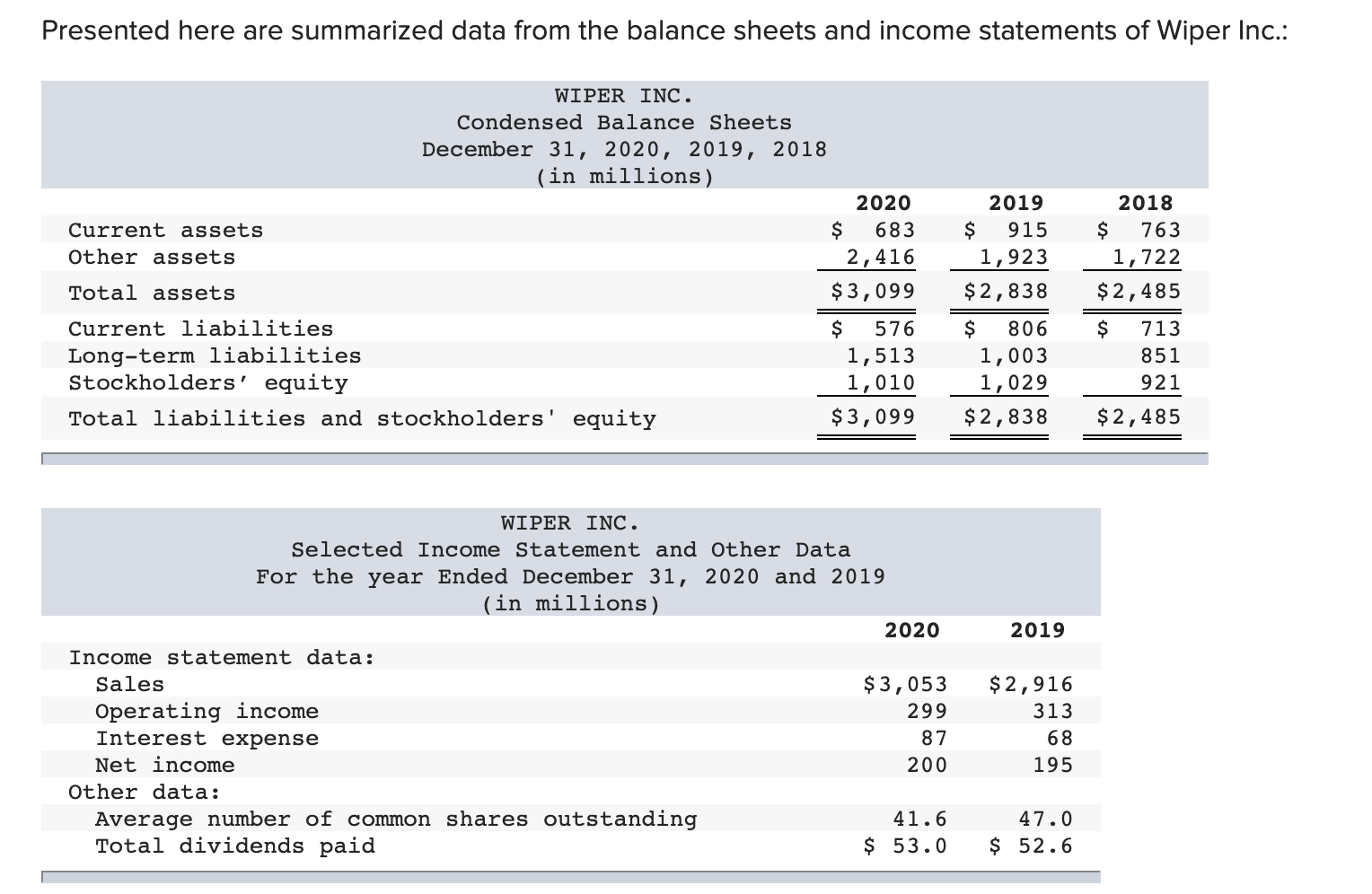

Question: Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018

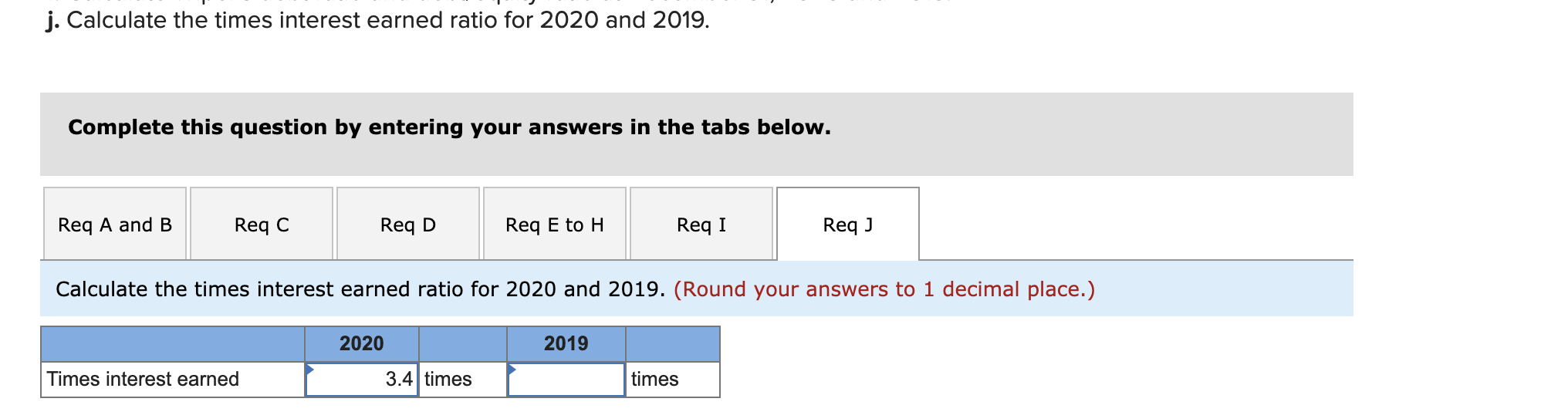

Presented here are summarized data from the balance sheets and income statements of Wiper Inc.: WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018 (in millions) 2020 Current assets $ 683 Other assets 2,416 Total assets $ 3,099 Current liabilities $ 576 Long-term liabilities 1,513 Stockholders' equity 1,010 Total liabilities and stockholders' equity $3,099 2019 $ 915 1,923 $ 2,838 $ 806 1,003 1,029 $2,838 2018 $ 763 1,722 $ 2,485 $ 713 851 921 $2,485 2019 WIPER INC. Selected Income Statement and Other Data For the year Ended December 31, 2020 and 2019 (in millions) 2020 Income statement data: Sales $3,053 Operating income 299 Interest expense 87 Net income 200 Other data: Average number of common shares outstanding 41.6 Total dividends paid $ 53.0 $2,916 313 68 195 47.0 $ 52.6 j. Calculate the times interest earned ratio for 2020 and 2019. Complete this question by entering your answers in the tabs below. Req A and B Reg A and B Reqc Reqc Req D Reg D Req E to H Req Eto H Reg I Reg I Req) Reqj Calculate the times interest earned ratio for 2020 and 2019. (Round your answers to 1 decimal place.) 2020 2019 Times interest earned 3.4 times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts