Question: Pricing an Asian Option Extra.pdf - Adobe Acrobat Reader DC X File Edit View Sign Window Help Home Tools Extra.pdf X (? Sign In T

Pricing an Asian Option

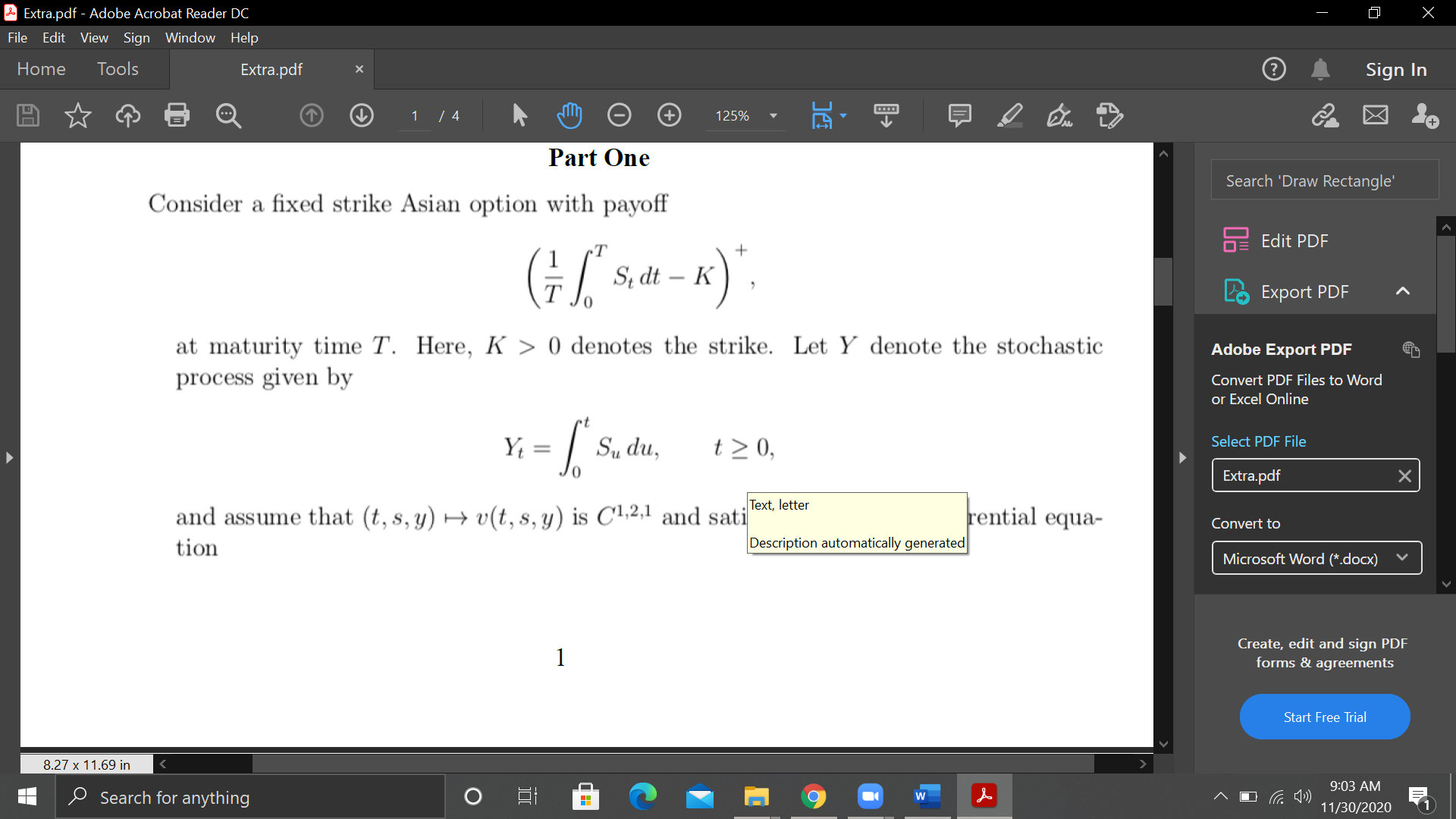

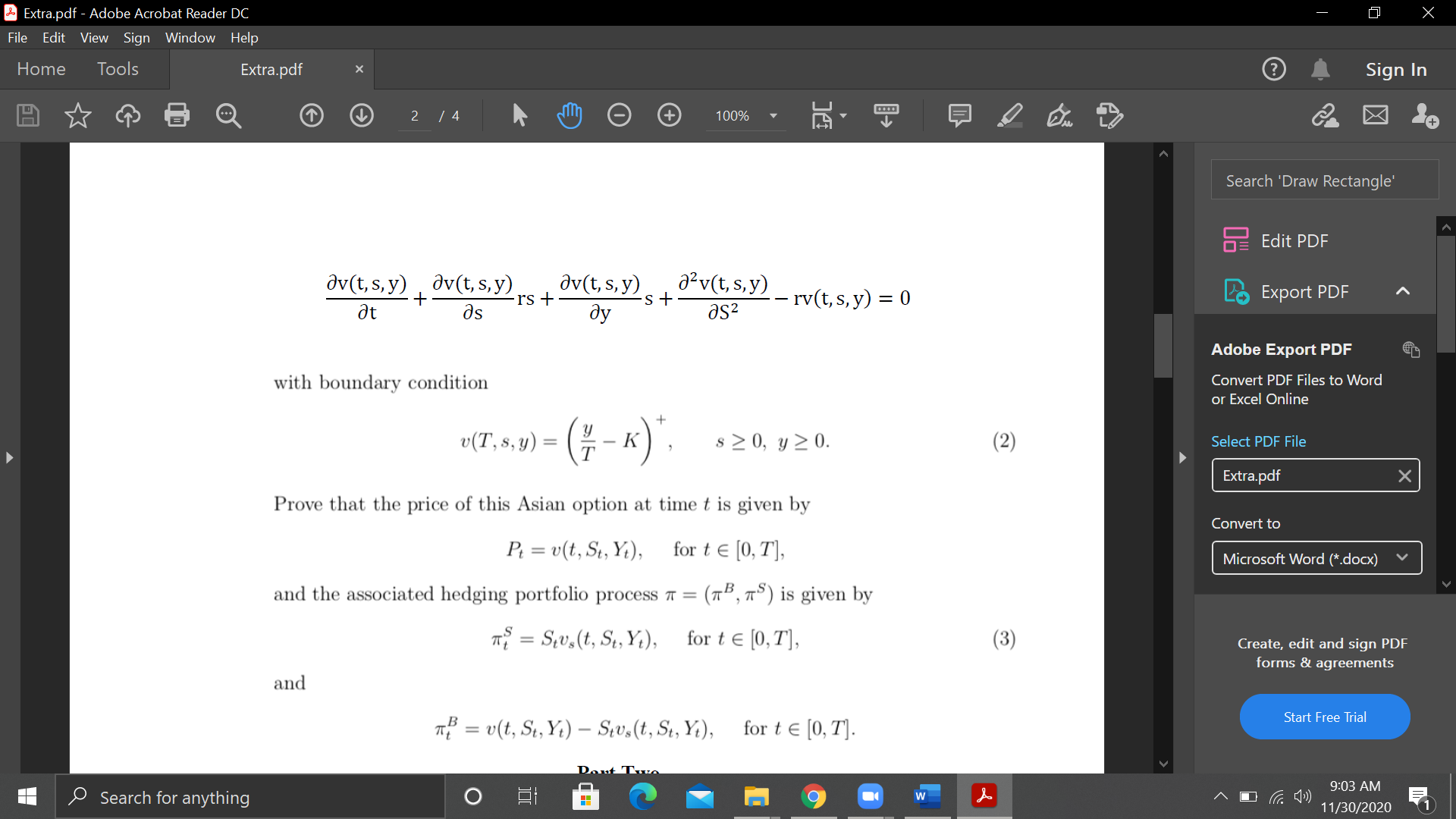

Extra.pdf - Adobe Acrobat Reader DC X File Edit View Sign Window Help Home Tools Extra.pdf X (? Sign In T 1 /4 + 125% Part One Search 'Draw Rectangle' Consider a fixed strike Asian option with payoff = Edit PDF ( * / . "S.dt - 1 ) , Export PDF at maturity time T. Here, K > 0 denotes the strike. Let Y denote the stochastic Adobe Export PDF process given by Convert PDF Files to Word or Excel Online Yi = Sudu, 120, Select PDF File Extra.pdf X and assume that (t, s, y) > v(t, s, y) is Cl,2,1 and sati Text, letter rential equa- Convert to tion Description automatically generated Microsoft Word (*.docx) Create, edit and sign PDF forms & agreements Start Free Trial 8.27 x 11.69 in Search for anything O w 9:03 AM 11/30/2020Extra.pdf - Adobe Acrobat Reader DC X File Edit View Sign Window Help Home Tools Extra.pdf (? Sign In H 2 14 + 100% Search 'Draw Rectangle' Edit PDF av (t, s, y) , av(t, s,y) av (t, s, y) a2 v ( t , s , y ) + - -rs + -S - rv(t, s, y) = 0 Export PDF at as ay as2 Adobe Export PDF with boundary condition Convert PDF Files to Word or Excel Online U (T, s, y ) = - K $ 20, y 2 0. (2) Select PDF File Extra.pdf X Prove that the price of this Asian option at time t is given by Convert to Pt = v(t, St, Yt), for t E [0, T], Microsoft Word (*.docx) and the associated hedging portfolio process 7 = (7, 75) is given by TY = SUs (t, St, Y.), for t e [0, T], (3) Create, edit and sign PDF forms & agreements and T. = v(t, St, Yt) - Stus (t, St, Yt), for te [0, T]. Start Free Trial Dout Toro Search for anything O w 9:03 AM 11/30/2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts