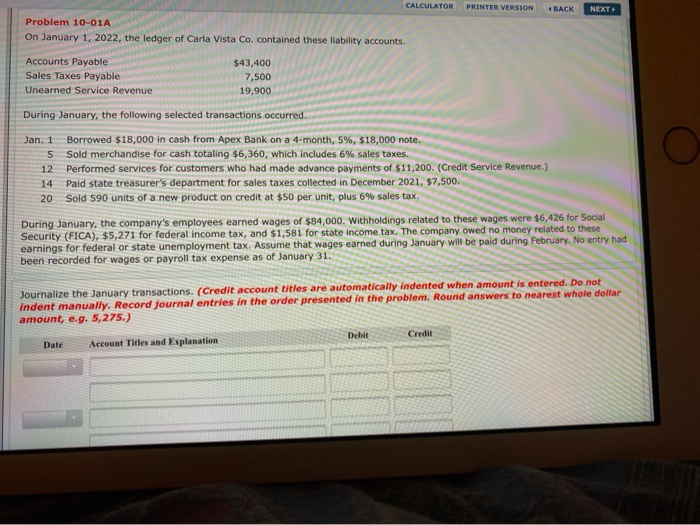

Question: PRINTER VERSION BACK NEXT CALCULATOR Problem 10-01A On January 1, 2022, the ledger of Carla Vista Co. contained these liability accounts Accounts Payable $43,400 Sales

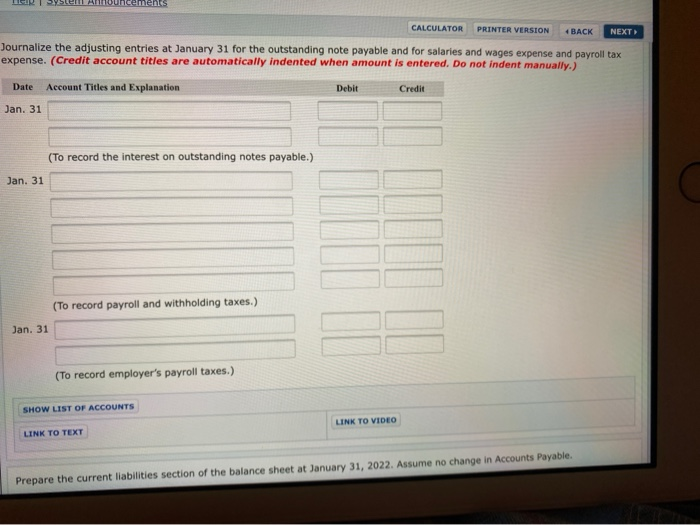

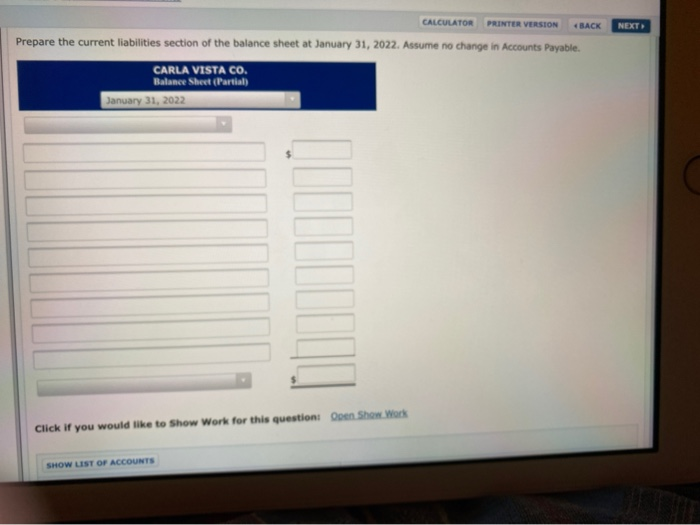

PRINTER VERSION BACK NEXT CALCULATOR Problem 10-01A On January 1, 2022, the ledger of Carla Vista Co. contained these liability accounts Accounts Payable $43,400 Sales Taxes Payable Unearned Service Revenue 7.500 carosenice Revenue 19.900 During January, the following selected transactions occurred. Jan. 1 5 12 14 20 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note Sold merchandise for cash totaling $6,360, which includes 6% sales taxes Performed services for customers who had made advance payments of $11,200. (Credit Service Revenue.) Paid state treasurer's department for sales taxes collected in December 2021, $7,500. Sold 590 units of a new product on credit at $50 per unit, plus 6% sales tax During January, the company's employees earned wages of $84,000. Withholdings related to these wages were $6,426 for Social Security (FICA), $5,271 for federal income tax, and $1,581 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. No entry had been recorded for wages or payroll tax expense as of January 31. Journalize the January transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to nearest whole dollar amount, e.g. 5,275.) Debit Credit Date Account Titles and Explanation Date Account Titles and Explanation CALCULATOR PRINTER VERSION Debit BACK Credit NEXT SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) CALCULATOR PRINTER VERSION BACK NEXT Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 (To record the interest on outstanding notes payable.) Jan. 31 (To record payroll and withholding taxes.) Jan. 31 (To record employer's payroll taxes.) SHOW LIST OF ACCOUNTS LINK TO VIDEO LINK TO TEXT Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable CALCULATOR PRINTER VERSION BACK Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable NEXT CARLA VISTA CO. Balance Sheet(Partial) January 31, 2022 Click if you would like to show Work for this questions Open Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts