Question: previous year 4 CF is $32,428. Question 3 (1 point) In the previous problem, the final cash flow comprises both the cash flow generated by

previous year 4 CF is $32,428.

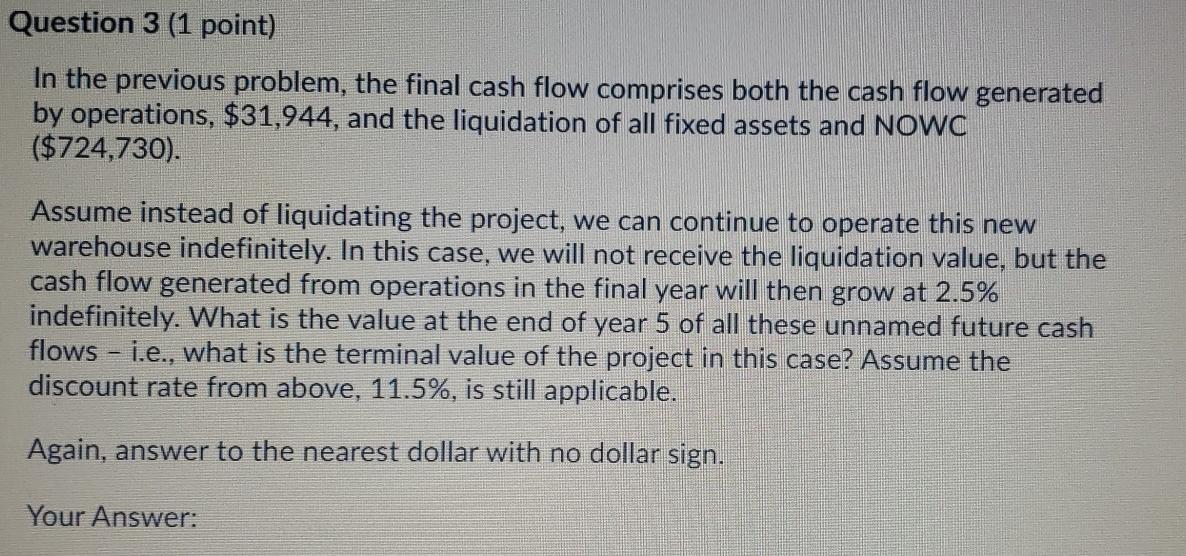

Question 3 (1 point) In the previous problem, the final cash flow comprises both the cash flow generated by operations, $31,944, and the liquidation of all fixed assets and NOWC ($724,730). Assume instead of liquidating the project, we can continue to operate this new warehouse indefinitely. In this case, we will not receive the liquidation value, but the cash flow generated from operations in the final year will then grow at 2.5% indefinitely. What is the value at the end of year 5 of all these unnamed future cash flows - i.e., what is the terminal value of the project in this case? Assume the discount rate from above, 11.5%, is still applicable. Again, answer to the nearest dollar with no dollar sign. Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts