Question: Presented here are summarized data from the balance sheets and income statements of Wiper Incorporated: Required: a . Calculate return on investment, based on net

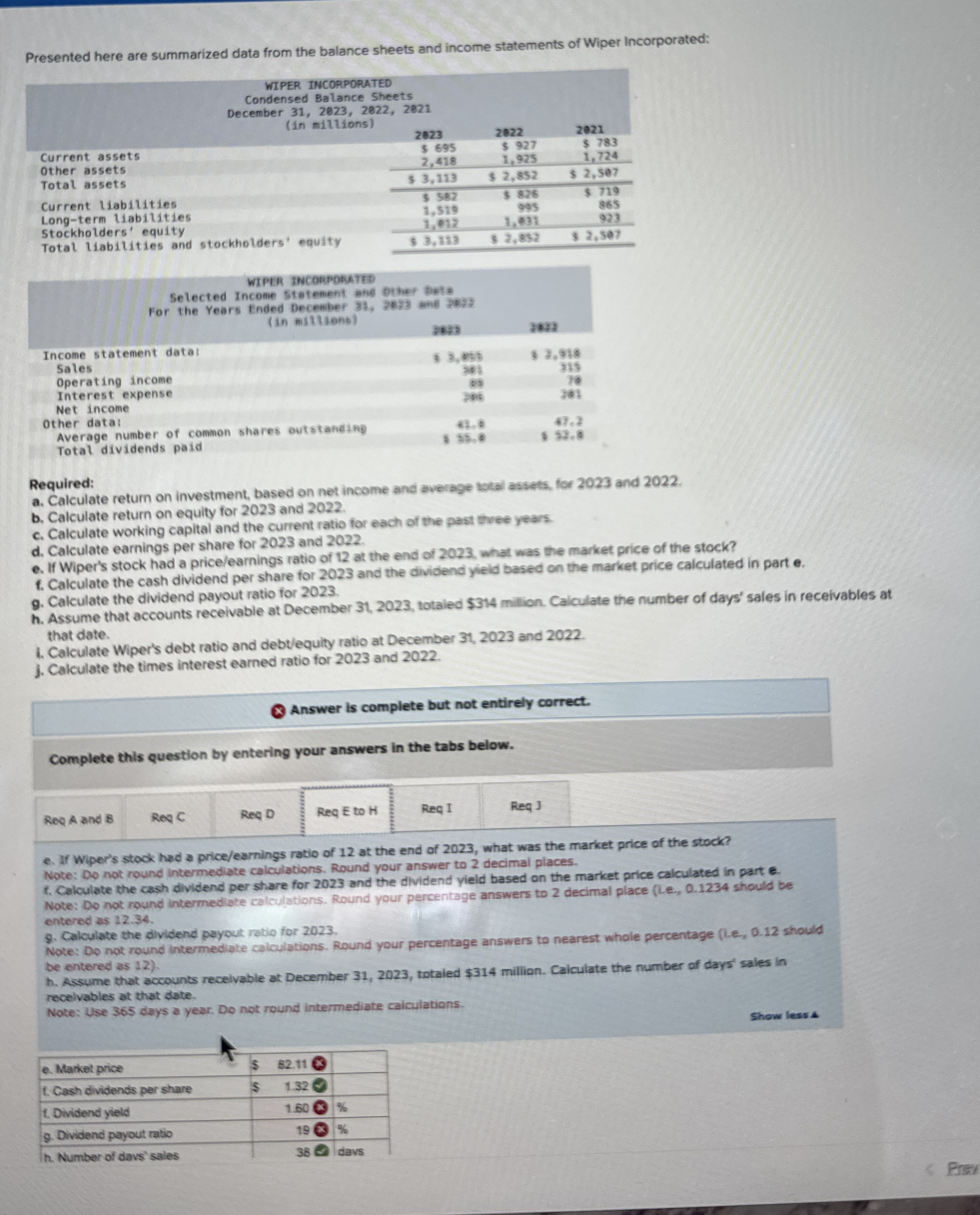

Presented here are summarized data from the balance sheets and income statements of Wiper Incorporated:

Required:

a Calculate return on investment, based on net income and average total assets, for and

b Calculate return on equity for and

c Calculate working capital and the current ratio for each of the past twee years.

d Calculate earnings per share for and

e If Wiper's stock had a priceearnings ratio of at the end of what was the market price of the stock?

f Calculate the cash dividend per share for and the dividend yield based on the market price calculated in part

Calculate the dividend payout ratio for

h Assume that accounts recelvable at December totaled $ milion. Calculate the number of days' sales in receivables at that date.

Calculate Wiper's debt ratio and debtequity ratio at December and

J Calculate the times interest earned ratio for and

Answer is complete but not entirely correct.

Complete this question by entering your answers in the tabs below.

Req A and

Rea

Req D

Req E to H

Req I

Req

e If Wiper's stook had a priceearnings ratio of at the end of what was the market price of the stock? Note: Do not round intermediate calculations. Round your answer to decimal places.

Calculate the cash dividend per share for and the dividend yield based on the market price calculated in part e Note: Do not round intermedate calculations. Round your percentage answers to decimal place le should be entered as

Calculate the dividend payput ratio for

Note: Do not round intermediate calculations. Round your percentage answers to nearest whole percentage le should be entered as

h Assume that accounts recelvable at December totaled $ millian. Calculate the number of days' sales in recelvables at that date.

Note: Use days a year. Do not round intermediate calculations.

Show less a

tablee Mariket price,$ f Cash dividends per share,$ Dividend yield, Dividend payout ratio,h Number of davs' sales,davs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock