Question: PRINTED NAME Problem ONE: Use the DATA in the assignment link Expected Rate of Return Standard Deviation Coefficient of Variation (CV) Problem TWO: Use the

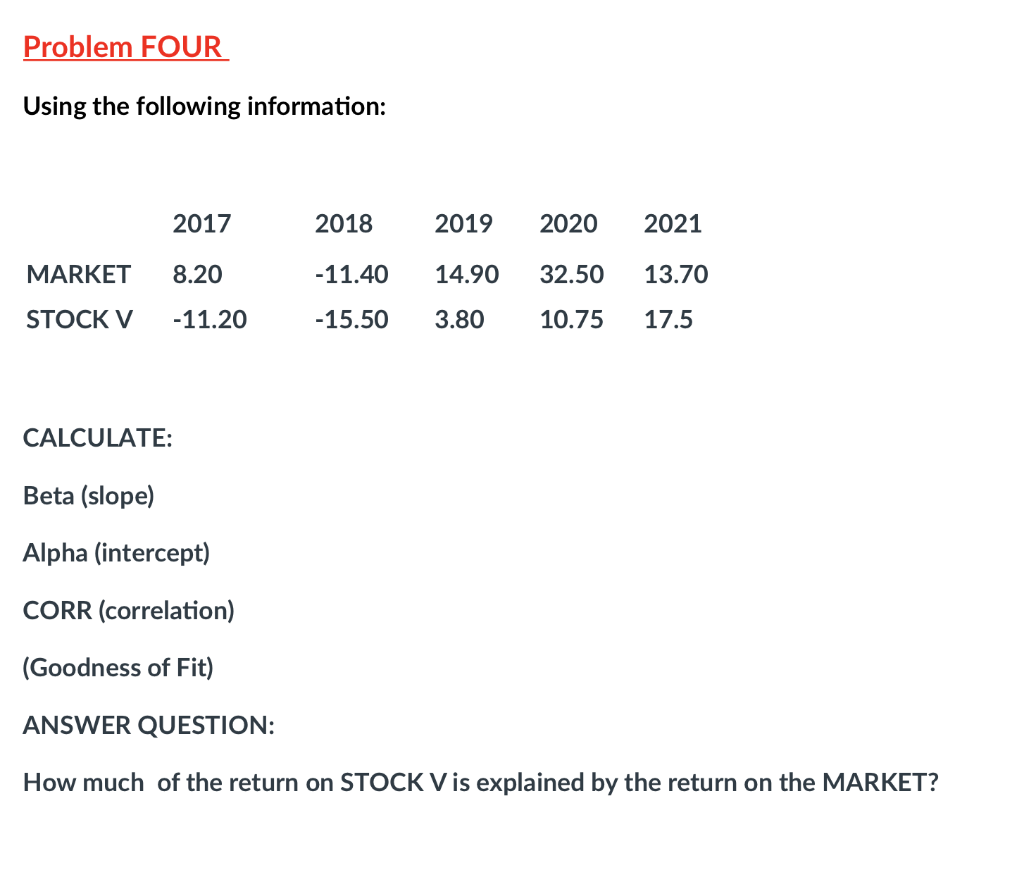

PRINTED NAME Problem ONE: Use the DATA in the assignment link Expected Rate of Return Standard Deviation Coefficient of Variation (CV) Problem TWO: Use the DATA in the assignment link What is the Required Rate of Return for the stock? Is the stock UNDER-valued or OVER-valued? Problem THREE: Use the DATA in the assignment link Portfolio Beta Problem FOUR: Use the DATA in the assignment link Beta (slope) Alpha (intercept) CORR (correlation) R? (Goodness of Fit) How much of the return on the stock is explained by the return on the market? SIGNATURE Problem FOUR Using the following information: 2017 2018 2019 2020 2021 MARKET 8.20 -11.40 14.90 32.50 13.70 STOCK V - 11.20 -15.50 3.80 10.75 17.5 CALCULATE: Beta (slope) Alpha (intercept) CORR (correlation) (Goodness of Fit) ANSWER QUESTION: How much of the return on STOCK V is explained by the return on the MARKET

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts