Question: Pretty sure Example 4 is correct, it may not be. But how would FV be calculated for Example 5 and how would the accumulated 200,000

Pretty sure Example 4 is correct, it may not be. But how would FV be calculated for Example 5 and how would the accumulated 200,000 be incorporated into the formula?

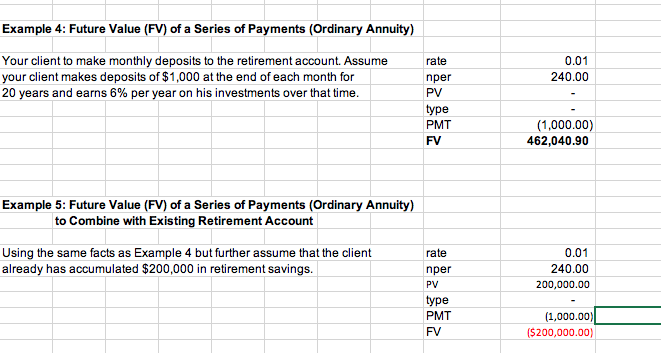

Example 4: Future Value (FV) of a Series of Payments (Ordinary Annuity) Your client to make monthly deposits to the retirement account. Assume your client makes deposits of $1,000 at the end of each month for 20 years and earns 6% per year on his investments over that time. 0.01 240.00 rate nper PV type PMT FV (1,000.00) 462,040.90 Example 5: Future Value (FV) of a Series of Payments (Ordinary Annuity) to Combine with Existing Retirement Account Using the same facts as Example 4 but further assume that the client already has accumulated $200,000 in retirement savings. 0.01 240.00 200,000.00 rate nper PV type PMT FV (1,000.00) ($ 200,000.00)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts