Question: -Previous Question 9 Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on Hand Total Current Assets

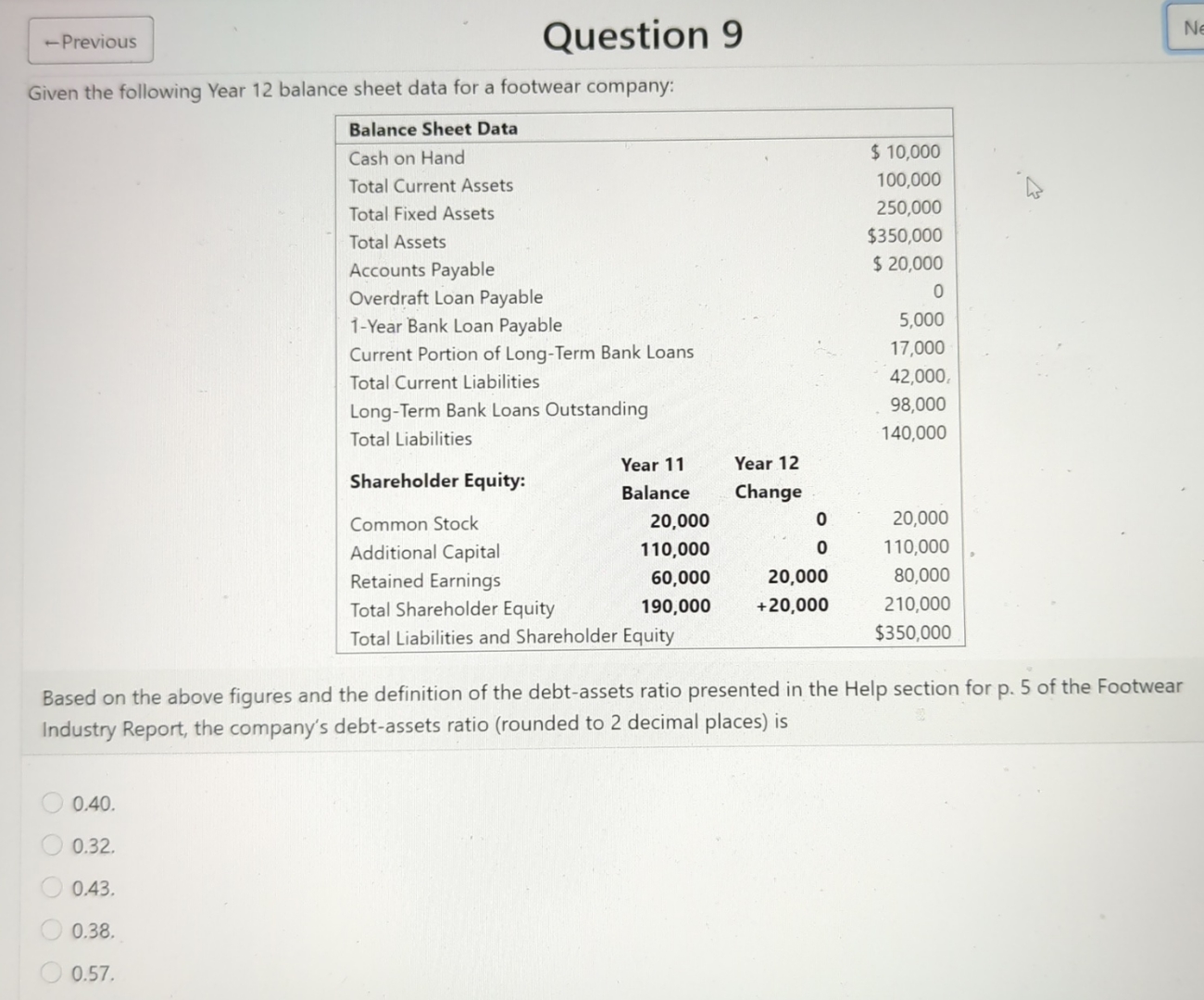

-Previous Question 9 Given the following Year 12 balance sheet data for a footwear company: Balance Sheet Data Cash on Hand Total Current Assets Total Fixed Assets Total Assets Accounts Payable $ 10,000 100,000 250,000 $350,000 $ 20,000 Overdraft Loan Payable 0 1-Year Bank Loan Payable Current Portion of Long-Term Bank Loans Total Current Liabilities Long-Term Bank Loans Outstanding 5,000 17,000 42,000, 98,000 Total Liabilities 140,000 Year 11 Year 12 Shareholder Equity: Balance Change Common Stock 20,000 0 20,000 Additional Capital 110,000 0 110,000 Retained Earnings 60,000 20,000 80,000 Total Shareholder Equity 190,000 +20,000 210,000 Total Liabilities and Shareholder Equity $350,000 Based on the above figures and the definition of the debt-assets ratio presented in the Help section for p. 5 of the Footwear Industry Report, the company's debt-assets ratio (rounded to 2 decimal places) is 0.40. 0.32. 0.43. 0.38. 0.57. Ne

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts