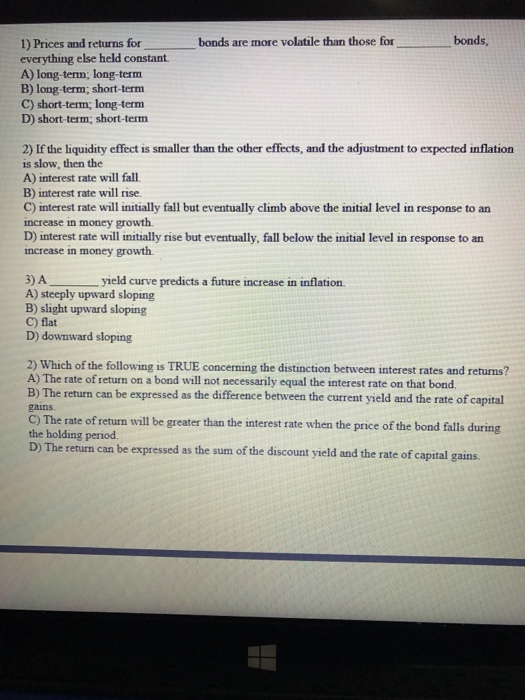

Question: Prices and returns for ______ bonds are more volatile than those for _________ bonds, everything else held constant long-term; long-term long-term; short-term short-term; long-term short-term:

Prices and returns for ______ bonds are more volatile than those for _________ bonds, everything else held constant long-term; long-term long-term; short-term short-term; long-term short-term: short-term If the liquidity effect is smaller than the other effects, and the adjustment to expected inflation is slow, then the interest rate will fall. interest rate will rise. interest rate will initially fall but eventually climb above the initial level in response to an increase in money growth. interest rate will initially rise but eventually, fall below the initial level in response to an increase in money growth. A _______ yield curve predicts a future increase in inflation steeply upward sloping slight upward sloping flat downward sloping which of the following is TRUE concerning the distinction between interest rates and returns? The rate of return on a bond will not necessarily equal the interest rate on that bond, The return can be expressed as the difference between the current yield and the rate of capital gains. The rate of return will be greater than the interest rate when the price of the bond falls during the holding period. The return can be expressed as the sum of the discount yield and the rate of capital gains

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts