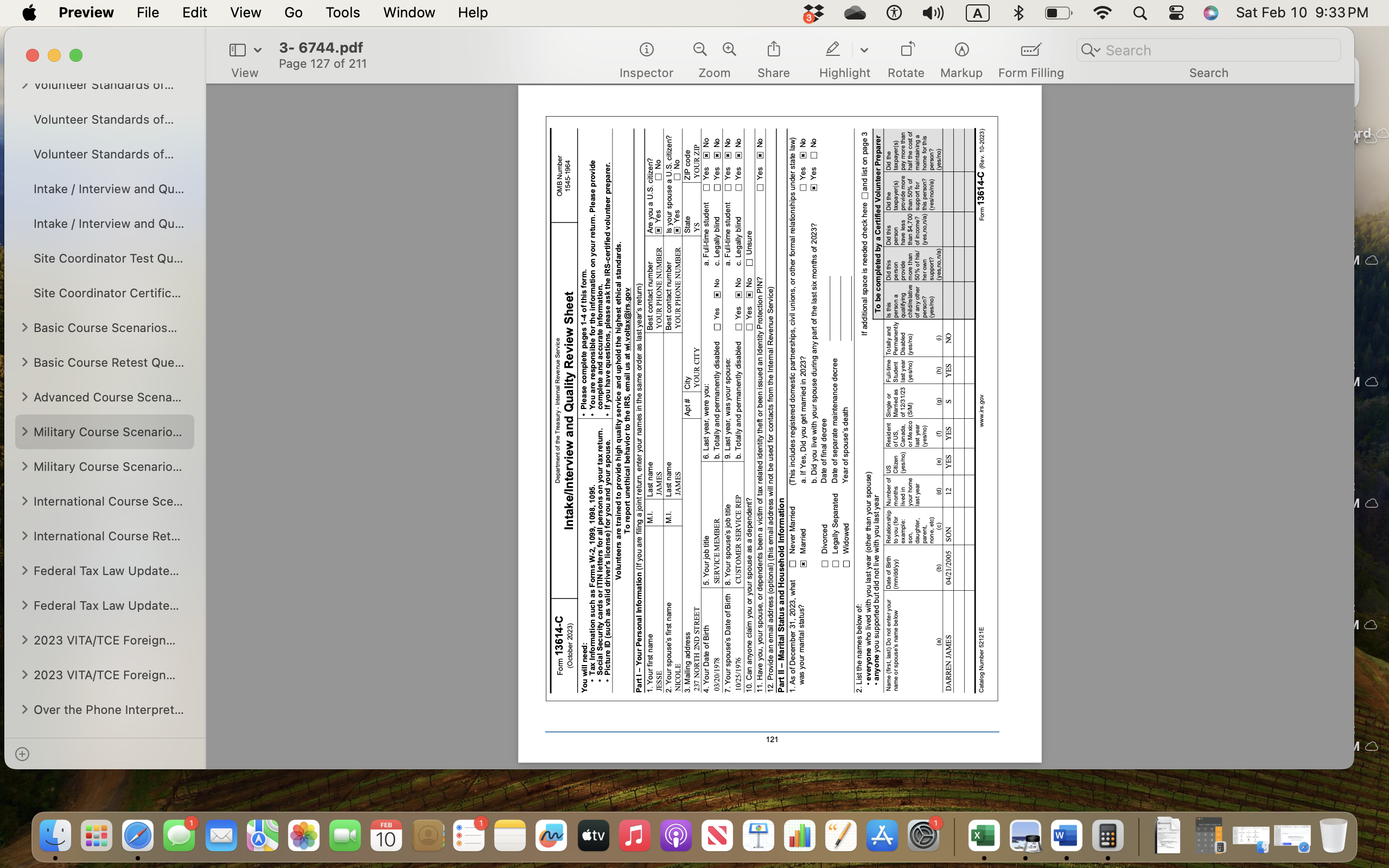

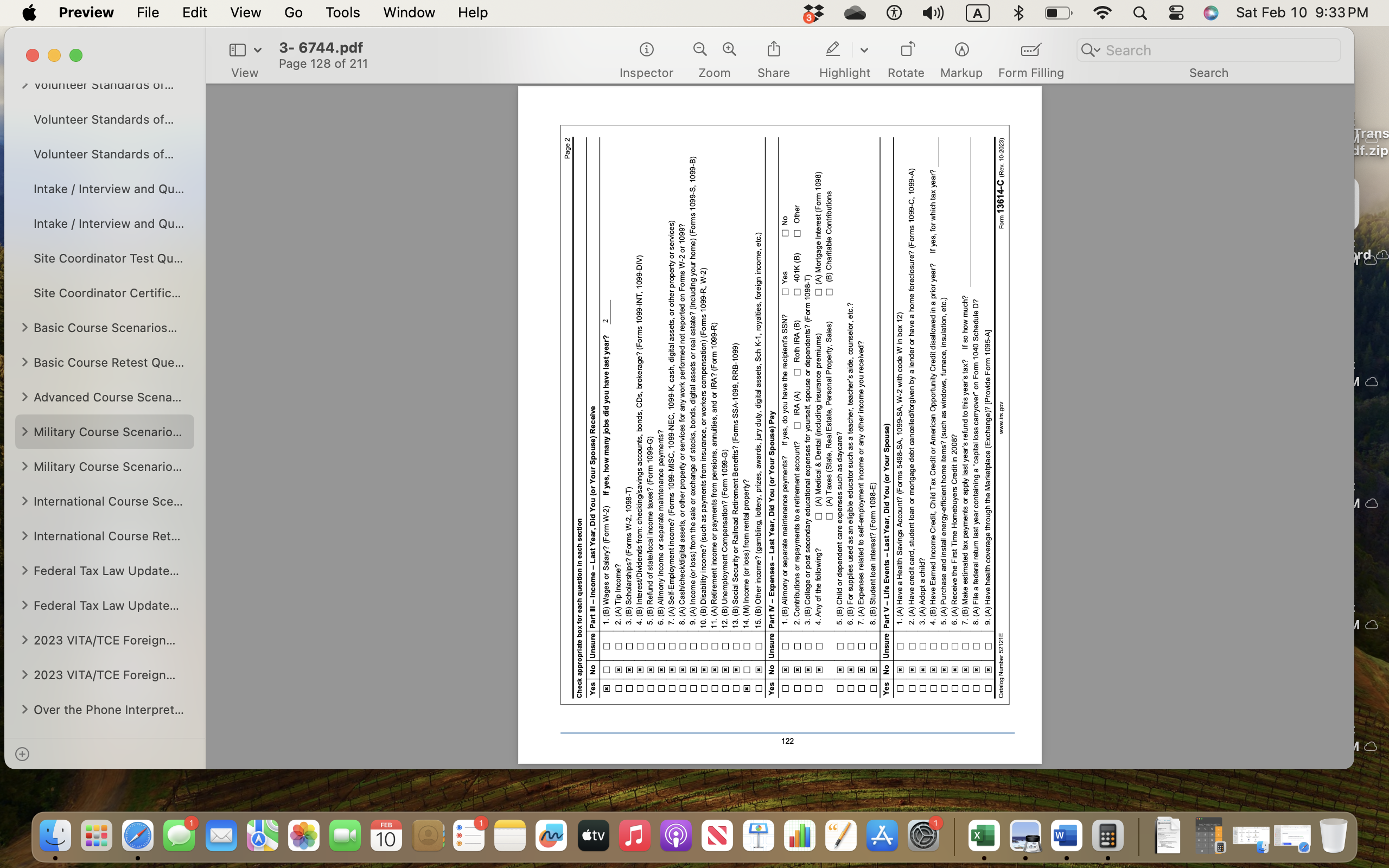

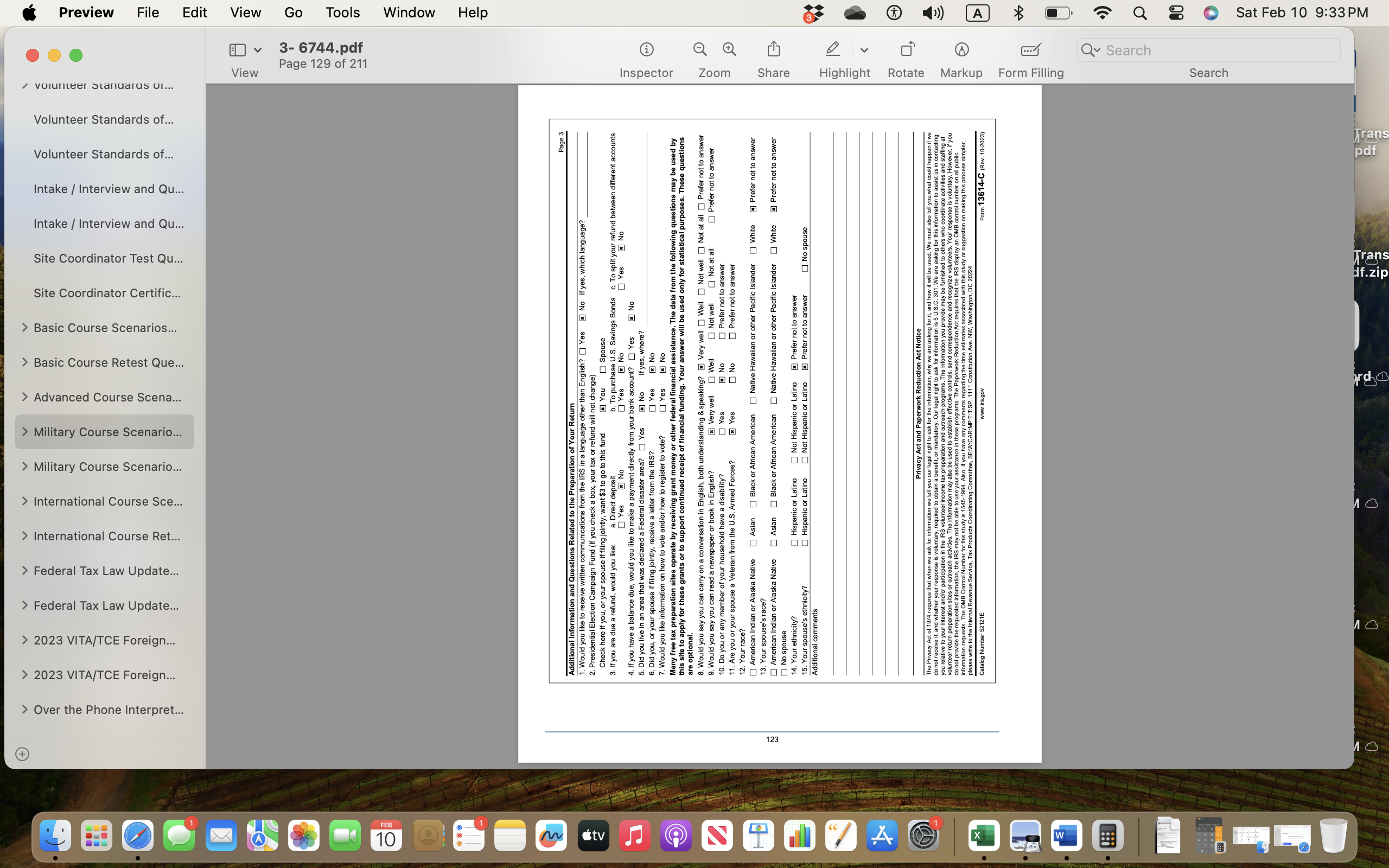

Question: Preview File Edit View Go Tools Window Help Q 9 0 Sat Feb 10 9:45 PM 3- 6744.pdf Q Q 2 v Q Search Page

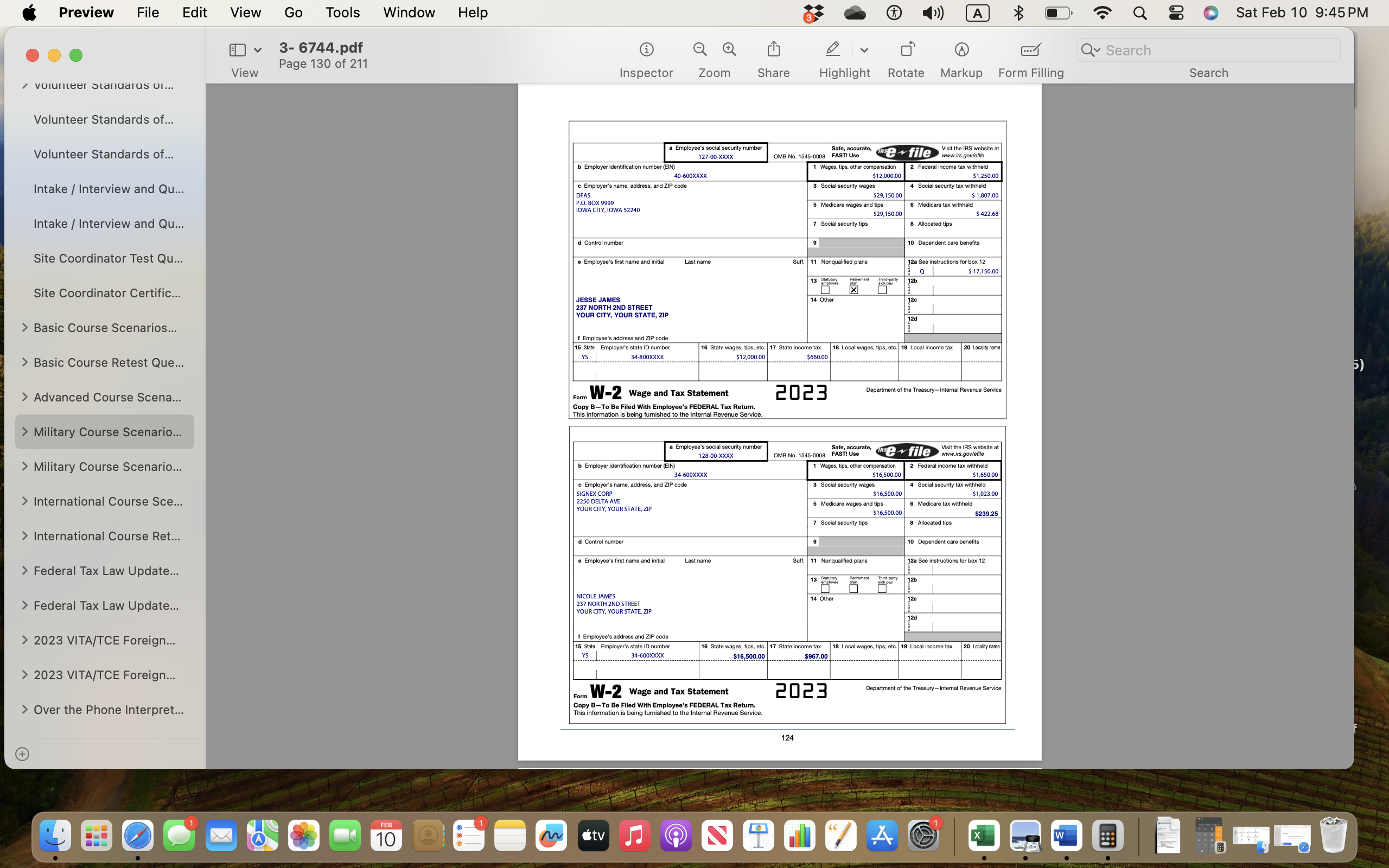

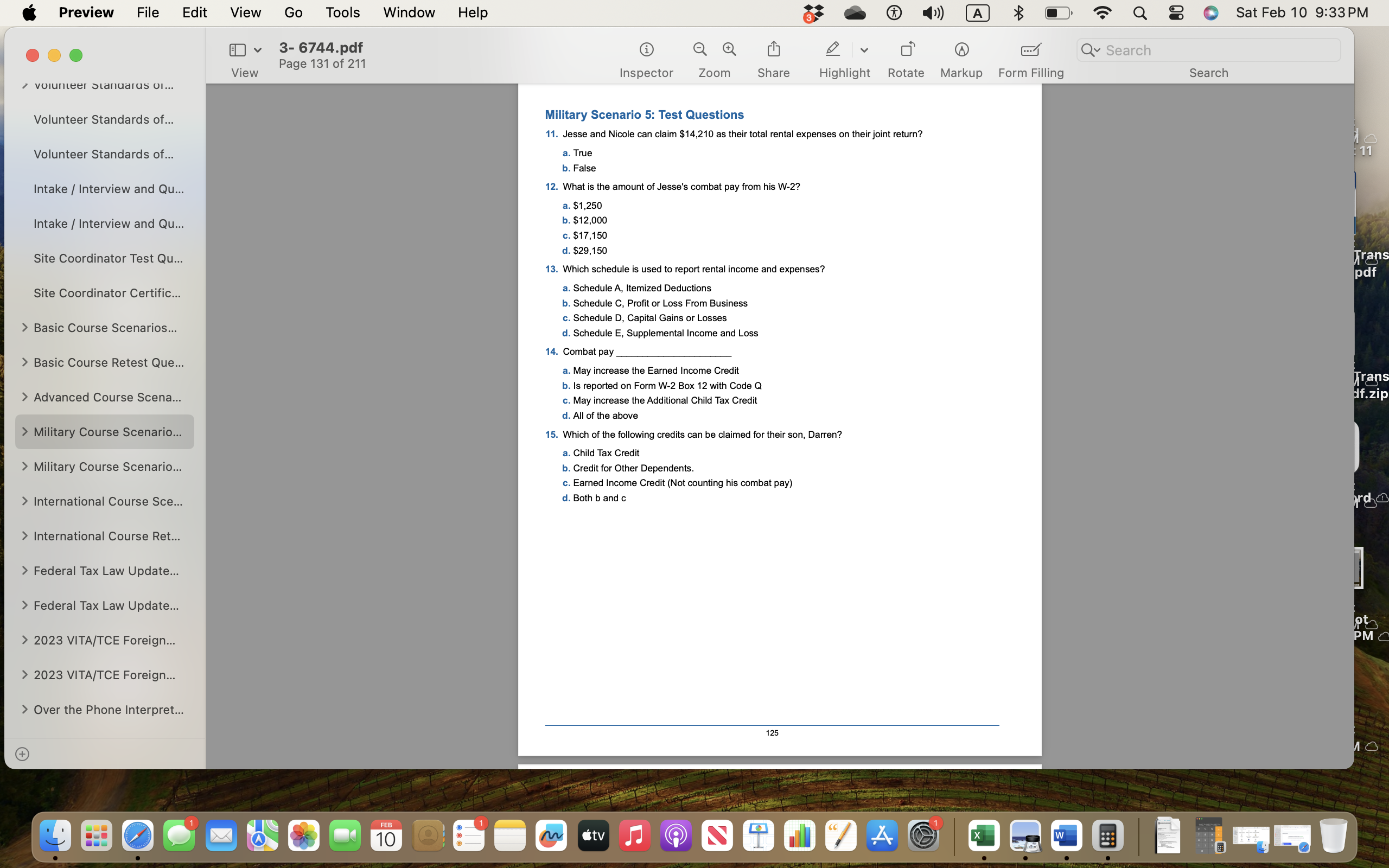

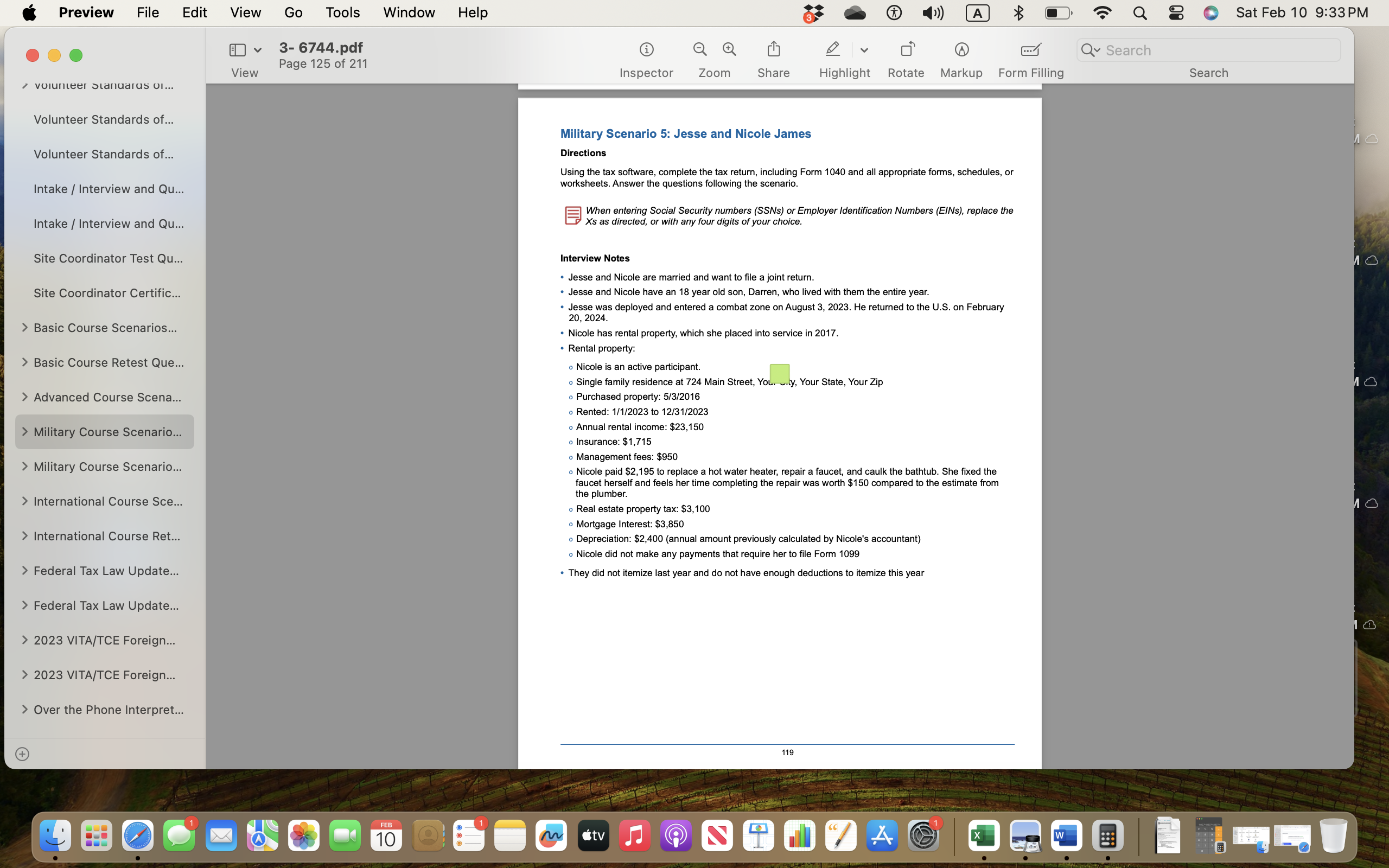

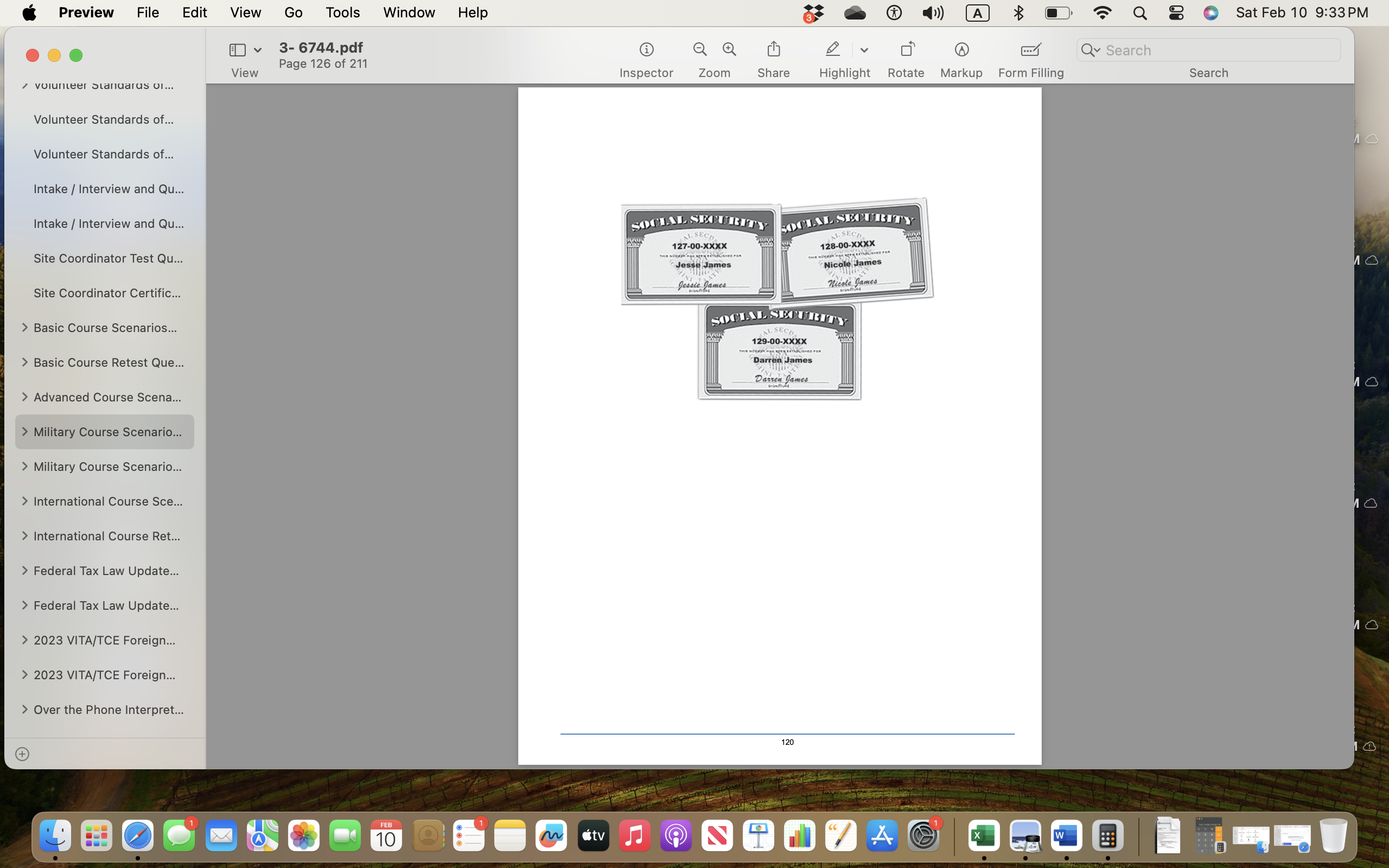

Preview File Edit View Go Tools Window Help Q 9 0 Sat Feb 10 9:45 PM 3- 6744.pdf Q Q 2 v Q Search Page 130 of 211 View Inspector Zoom Share Highlight Rotate Markup Form Filling Search volumeer Standards of... Volunteer Standards of... Volunteer Standards of... Employee's social security number 127-00-XXXX OMB No. 1545-0008 FAST! Use Safe, accurate, onse file Visit the IRS website at b Employer identification number (EIN) 1 Wages, tips, other comp 2 Federal income tax withheld 40-600XXXX $12,000.00 $1,250.0 Intake / Interview and Qu... c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld DFAS $29,150.00 $ 1,807.00 P.O. BOX 9999 IOWA CITY, IOWA 52240 5 Medicare wages and tips 6 Medicare tax withheld $29,150.00 $ 422.68 Intake / Interview and Qu... 7 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits Site Coordinator Test Qu... e Employee's first name and initial Last name Suff. 11 Nonqualified plans 2a See instructions for box 12 $ 17,150.00 Site Coordinator Certific... JESSE JAMES 14 Other 237 NORTH 2ND STREET YOUR CITY, YOUR STATE, ZIP > Basic Course Scenarios... * Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax Locality name > Basic Course Retest Que... .YS. 34-800XXXX $12,000.00 $660.00 > Advanced Course Scena... Form W-2 Wage and Tax Statement 2023 epartment of the Treasury-Internal Revenue Service Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service > Military Course Scenario... Employee's social security number 128-00-XXXX OMB No. 1545-0008 FASTI Use Hey file Visit the IRS website at > Military Course Scenario... b Employer identification numb 1 Wages, tips, other compens $16,500.00 2 Federal income tax withheld 34-600XXXX c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld SIGNEX CORP $16,500.00 > International Course Sce... $1,023.00 2250 DELTA AVE YOUR CITY, YOUR STATE, ZIP 5 Medicare wages and tips 6 Medicare tax withheld $16,500.00 $239.25 7 Social security tips 8 Allocated tips > International Course Ret... d Control number 10 Dependent care benefits Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 > Federal Tax Law Update... 14 Other > Federal Tax Law Update... NICOLE JAMES 237 NORTH 2ND STREET YOUR CITY, YOUR STATE, ZIP > 2023 VITA/TCE Foreign... f Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 34-600XXXX $16,500.00 $967.00 > 2023 VITA/TCE Foreign... Form W-2 Wage and Tax Statement 2023 Department of the Treasury-Internal Revenue Service > Over the Phone Interpret... Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service 124 FEB 10Preview File Edit View Go Tools Window Help Q Sat Feb 10 9:33 PM 3- 6744.pdf Q Q Q Search Page 131 of 211 View Inspector Zoom Share Highlight Rotate Markup Form Filling Search volunteer Standards ol... Volunteer Standards of... Military Scenario 5: Test Questions 11. Jesse and Nicole can claim $14,210 as their total rental expenses on their joint return? a. True E11 Volunteer Standards of... b. False Intake / Interview and Qu... 12. What is the amount of Jesse's combat pay from his W-2? a. $1,250 Intake / Interview and Qu... b. $12,000 c. $17,150 d. $29,150 Site Coordinator Test Qu... Fran 13. Which schedule is used to report rental income and expenses? pdf Site Coordinator Certific... a. Schedule A, Itemized Deductions . Schedule C, Profit or Loss From Business . Schedule D, Capital Gains or Losses > Basic Course Scenarios... d. Schedule E, Supplemental Income and Loss 14. Combat pay > Basic Course Retest Que... a. May increase the Earned Income Credit Trans b. Is reported on Form W-2 Box 12 with Code Q > Advanced Course Scena... C. May increase the Additional Child Tax Credit af.zip d. All of the above > Military Course Scenario... 15. Which of the following credits can be claimed for their son, Darren? a. Child Tax Credit > Military Course Scenario... b. Credit for Other Dependents c. Earned Income Credit (Not counting his combat pay) > International Course Sce... d. Both b and c > International Course Ret... > Federal Tax Law Update... > Federal Tax Law Update... PM > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... > Over the Phone Interpret... 125 FEB 10& Preview File Edit View Go Tools Window Help @O0 @A 3 & F a8 oo = 7 VOIUNLEE! SLEnyuaras ol... Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Intake / Interview and Qu... Site Coordinator Test Qu... Site Coordinator Certific... > Basic Course Scenarios... > Basic Course Retest Que... > Advanced Course Scena... > Military Course Scenario... > International Course Sce... > International Course Ret... > Federal Tax Law Update... > Federal Tax Law Update... > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... > Over the Phone Interpret... Q a M g v 7 Inspector Zoom Share A Qv Search Highlight ~Rotate Markup Form Filling Search Military Scenario 5: Jesse and Nicole James Directions Using the tax software, complete the tax return, including Form 1040 and all appropriate forms, schedules, or worksheets. Answer the questions following the scenario. When entering Social Security numbers (SSNs) or Employer Identification Numbers (EINS), replace the Xs as directed, or with any four digits of your choice. Interview Notes + Jesse and Nicole are married and want to file a joint return. + Jesse and Nicole have an 18 year old son, Darren, who lived with them the entire year. + Jesse was deployed and entered a combat zone on August 3, 2023. He retumed to the U.S. on February 20,2024. + Nicole has rental property, which she placed into service in 2017. + Rental property: o Nicole is an active participant. o Single family residence at 724 Main Street, You. ..y, Your State, Your Zip o Purchased property: 5/3/2016 o Rented: 1/1/2023 to 12/31/2023 o Annual rental income: $23,150 o Insurance: $1,715 o Management fees: $950 o Nicole paid $2,195 to replace a hot water heater, repair a faucet, and caulk the bathtub. She fixed the faucet herself and feels her time completing the repair was worth $150 compared to the estimate from the plumber. o Real estate property tax: $3,100 Mortgage Interest: $3,850 o Depreciation: $2,400 (annual amount previously calculated by Nicole's accountant) o Nicole did not make any payments that require her to file Form 1099 * They did not itemize last year and do not have enough deductions to itemize this year SatFeb 10 9:33PM Preview File Edit View Go Tools Window Help Q Sat Feb 10 9:33PM 3- 6744.pdf Q Q Q Search Page 126 of 211 View Inspector Zoom Share Highlight Rotate Markup Form Filling Search volunteer Standards of... Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Intake / Interview and Qu... SOCIAL SECURITY SOCIAL SECURITY ALL. SECO. 127-00-XXXX 128-00-XXXX Site Coordinator Test Qu... Jesse James Nicole James Jessie James nicole James Site Coordinator Certific... SOCIAL SECURITY > Basic Course Scenarios... M. SECO. 129-00-XXXX > Basic Course Retest Que... Darren James Darren James > Advanced Course Scena... > Military Course Scenario... > Military Course Scenario... > International Course Sce... > International Course Ret... > Federal Tax Law Update... > Federal Tax Law Update... > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... > Over the Phone Interpret... 120 FEB 10Preview > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... > Basic Course Scenarios... > Federal Tax Law Update... volunteer Standards ol... > Federal Tax Law Update... > Advanced Course Scena... > International Course Ret... > Military Course Scenario... > Military Course Scenario... > Over the Phone Interpret... > International Course Sce... > Basic Course Retest Que... Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Site Coordinator Certific... Site Coordinator Test Qu... Intake / Interview and Qu... File Edit View View Go 3- 6744.pdf Page 127 of 211 Tools Window 10 FEB Help Form 13614-C Department of the Treasury - Internal Revenue Service OMB Number (October 2023) Intake/Interview and Quality Review Sheet 1545-1964 You will need: . Please complete pages 1-4 of this form. tv Ich as Forms W-2, 1099, 1098, 1095. are responsible for the information on your return. Please provide . Social Security cards or ITIN letters for all persons on your tax return. mplete and accurate information. or you and your spouse. If you have questions, please ask the IRS-certified volunteer preparer. Volunteers are trained to provide high quality service and uphold the highest ethical standards. To report unethical behavior to the IRS, email us at wi.voltax@irs.gov Part I - Your Personal Information (If you are filing a joint return, enter your names in ame order as last year's return) 1. Your first name M. I. Last name Best contact number Inspector i Are you a U.S. citizen JESSE JAMES YOUR PHONE NUMBER 2. Your spouse's first name M.I. Last nam Best contact number Is your spouse a U.S. citizen? NICOLE JAMES YOUR PHONE NUMBER Yes No 3. Mailing address Apt # City State ZIP code 237 NORTH 2ND STREET YOUR CITY YS YOUR ZIP 4. Your Date of Birth 5. Your job title 6. Last year, were you: a. Full-time student Yes No 03/20/1978 SERVICE MEMBER b. Totally and permanently disabled ] Yes No c. Legally blind Yes x No Zoom 7. Your spouse's Date of Birth 8. Your spouse's job title 9. Last year, was your spouse: a. Full-time student Yes * No 10/25/1976 CUSTOMER SERVICE RE b. Totally ar ently disabled [ Yes * No c. Legally blind Yes = No 10. Can anyone claim you or your spouse as a dependent? Yes No Unsure 11. Have you, your spouse, or dependents been a victim of tax related identity theft or been issued an Identity Protection PIN? Yes X No 12. Provide an email address (optional) (this email address will not be used for contacts from the Internal Revenue Service) Share 121 Part II - Marital Status and Household Information 1. As of December 31, 2023, what Never Married (This includes registered domestic partnerships, civil unions, or other formal relationships under state law) was your marital status? Married a. If Yes, Did you get married in 2023? Yes b. Did you live with your spouse during any part of the last six months of 2023 Yes No Divorced Date of final decree Legally Separated Date of separate maintenance decree Widowed Year of spouse's death 2. List the names below of: . everyone who lived with you last year (other than your spouse) If additional space is needed check here and list on page 3 . anyone you supported but did not live with you last year To be completed by a Certified Volunteer Preparer 4 Name ( first , last ) Do not enter your Date of Birth Relationship Number name or spouse's name below ( mm/daiyy) to you (for of Citizen Resident Single or Full-time Totally a eme gotally and is this Did this Did this Did the example: ( yeso) Canada, of 12/3 1/23 last year Disabled qualifying provide person Did the axpayer(s) taxpayer(s) son, your home or Mexico (S/M) ( yeso ) ( yeso ) n than $4 700 provide more Day mercost of O' last year of any other 50% of his/ of income? support for parent, ( yeso ) (yeso ) support? (yes,no,n/a) this person? home for this (a) (6) (C ) (9) (yes,no,n/a) (yeso) Highlight Rotate Markup Form Filling DARREN JAMES 04/21/2005 SON YES YES YES NO Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2023) Q Search Search Q Sat Feb 10 9:33 PM 10Preview > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... volunteer Standards of... > Federal Tax Law Update... > Basic Course Scenarios... > Federal Tax Law Update... > Military Course Scenario... > Advanced Course Scena... > International Course Ret... > Military Course Scenario... > Over the Phone Interpret... > International Course Sce... > Basic Course Retest Que... Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Intake / Interview and Qu... Site Coordinator Certific... Site Coordinator Test Qu... File Edit View View Go 3- 6744.pdf Page 128 of 211 Tools Window 10 FEB Help Page 2 Check appropriate box for each question in each section "tv Yes No Unsure Part III - Income - Last Year, Did You (or Your Spouse) Receive 1. (B) Wages or Salary? (Form W-2) If yes, how many jobs did you have last year? 2 2. (A) Tip Income? 3. (B) Scholarships? (Forms W-2, 1098-T) 4. (B) Interest/Dividends from: checking/savings accounts, bonds, CDs, brokerage? (Forms 1099-INT, 1099-DIV) 5. (B) Refund of state/local income taxes? (Form 1099-G) Inspector 6. (B) Alimony income or separate maintenance payments? 7. (A) Self-Employment income? (Forms 1099-MISC, 1099-NEC, 1099-K, cash, digital assets, or other property or services 8. (A) Cash/check/digital assets, or other property or services for any work performed not reported on Forms W-2 or 1099? 9. (A) Income 1000800808080 nge of stocks, bonds, digital assets or real estate? (including your home) (Forms 1099-S, 1099-B) 10. (B) Disability income? ce, or workers compensation) (Forms 1099-R, W-2) 11. (A) Retirement income or payments from pensions, annuities, and or IRA? (Form 1099-R) Zoom 12. (B) Unemployment Compensation? (Form 1099-G) 13. (B) Social Security or Railroad Retirement Benefits? (Forms SSA-1099, RRB-1099 14. (M) Income (or loss) from rental property? 15. (B ) Other i wards, jury duty, digital assets, Sch K-1, royalties, foreign income, etc.) Yes No Unsure Part IV - Expenses - Last , Did You (or Your Spouse) Pay Share 122 1. (B) Alimony or separate maintenance payments? If yes, do you have the recipient's SSN? O Yes No 80 000 2. Contributions or repayments to a retirement account? ] IRA (A) ] Roth IRA (B) 401K (B) DOthe 3. (B) College or post secondary educational expenses for yourself, spouse or dependents? (Form 1098-T) 4. Any of the following ? (A) Medical & Dental (including insurance premiums) (A) Mortgage Interest (Form 1098) (A) Taxes (State, Real Estate, Personal Property, Sales [ (B) Charitable Contributions 5. (B) Child or deper 6. (B) For supplies used as an eligible educator such as a teacher, teacher's aide, counselor, etc.? D V 0000 7. (A) Expenses related to self-employment income or any other income you received? 8. (B) Student loan intere Form 1098-E) Yes No Unsure Part V - Life Events - , Did You (or Your Spouse) 1. (A) Have a Health Savings Account? (Forms 5498-SA, 1099-SA, W-2 with code W in box 12) 2. (A) Have credit card, student loan or mortgage debt cancelled/forgiven by a lender or have a home foreclosure? (Forms 1099-C, 1099-A) 3. (A) Adopt a chi 4. (B) Have Earned Income Credit, Child Tax Credit or American Opportunity Credit disallowed in a prior year? If yes, for which tax year?_ 10 0 0 0 0 0 0 0 5 . (A ) Purchase ficient home items? (such as windows, furnace, insulation, etc.) Highlight Rotate Markup Form Filling 0 0000800 6. (A) Receive the First Time Homebuy Credit in 2008? 7. (B) Make estim year's refund to this year's tax? If so how much 8. (A) File a feder capital loss carryover" on Form 1040 Schedule D? 9. (A ) Have health larketplace (Exchange)? [Provide Form 1095-A] Catalog Number 521218 www.irs.gov Form 13614-C (Rev. 10-2023) Q Search Search Q Sat Feb 10 9:33 PM ard if.zip TransPreview > 2023 VITA/TCE Foreign... > 2023 VITA/TCE Foreign... volunteer Standards of... > Basic Course Scenarios... > Federal Tax Law Update... > Federal Tax Law Update... > Advanced Course Scena... > International Course Ret... > Military Course Scenario... > Military Course Scenario... > Over the Phone Interpret... > International Course Sce... > Basic Course Retest Que... Volunteer Standards of... Volunteer Standards of... Intake / Interview and Qu... Site Coordinator Certific... Site Coordinator Test Qu... Intake / Interview and Qu... File Edit View View Go 3- 6744.pdf Page 129 of 211 Tools Window 10 FEB Help Page 3 Additional Information and Questions Related to the Preparation of Your Return 1. Would you like to receive written communications from the IRS in a language other than English? Yes * No If yes, which language? 2. Presidential Election Campaign Fund (If you check a box, your tax or refund will not change) Check here if you, or your spouse if filing jointly, want $3 to go to this fund You Spouse . If you are due a refund, would you like: a. Direct deposit b. To purchase U.S. Savings Bonds c. To split your refund between different accounts Yes No Yes No Yes 4. If you have a balance due, would you like to make a payment directly from your bank account? _ Yes No 5. Did you live in an area that was declared a Federal disaster area? ] Yes No If yes, where Inspector i 6. Did you, or your spouse if filing jointly, receive a letter from the IRS? O Ye No 7. Would you like information on how to vote and/or how to register to vote? Yes No Many free tax preparation sites operate by receiving grant money or other federal financial assistance. The data from the following this site to apply for these gr or starlowing questions may be used by tinued receipt of financial funding. Your answer will be used only for statistical purposes. These questions are optional. 8. Would you say you can carry on a conversation in English, both understanding & speaking? * Very well Well ] Not well ] Not at all ] Prefer not to answer 9. Would you say you can read a newsp newspaper or book in English? Very well Well Not well ]Not at all Prefer not to answer Zoom 10. Do you or any member of your household have a disability? Yes OPrefer not to answer 11. Are you or your spouse a Veteran from the U.S. Armed Forces 3 Ye Prefer not to answer 12. Your race ? American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander White Prefer not to answer 13. Your spouse's race? 123 American Indian or Alaska Native Asian Black or African American Native Hawaiian or other Pacific Islander ]White Prefer not to answer Share No spouse 14. Your ethnicity? Hispanic or Latino Not Hispanic or Latino Prefer not to answer 15. Your spouse's ethnicity? Hispanic or Latino ]Not Hispanic or Latino Prefer not to answer No spouse Additional comments Privacy Act and Paperwork Reduction Act Notice The Privacy Act of 1974 requires that when we ask for information we tell you our legal right to ask for the information, why we are asking for it, and how it will be used. We must also tell you what could happen if we do not receive it, and whether y you relative to your inter mation is 5 U.S.C. 301. We are asking for this information to assist us in contacting Highlight Rotate Markup Form Filling volunteer fence and recognize volunteers. "is voluntary . However. i you information request action Act requires that the IRS display please write to the Internal Re SE:W:CAR:MP :T:T:SP. 1111 Constitution Ave. NW, Washington, DC 20224 stion on making this process simpler , Catalog Number 52121E www.irs.gov Form 13614-C (Rev. 10-2023) Q Search Search Q Sat Feb 10 9:33PM 10 10 Fran ard af.zip Iran

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts