Question: Previous answers are totally wrong so please don't copy paste Problem 2 The cumulative discounted cash flows are shown in the following table for a

Previous answers are totally wrong so please don't copy paste

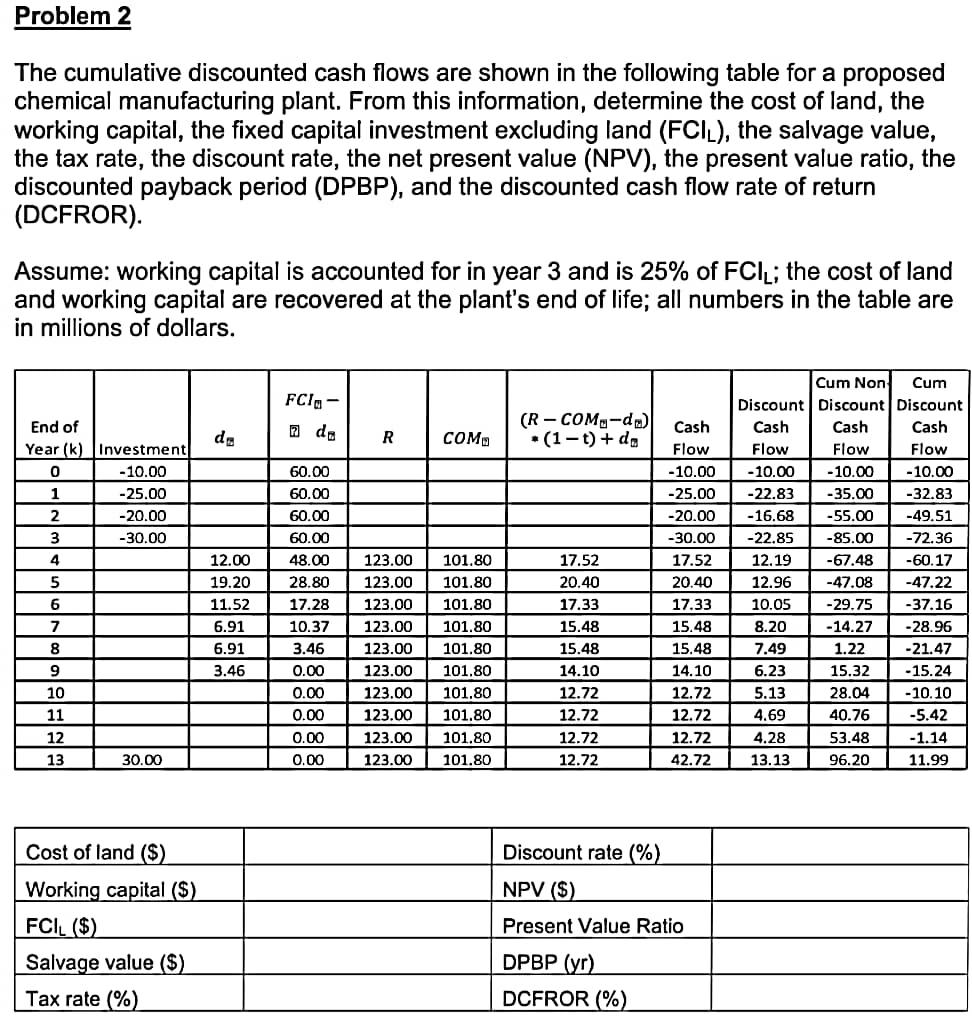

Problem 2 The cumulative discounted cash flows are shown in the following table for a proposed chemical manufacturing plant. From this information, determine the cost of land, the working capital, the fixed capital investment excluding land (FCIL), the salvage value, the tax rate, the discount rate, the net present value (NPV), the present value ratio, the discounted payback period (DPBP), and the discounted cash flow rate of return (DCFROR). Assume: working capital is accounted for in year 3 and is 25% of FCIL; the cost of land and working capital are recovered at the plant's end of life; all numbers in the table are in millions of dollars. FCIA- 7 de d. R COM (R - COM.-d.) (1 t) + d. End of Year (k) Investment 0 -10.00 1 -25.00 2 -20.00 3 -30.00 4 5 60.00 60.00 60.00 60.00 48.00 28.80 17.28 10.37 3.46 0.00 0.00 0.00 12.00 19.20 11.52 6.91 6.91 3.46 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 6 7 8 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 Cum Non Cum Discount Discount Discount Cash Cash Cash Flow Flow Flow - 10.00 - 10.00 -10.00 -22.83 -35.00 -32.83 - 16.68 -55.00 -49.51 -22.85 -85.00 -72.36 12.19 -67.48 -60.17 12.96 -47.08 -47.22 10.05 -29.75 -37.16 8.20 - 14.27 -28.96 7.49 1.22 -21.47 6.23 15.32 - 15.24 5.13 28.04 - 10.10 4.69 40.76 -5.42 4.28 53.48 -1.14 13.13 96.20 11.99 Cash Flow - 10.00 -25.00 -20.00 -30.00 17.52 20.40 17.33 15.48 15.48 14.10 12.72 12.72 12.72 42.72 17.52 20.40 17.33 15.48 15.48 14.10 12.72 12.72 12.72 12.72 9 10 11 12 13 0.00 0.00 30.00 Discount rate (%) NPV (S) Cost of land ($). Working capital (S) FCIL ($) Salvage value ($) Tax rate (%) Present Value Ratio DPBP (y) DCFROR (%) Problem 2 The cumulative discounted cash flows are shown in the following table for a proposed chemical manufacturing plant. From this information, determine the cost of land, the working capital, the fixed capital investment excluding land (FCIL), the salvage value, the tax rate, the discount rate, the net present value (NPV), the present value ratio, the discounted payback period (DPBP), and the discounted cash flow rate of return (DCFROR). Assume: working capital is accounted for in year 3 and is 25% of FCIL; the cost of land and working capital are recovered at the plant's end of life; all numbers in the table are in millions of dollars. FCIA- 7 de d. R COM (R - COM.-d.) (1 t) + d. End of Year (k) Investment 0 -10.00 1 -25.00 2 -20.00 3 -30.00 4 5 60.00 60.00 60.00 60.00 48.00 28.80 17.28 10.37 3.46 0.00 0.00 0.00 12.00 19.20 11.52 6.91 6.91 3.46 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 123.00 6 7 8 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 101.80 Cum Non Cum Discount Discount Discount Cash Cash Cash Flow Flow Flow - 10.00 - 10.00 -10.00 -22.83 -35.00 -32.83 - 16.68 -55.00 -49.51 -22.85 -85.00 -72.36 12.19 -67.48 -60.17 12.96 -47.08 -47.22 10.05 -29.75 -37.16 8.20 - 14.27 -28.96 7.49 1.22 -21.47 6.23 15.32 - 15.24 5.13 28.04 - 10.10 4.69 40.76 -5.42 4.28 53.48 -1.14 13.13 96.20 11.99 Cash Flow - 10.00 -25.00 -20.00 -30.00 17.52 20.40 17.33 15.48 15.48 14.10 12.72 12.72 12.72 42.72 17.52 20.40 17.33 15.48 15.48 14.10 12.72 12.72 12.72 12.72 9 10 11 12 13 0.00 0.00 30.00 Discount rate (%) NPV (S) Cost of land ($). Working capital (S) FCIL ($) Salvage value ($) Tax rate (%) Present Value Ratio DPBP (y) DCFROR (%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts