Question: Equipment that cost $149000 and on which $128000 of accumulated depreciation has been recorded was disposed of for $35000 cash. The entry to record

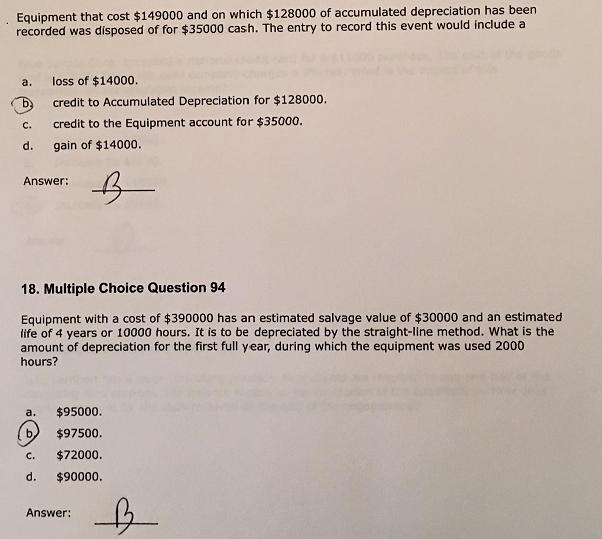

Equipment that cost $149000 and on which $128000 of accumulated depreciation has been recorded was disposed of for $35000 cash. The entry to record this event would include a a. loss of $14000. credit to Accumulated Depreciation for $128000. C. credit to the Equipment account for $35000. d. gain of $14000. Answer: 18. Multiple Choice Question 94 Equipment with a cost of $390000 has an estimated salvage value of $30000 and an estimated life of 4 years or 10000 hours. It is to be depreciated by the straight-Iline method. What is the amount of depreciation for the first full year, during which the equipment was used 2000 hours? a. $95000. $97500. . $72000. d. $90000. Answer:

Step by Step Solution

There are 3 Steps involved in it

Lets look at each question step by step Question 1 Equipment Disposal 1 Determine Book Value Cost of ... View full answer

Get step-by-step solutions from verified subject matter experts