Question: Previous Problem Problem List Next Problem Suppose that you'd like to retire in 40 years and you want to have a future value of $

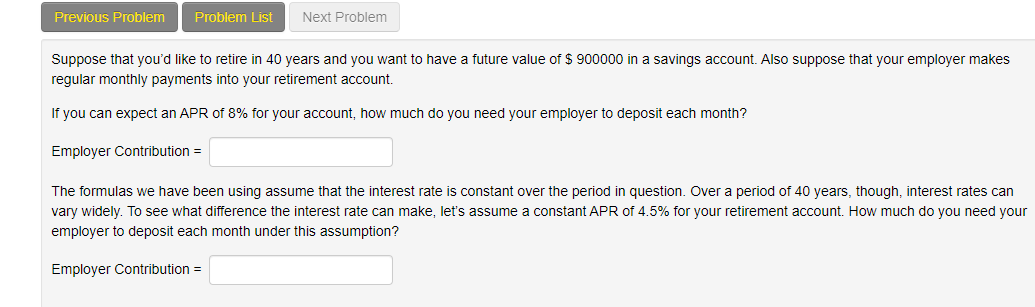

Previous Problem Problem List Next Problem Suppose that you'd like to retire in 40 years and you want to have a future value of $ 900000 in a savings account. Also suppose that your employer makes regular monthly payments into your retirement account. If you can expect an APR of 8% for your account, how much do you need your employer to deposit each month? Employer Contribution = The formulas we have been using assume that the interest rate is constant over the period in question. Over a period of 40 years, though, interest rates can vary widely. To see what difference the interest rate can make, let's assume a constant APR of 4.5% for your retirement account. How much do you need your employer to deposit each month under this assumption? Employer Contribution =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts