Question: Prev Up Next 1 pt) Consider a treasury bond with face value of 10000 dollars and several years to maturity The bond pays coupons of

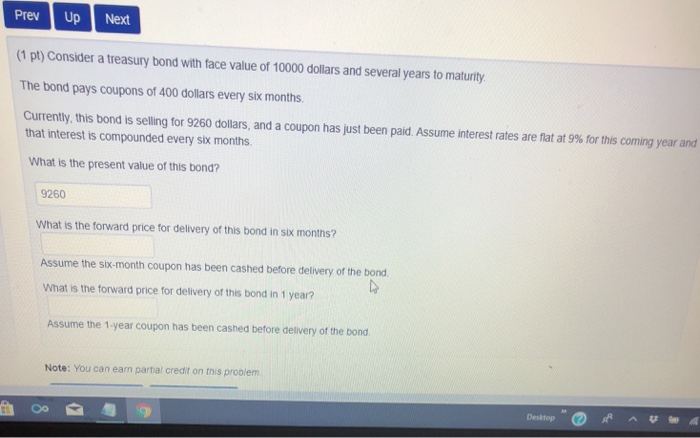

Prev Up Next 1 pt) Consider a treasury bond with face value of 10000 dollars and several years to maturity The bond pays coupons of 400 dollars every six months Currently, this bond is selling for 9260 dollars, and a coupon has just been paid. Assume interest rates are flat at 9% for this coming year and that interest is compounded every six months What is the present value of this bond? 9260 What is the forward price for delivery of this bond in six months? Assume the six-month coupon has been cashed before delivery of the bond What is the forward price for delivery of this bond in 1 year? Assume the 1-year coupon has been cashed before delivery of the bond Note: You can earn partial credit on this problem Desktop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts