Question: Preview File Edit View Go Tools Window M 14%D Mon 10:55 AM QE Help Problem Set 2.pdf (page 1 of 2) - Edited @ Q

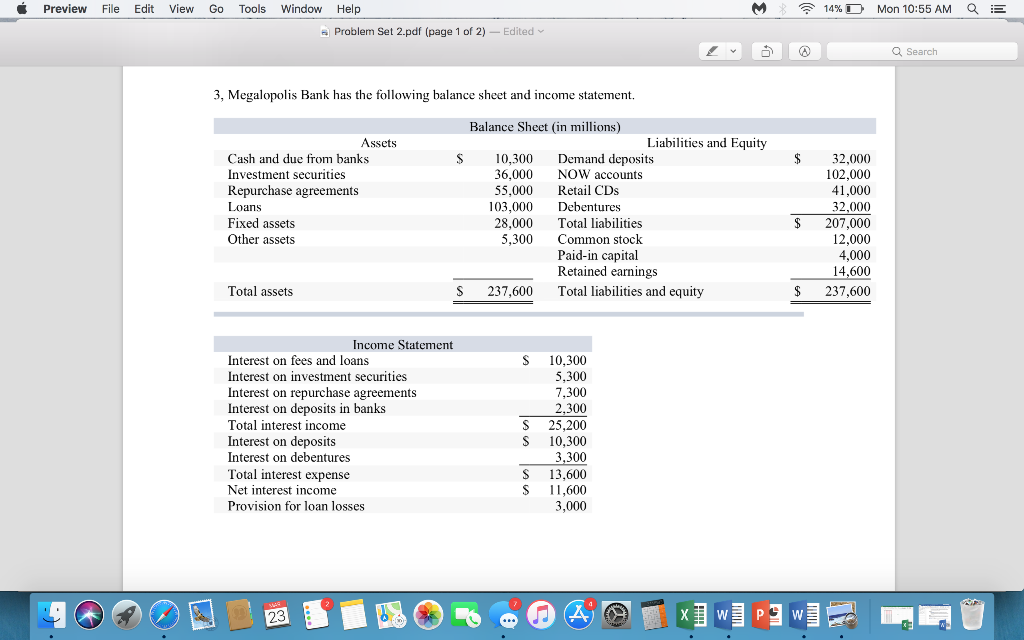

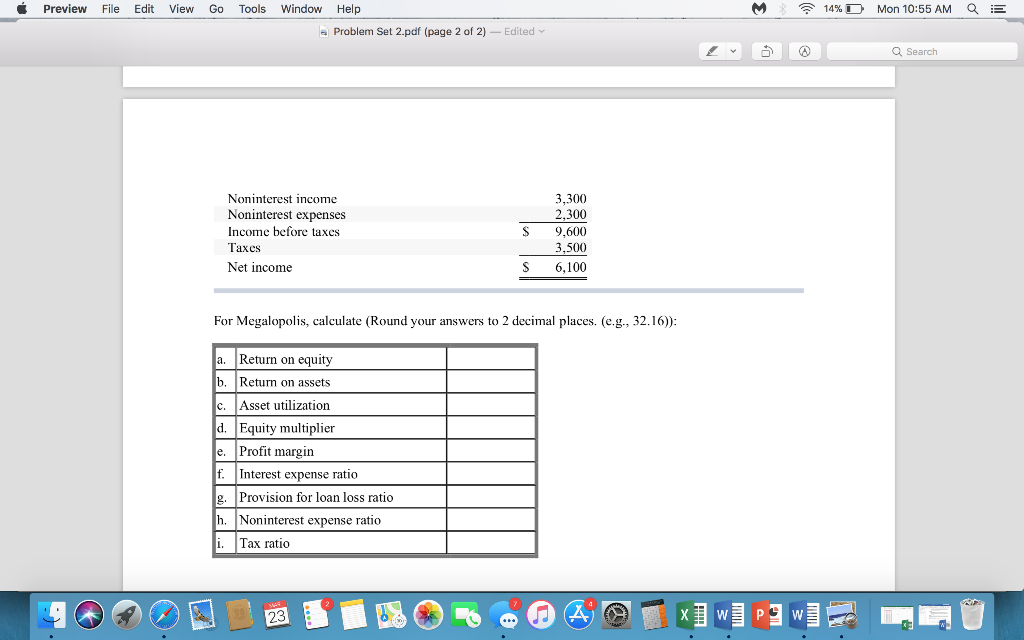

Preview File Edit View Go Tools Window M 14%D Mon 10:55 AM QE Help Problem Set 2.pdf (page 1 of 2) - Edited @ Q Search 3, Megalopolis Bank has the following balance sheet and income statement. S $ Assets Cash and due from banks Investment securities Repurchase agreements Loans Fixed assets Other assets Balance Sheet (in millions) Liabilities and Equity 10,300 Demand deposits 36,000 NOW accounts 55,000 Retail CDs 103,000 Debentures 28,000 Total liabilities 5,300 Common stock Paid-in capital Retained earnings $ 237,600 Total liabilities and equity 32,000 102,000 41,000 32,000 207,000 12,000 4,000 14,600 237,600 Total assets $ $ Income Statement Interest on fees and loans Interest on investment securities Interest on repurchase agreements Interest on deposits in banks Total interest income Interest on deposits Interest on debentures Total interest expense Net interest income Provision for loan losses $ 10,300 5,300 7,300 2,300 25,200 10,300 3,300 13,600 11,600 3.000 $ S MIT Preview File Edit View Go Tools Window M * 14%D Mon 10:55 AM Q E Help Problem Set 2.pdf (page 2 of 2) - Edited @ Q Search Noninterest income Noninterest expenses Income before taxes Taxes Net income 3,300 2,300 9,600 3,500 6,100 S For Megalopolis, calculate (Round your answers to 2 decimal places. (e.g., 32.16)): a. Return on equity b. Return on assets c. Asset utilization d. Equity multiplier e. Profit margin f. Interest expense ratio g. Provision for loan loss ratio h. Noninterest expense ratio i. Tax ratio MIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts