Question: Presented here are summarized data from the balance sheets and income statements of Wiper Incorporated: table [ [ table [ [ WIPER INCORPORATED

Presented here are summarized data from the balance sheets and income statements of Wiper Incorporated:

tabletableWIPER INCORPORATEDCondensed Balance Sheets December in millionsCurrent assets,$ $ $ Other assets,Total assets,$ $ $ Current liabilities,$ $ $ Longterm liabilities,Stockholders equity Total liabilities and stockholders' equity,Total liabilities and stockholders' equity,$ $ $

tableSelected Income Statement and Other Data For the Years Ended December and in millionsIncome statement data:,SalesOperating in$ $ Interest exp,Net income,Other data:,Average number of common share,,Total dividends paid,

$$

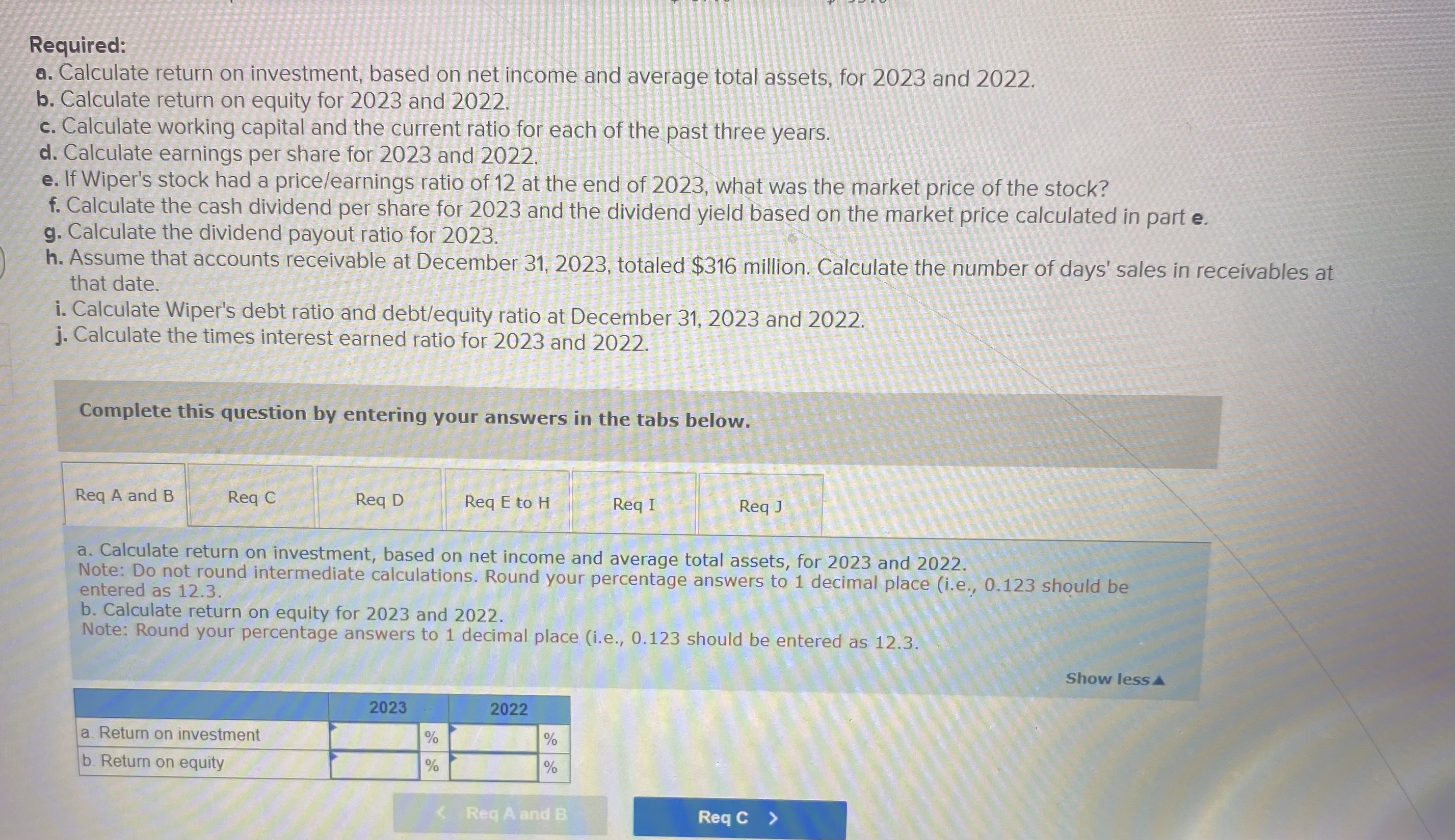

Required:

a Calculate return on investment, based on net income and average total assets, for and

b Calculate return on equity for and

c Calculate working capital and the current ratio for each of the past three years.

d Calculate earnings per share for and

e If Wiper's stock had a priceearnings ratio of at the end of what was the market price of the stock?

f Calculate the cash dividend per share for and the dividend yield based on the market price calculated in part

g Calculate the dividend payout ratio for

h Assume that accounts receivable at December totaled $ million. Calculate the number of days' sales in receivables at that date.

i Calculate Wiper's debt ratio and debtequity ratio at December and

j Calculate the times interest earned ratio for and

Complete this question by entering your answers in the tabs below.

Req A and

Req C

Req D

Req E to H

Req I

Req J

a Calculate return on investment, based on net income and average total assets, for and

Note: Do not round intermediate calculations. Round your percentage answers to decimal place ie should be entered as

b Calculate return on equity for and

Note: Round your percentage answers to decimal place ie should be entered as

Show less

tablea Return on investment,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock