Question: previous question also posted here 3 points Save Answer This question relates to your answers for Question 3. Write a short paragraph (maximum 150 words)

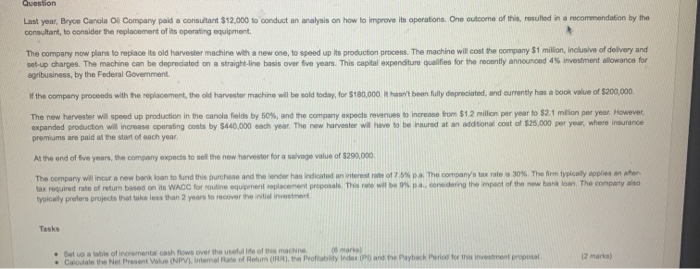

3 points Save Answer This question relates to your answers for Question 3. Write a short paragraph (maximum 150 words) to explain the company should or should not proceed with the investment project, based on your results for the project's NPV, IRR, PI and Payback Period Write a short paragraph (maximum 150 words) to explain if the company should or should not proceed with the investment project, based on your results for the prbject's NPV, IRR, PI and Payback Period TTT Ariel 03 (12) T Question Last year, Bryce Canola Ol Company paid a consultant $12,000 to conduct an analysis on how to improve its operations. One outcome of this resulted in a recommendation by the consultant, to consider the replacement of its operating equipment The company now plans to replace its old harvester machine with a new one, to speed up its production process. The machine will cost the company $1 milion, inclusive of delivery and set-up charges. The machine can be depreciated on a straight-line basis over five years. This capital expenditure qualities for the recently announced 4% investment allowance agribusiness, by the Federal Government If the company proceeds with the replacement, the old harvester machine will be sold today for $100,000 It hasn't been fully deprecated, and currently has a book value of $200,000 The new harvester will speed up production in the canola fields by 50%, and the company expects revenues to increase from $12 million per year to $21 million per year. However, expanded production will increase operating costs by $440,000 each year. The new harvester will have to be insured at an additional cost of $25,000 per year, where insurance premiums are paid at the start of each year. At the end of five years, the company expect to sell the new harvester for a salvage value of $290,000 The company wil incur a new bank loan to find the purchase and the one has indicated an interest rate of the company tax rate 30%. The firm typically coples anter tax required rate of return based on its WACC for routine equipment replacement proposals. This role wil acordering the impact of the new bankom. The company typically prefers projects that take less than 2 years to recover the internet Tasks Set up a wate of incremental cash flows over the line of the machine 16 Calculate the Net Present Value (NPV), Internal Role of Retum (IRR), the Profilleder Pan Pack Period for the investment proposal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts