Question: Price the new security using a tracking pou0 pp ortiolnO apprOu 4. Assume there are three possible future states for the economy (Boom, Stagnant, and

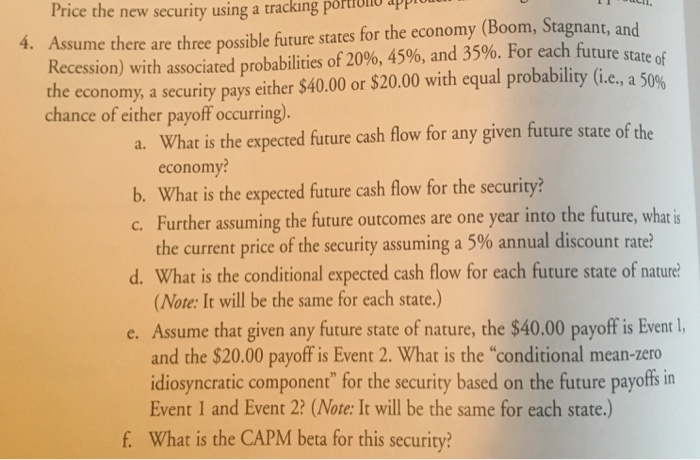

Price the new security using a tracking pou0 pp ortiolnO apprOu 4. Assume there are three possible future states for the economy (Boom, Stagnant, and Recession) with associated probabilities of 20%,45%, and 35%. For each future state of the economy, a security pays either $40.00 or $20.00 with equal probability (i.e, a 50 chance of either payoff occurring). a. What is the expected future cash flow for any given future state of the economy? b. What is the expected future cash flow for the security? c. Further assuming the future outcomes are one year into the future, what i d. What is the conditional expected cash flow for each future state of nature e. Assume that given any future state of nature, the $40.00 payoff is Event I the current price of the security assuming a 5% annual discount rate? (Note: It will be the same for each state.) and the $20.00 payof is Event 2. What is the "conditional mean-zero idiosyncratic component" for the security based on the future payoffs in Event 1 and Event 2? (Note: It will be the same for each state.) What is the CAPM beta for this security? f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts