Question: Price per Question 2 (30 points) Saved Question 2- 30 Marks: Suggested time 23 minutes Rodger Dodger needs help in calculating his net taxable capital

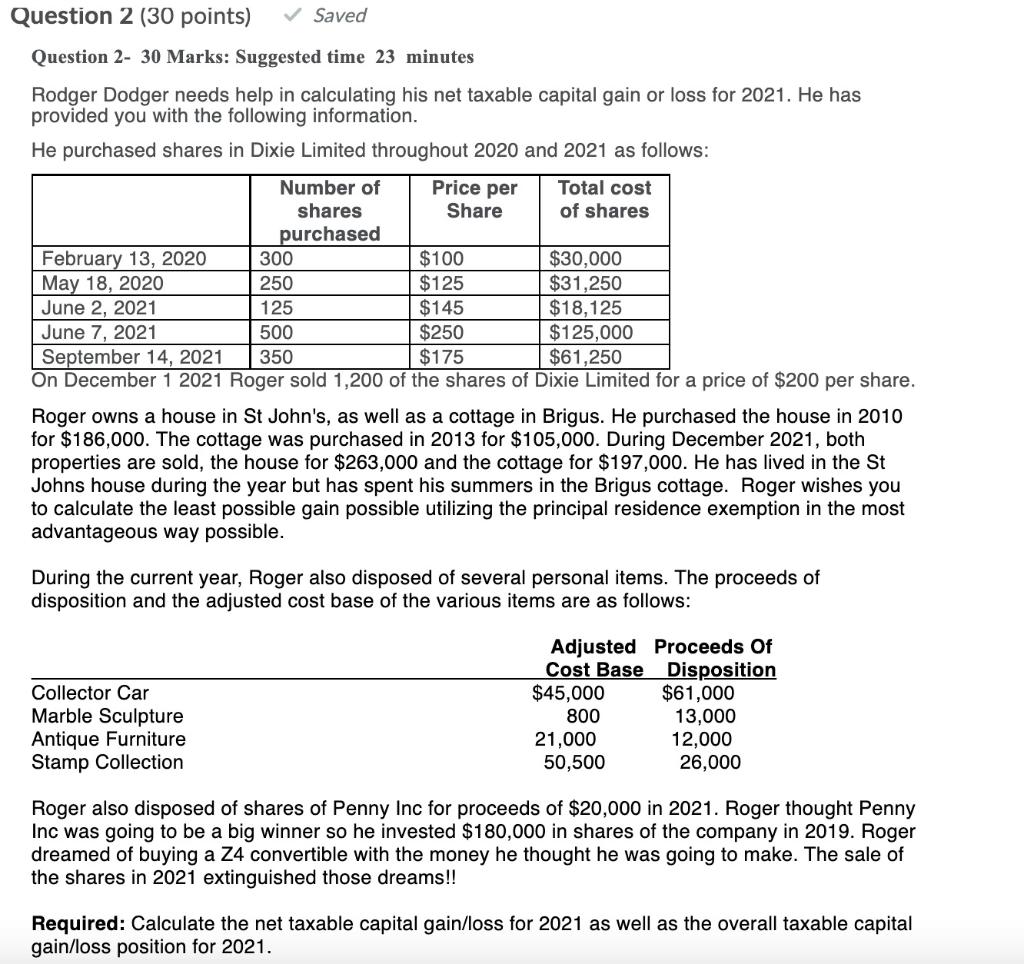

Price per Question 2 (30 points) Saved Question 2- 30 Marks: Suggested time 23 minutes Rodger Dodger needs help in calculating his net taxable capital gain or loss for 2021. He has provided you with the following information. He purchased shares in Dixie Limited throughout 2020 and 2021 as follows: Number of Total cost shares Share of shares purchased February 13, 2020 300 $100 $30,000 May 18, 2020 250 $125 $31,250 June 2, 2021 125 $145 $18,125 June 7, 2021 500 $250 $125,000 September 14, 2021 350 $175 $61,250 On December 1 2021 Roger sold 1,200 of the shares of Dixie Limited for a price of $200 per share. Roger owns a house in St John's, as well as a cottage in Brigus. He purchased the house in 2010 for $186,000. The cottage was purchased in 2013 for $105,000. During December 2021, both properties are sold, the house for $263,000 and the cottage for 97,000. He has lived in the St Johns house during the year but has spent his summers in the Brigus cottage. Roger wishes you to calculate the least possible gain possible utilizing the principal residence exemption in the most advantageous way possible. During the current year, Roger also disposed of several personal items. The proceeds of disposition and the adjusted cost base of the various items are as follows: Collector Car Marble Sculpture Antique Furniture Stamp Collection Adjusted Proceeds Of Cost Base Disposition $45,000 $61,000 800 13,000 21,000 12,000 50,500 26,000 Roger also disposed of shares of Penny Inc for proceeds of $20,000 in 2021. Roger thought Penny Inc was going to be a big winner so he invested $180,000 in shares of the company in 2019. Roger dreamed of buying a 24 convertible with the money he thought he was going to make. The sale of the shares in 2021 extinguished those dreams!! Required: Calculate the net taxable capital gain/loss for 2021 as well as the overall taxable capital gain/loss position for 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts