Question: previously asked answer correctly not sure what table to use Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about

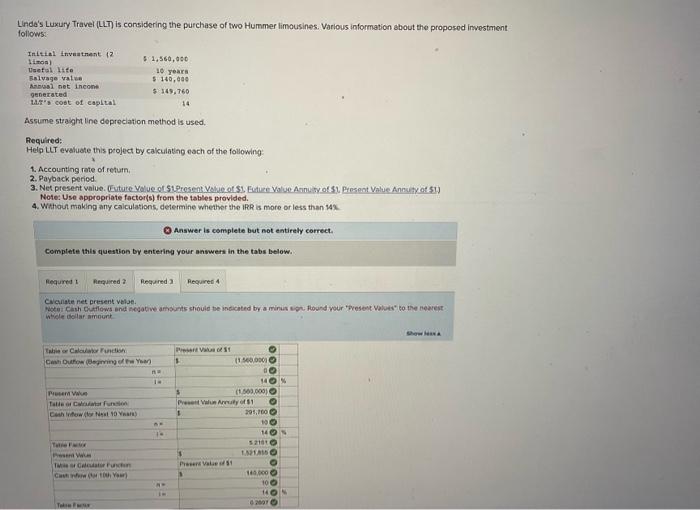

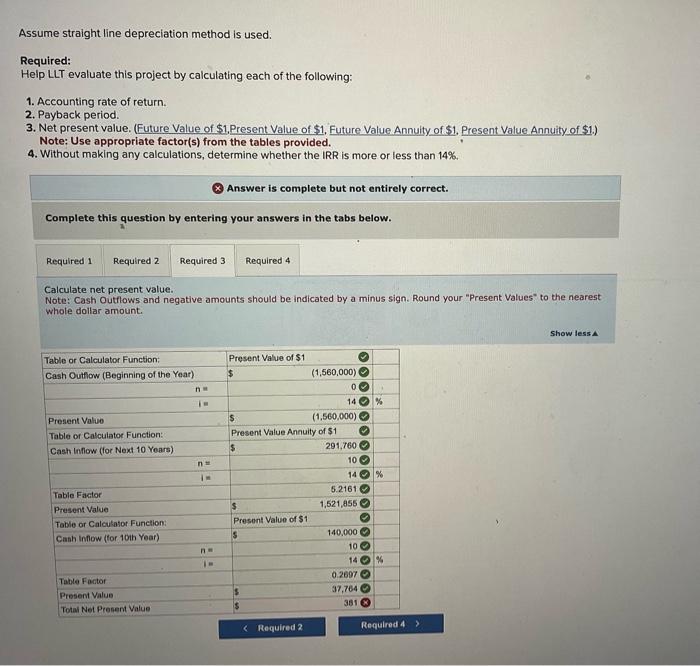

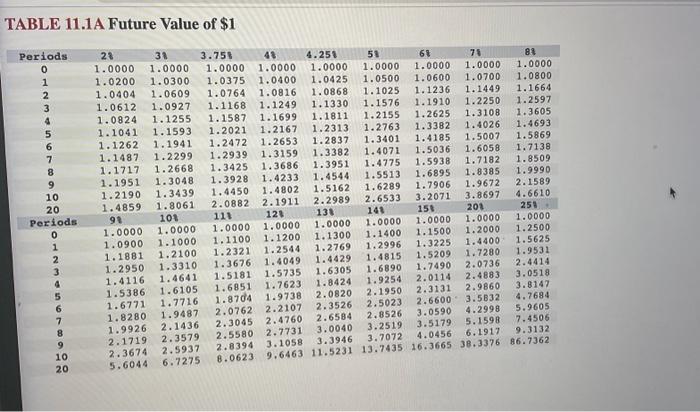

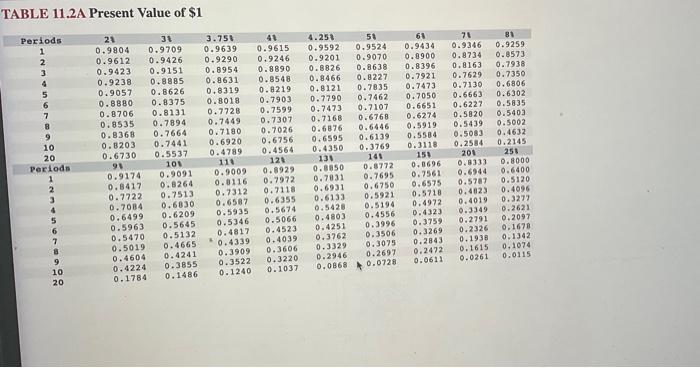

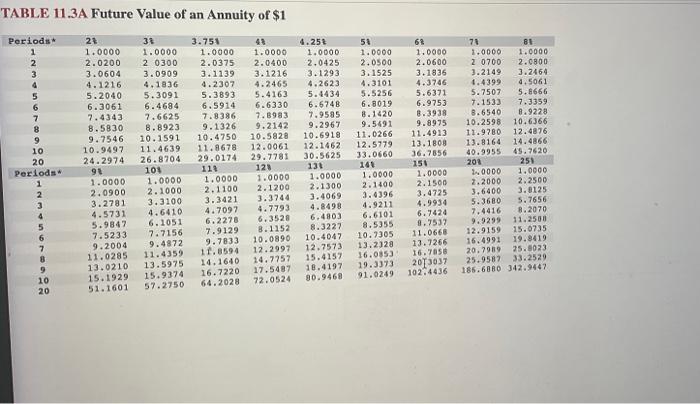

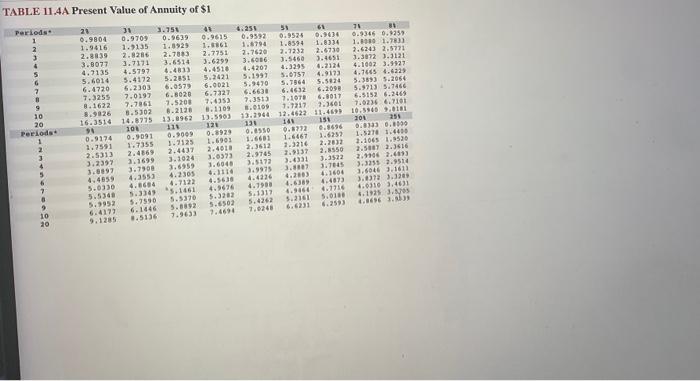

Linda's Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposod investmentfollows: Assume straight line depreclation method is used, Required: Help LLT evaluate this project by cakulating each of the following: 1. Accounting rate of retum, 2. Payback pericd. 3. Net present value. Eviture Value of St3resent Vekje of 35. Eutier Volue A suuty of 31, Pinsent Value Annuty ot 51] Note: Use appropriate factor(s) from the tables provided. 4. Whthour making any calculations, determine whether the IRR is more or less than 14% (8) Answer is complete but not entirely correct. complefe this question by entering your answers in the tabs below. Evavate ret present vbloe. whele delar mount. Assume straight line depreciation method is used. Required: Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. 2. Payback period. 3. Net present value. (Future Value of $1,Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. 4. Without making any calculations, determine whether the IRR is more or less than 14%. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Calculate net present value. Caiculate net present value. Note: Cash Outflows and negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount. TABLE 11.1A Future Value of $1 TABLE 11.2A Present Value of $1 TABLE 11.3A Future Value of an Annuity of $1 TABLE 11.4A Present Value of Annuity of $1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts