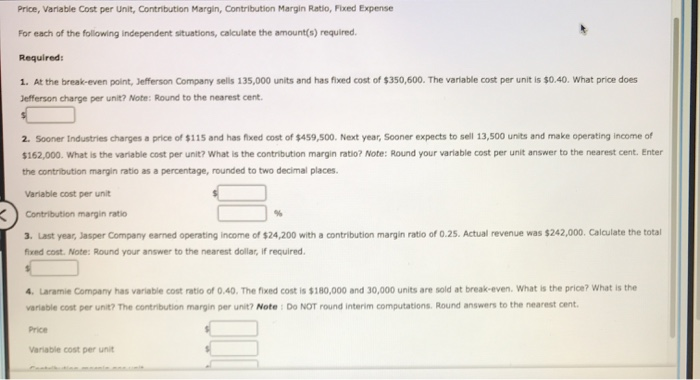

Question: Price, Variable Cost per Unit, Contribution Margin, Contribution Margin Ratio, Fixed Expense For each of the following independent situations, calculate the amount(s) required. Required: 1.

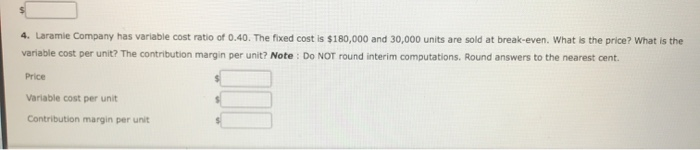

Price, Variable Cost per Unit, Contribution Margin, Contribution Margin Ratio, Fixed Expense For each of the following independent situations, calculate the amount(s) required. Required: 1. At the break-even point, Jefferson Company sells 135,000 units and has foed cost of $350,600. The variable cost per unit is $0.40. What price does Jefferson charge per unit? Note: Round to the nearest cent. 2. Sooner Industries charges a price of $115 and has fixed cost of $459,500. Next year, Sooner expects to sell 13,500 units and make operating income of $162,000. What is the variable cost per unit? What is the contribution margin ratio? Note: Round your variable cost per unit answer to the nearest cent. Enter the contribution margin ratio as a percentage, rounded to two decimal places. Variable cost per unit Contribution margin ratio 3. Last year, Jasper Company carned operating income of $24,200 with a contribution margin ratio of 0.25. Actual revenue was $242,000. Calculate the total fed cost. Note: Round your answer to the nearest dollar, if required. 4. Laramie Company has variable cost ratio of 0.40. The fixed cost is $180,000 and 30,000 units are sold at break-even. What is the price? What is the variable cost per unit? The contribution margin per unit? Note: Do NOT round interim computations. Round answers to the nearest cent. Price Variable cost per unit 4. Laramie Company has variable cost ratio of 0.40. The fixed cost is $180,000 and 30,000 units are sold at break-even. What is the price? What is the variable cost per unit? The contribution margin per unit? Note: Do NOT round interim computations. Round answers to the nearest cent. Price Variable cost per unit Contribution margin per unit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts