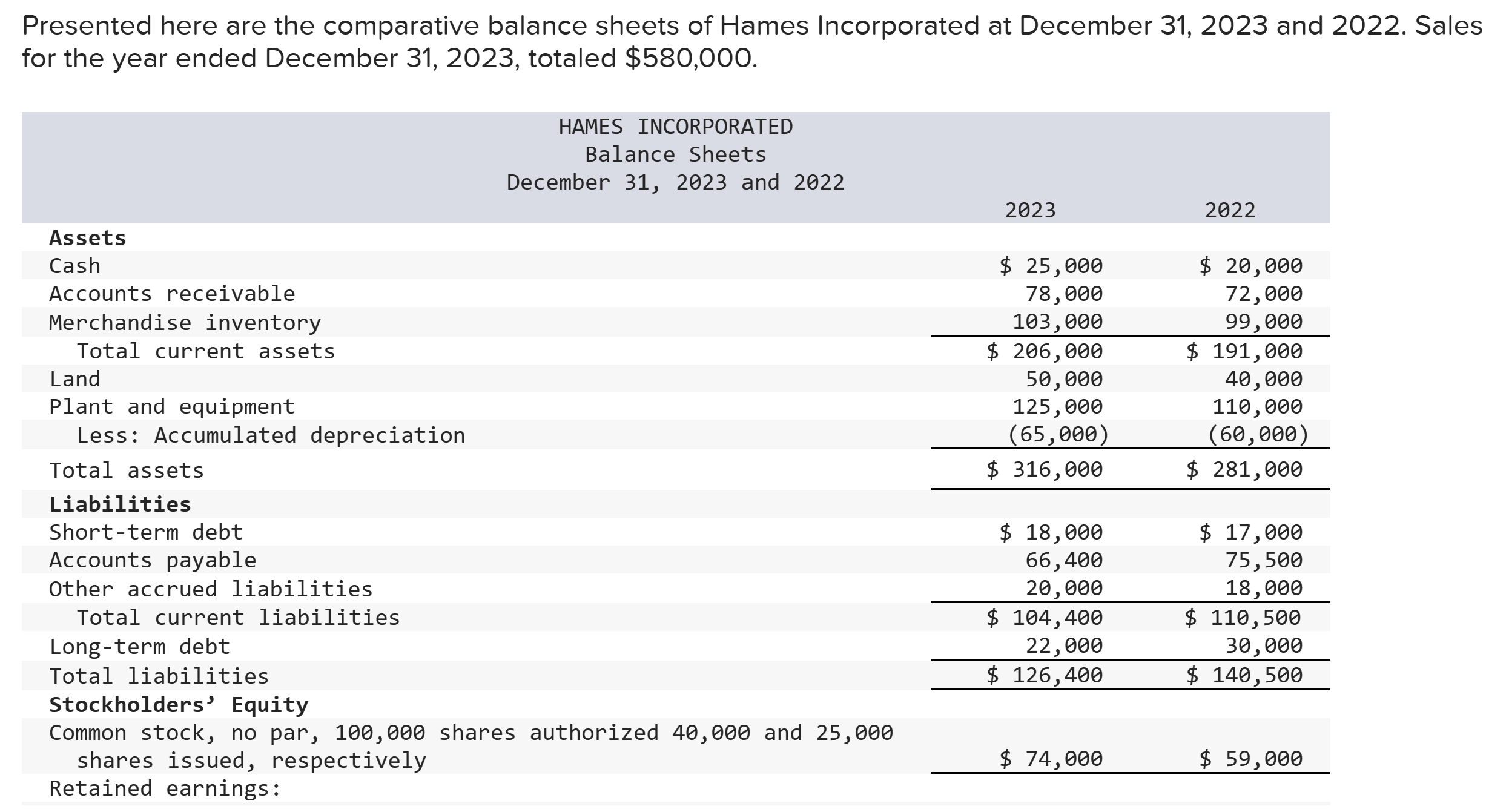

Question: Presented here are the comparative balance sheets of Hames Incorporated at December 31, 2023 and 2022. Sal for the year ended December 31, 2023, totaled

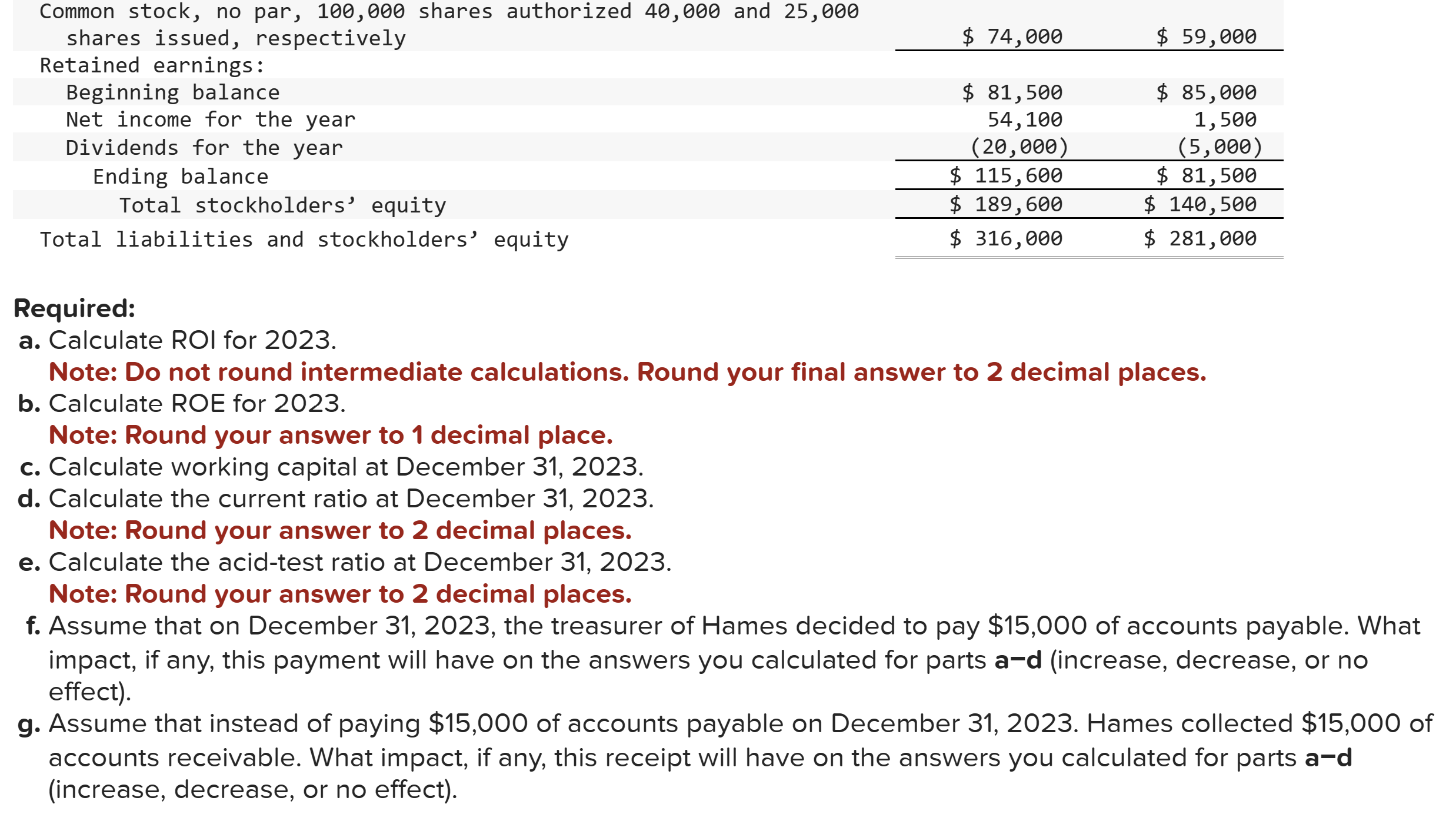

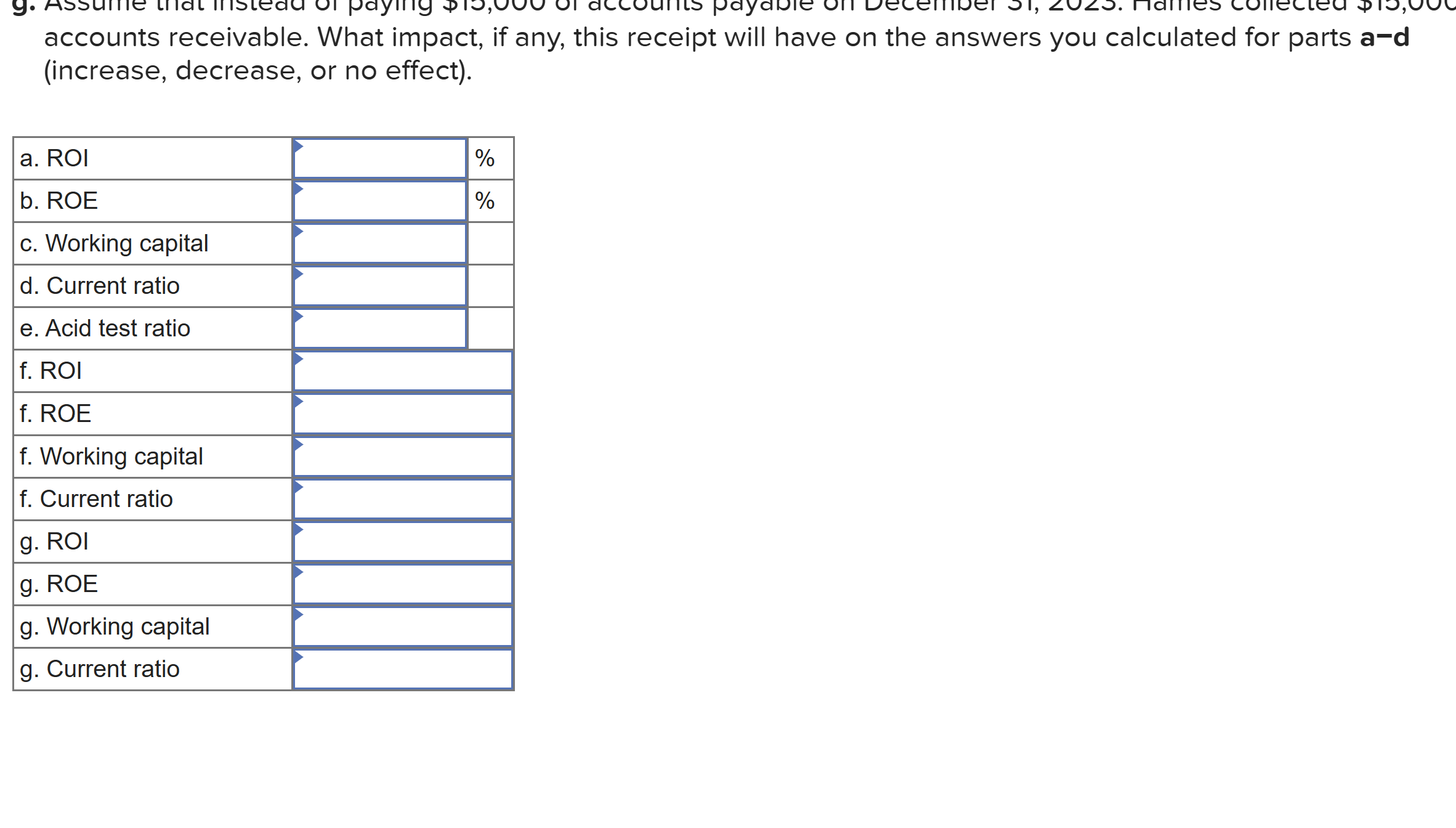

Presented here are the comparative balance sheets of Hames Incorporated at December 31, 2023 and 2022. Sal for the year ended December 31, 2023, totaled $580,000. Required: a. Calculate ROI for 2023. Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. b. Calculate ROE for 2023. Note: Round your answer to 1 decimal place. c. Calculate working capital at December 31, 2023. d. Calculate the current ratio at December 31, 2023. Note: Round your answer to 2 decimal places. e. Calculate the acid-test ratio at December 31, 2023. Note: Round your answer to 2 decimal places. f. Assume that on December 31, 2023, the treasurer of Hames decided to pay $15,000 of accounts payable. What impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect). g. Assume that instead of paying $15,000 of accounts payable on December 31,2023 . Hames collected $15,000 of accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts ad (increase, decrease, or no effect). accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect). Presented here are the comparative balance sheets of Hames Incorporated at December 31, 2023 and 2022. Sal for the year ended December 31, 2023, totaled $580,000. Required: a. Calculate ROI for 2023. Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. b. Calculate ROE for 2023. Note: Round your answer to 1 decimal place. c. Calculate working capital at December 31, 2023. d. Calculate the current ratio at December 31, 2023. Note: Round your answer to 2 decimal places. e. Calculate the acid-test ratio at December 31, 2023. Note: Round your answer to 2 decimal places. f. Assume that on December 31, 2023, the treasurer of Hames decided to pay $15,000 of accounts payable. What impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect). g. Assume that instead of paying $15,000 of accounts payable on December 31,2023 . Hames collected $15,000 of accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts ad (increase, decrease, or no effect). accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts