Question: < Previous Problem 6 Bookmark this page Problem 6 0 points possible (ungraded) b Q M M Next An oil company owns an oil

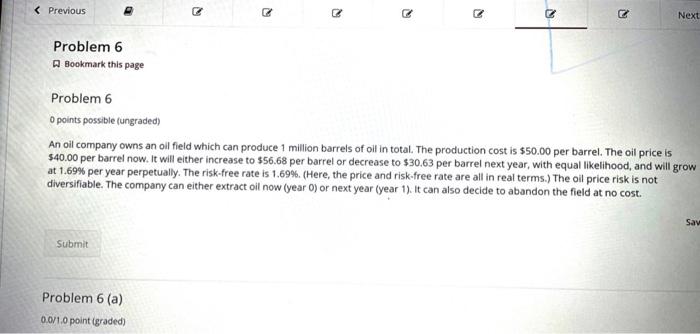

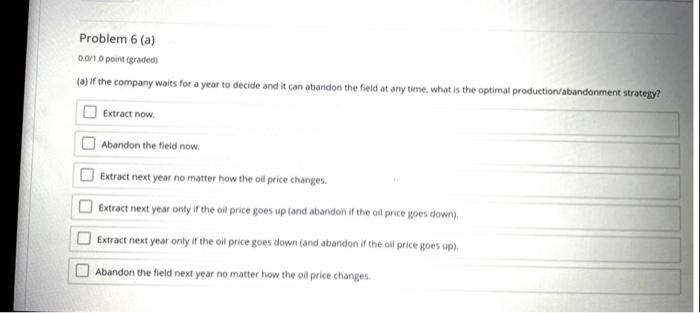

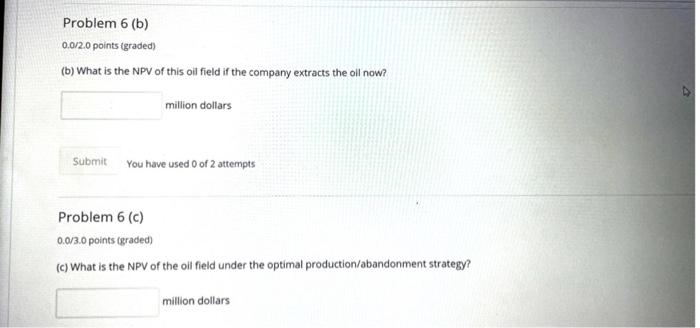

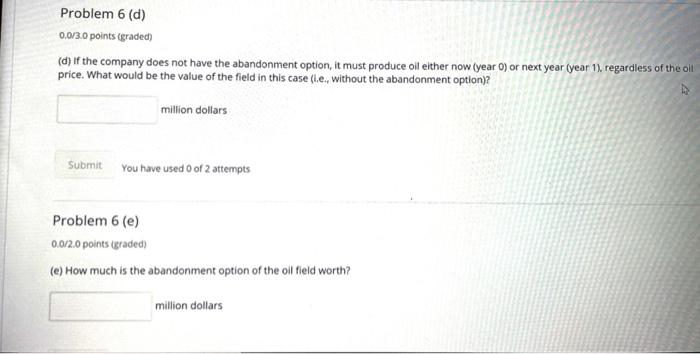

< Previous Problem 6 Bookmark this page Problem 6 0 points possible (ungraded) b Q M M Next An oil company owns an oil field which can produce 1 million barrels of oil in total. The production cost is $50.00 per barrel. The oil price is $40.00 per barrel now. It will either increase to $56.68 per barrel or decrease to $30.63 per barrel next year, with equal likelihood, and will grow at 1.69% per year perpetually. The risk-free rate is 1.69%. (Here, the price and risk-free rate are all in real terms.) The oil price risk is not diversifiable. The company can either extract oil now (year 0) or next year (year 1). It can also decide to abandon the field at no cost. Submit Problem 6 (a) 0.0/1.0 point (graded) Sav

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts