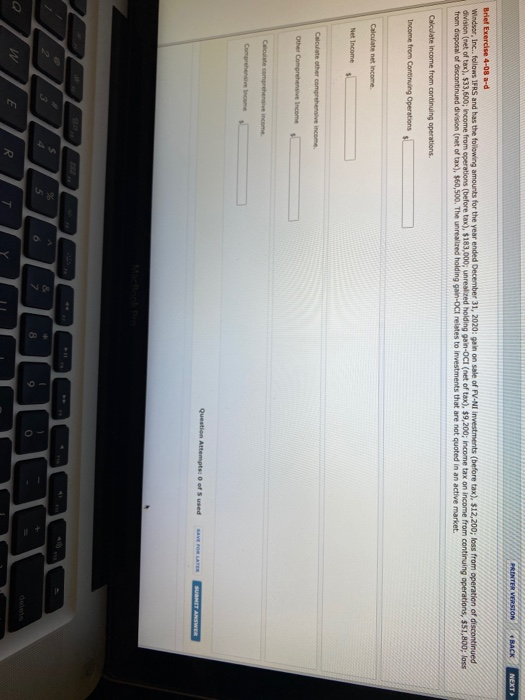

Question: PRINTER VERSION BACK NEXT Brief Exercise 4-08 a-d Windsor, Inc.. follows IFRS and has the following amounts for the year ended December 31, 2020: gain

PRINTER VERSION BACK NEXT Brief Exercise 4-08 a-d Windsor, Inc.. follows IFRS and has the following amounts for the year ended December 31, 2020: gain on sale of PV-NI investments (before tax). $12,200; loss from operation of discontinued division (net of tax) $33,600; income from operations (before tax) $183,000; unrealized holding gain-OCI (net of tax). $9,200; income tax on income from continuing operations, 551,800; lass from disposal of discontinued division (net of tax), 160,500. The unrealized holding gain-OCI relates to investments that are not quoted in an active market. Calculate income from continuing operations Income from Continuing Operations Calculate net income Net Income 5 Calculate the comprehensive income Other Comprehensive Income Ce comprehensive income Comores come Question Attempts of sused E LATER SUBMIT ANSWER . 3 s 6 & 7 8 9 Q E R

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts