Question: Previously in the problem I solved for capital structure based on market weights, they were. 30% in debt and 70% in equity. The question asks

Previously in the problem I solved for capital structure based on market weights, they were. 30% in debt and 70% in equity.

The question asks for me to solve the Weighted Average Cost of Capital (WACC)

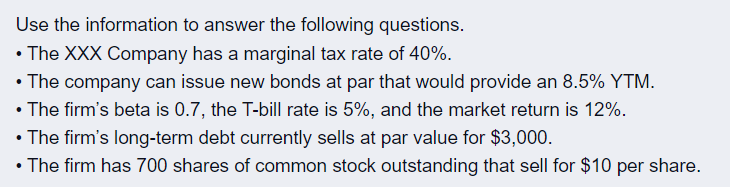

Use the information to answer the following questions. - The XXX Company has a marginal tax rate of 40%. - The company can issue new bonds at par that would provide an 8.5\% YTM. - The firm's beta is 0.7, the T-bill rate is 5%, and the market return is 12%. - The firm's long-term debt currently sells at par value for $3,000. - The firm has 700 shares of common stock outstanding that sell for $10 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts