Question: PRINTER VERSION BACK Exercise 4-17 (Part Level Submission) The following information was taken from the records of Pearl Inc. for the year 2017: Income tax

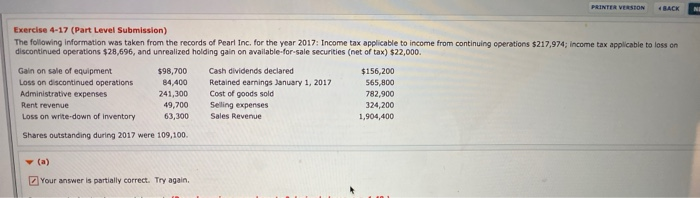

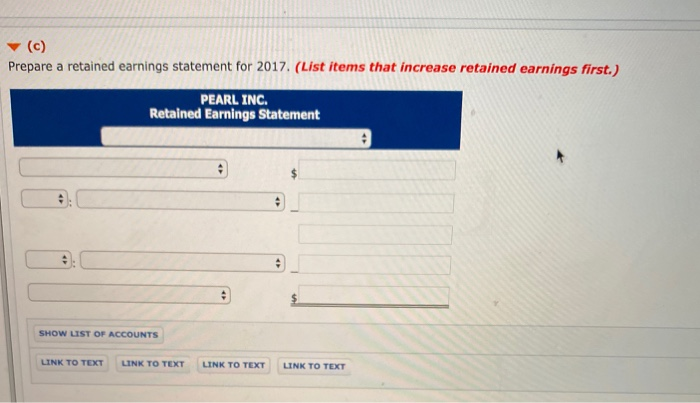

PRINTER VERSION BACK Exercise 4-17 (Part Level Submission) The following information was taken from the records of Pearl Inc. for the year 2017: Income tax applicable to income from continuing operations $217,974; Income tax applicable to loss on discontinued operations $28,696, and unrealized holding gain on available for sale securities (net of tax) $22,000. Gain on sale of equipment Loss on discontinued operations Administrative expenses Rent revenue Loss on write down of inventory $98,700 84,400 241,300 49,700 63,300 Cash dividends declared Retained earnings January 1, 2017 Cost of goods sold Selling expenses Sales Revenue $156,200 565,800 782,900 324,200 1,904,400 Shares outstanding during 2017 were 109,100 Your answer is partially correct. Try again. Prepare a retained earnings statement for 2017. (List items that increase retained earnings first.) PEARL INC. Retained Earnings Statement SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts