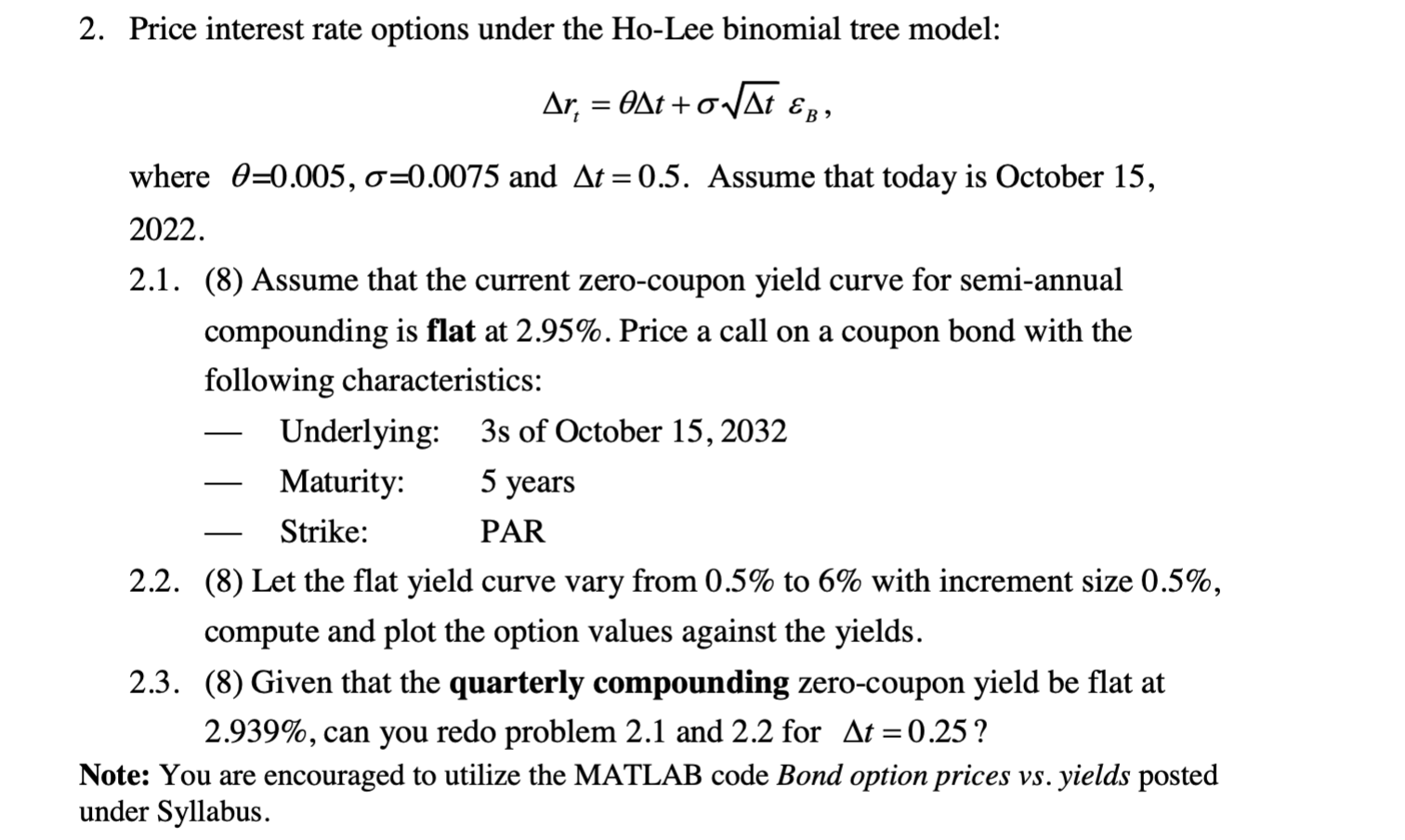

Question: Price interest rate options under the Ho-Lee binomial tree model: rt=t+tB, where =0.005,=0.0075 and t=0.5. Assume that today is October 15 , 2022. 2.1. (8)

Price interest rate options under the Ho-Lee binomial tree model: rt=t+tB, where =0.005,=0.0075 and t=0.5. Assume that today is October 15 , 2022. 2.1. (8) Assume that the current zero-coupon yield curve for semi-annual compounding is flat at 2.95%. Price a call on a coupon bond with the following characteristics: - Underlying: 3s of October 15, 2032 - Maturity: 5 years - Strike: PAR 2.2. (8) Let the flat yield curve vary from 0.5% to 6% with increment size 0.5%, compute and plot the option values against the yields. 2.3. (8) Given that the quarterly compounding zero-coupon yield be flat at 2.939%, can you redo problem 2.1 and 2.2 for t=0.25 ? Iote: You are encouraged to utilize the MATLAB code Bond option prices vs. yields posted Price interest rate options under the Ho-Lee binomial tree model: rt=t+tB, where =0.005,=0.0075 and t=0.5. Assume that today is October 15 , 2022. 2.1. (8) Assume that the current zero-coupon yield curve for semi-annual compounding is flat at 2.95%. Price a call on a coupon bond with the following characteristics: - Underlying: 3s of October 15, 2032 - Maturity: 5 years - Strike: PAR 2.2. (8) Let the flat yield curve vary from 0.5% to 6% with increment size 0.5%, compute and plot the option values against the yields. 2.3. (8) Given that the quarterly compounding zero-coupon yield be flat at 2.939%, can you redo problem 2.1 and 2.2 for t=0.25 ? Iote: You are encouraged to utilize the MATLAB code Bond option prices vs. yields posted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts