Question: PRINTER VERSION BACK NEXT Exercise 11-13 (Part Level Submission) According to a payroll register summary of Frederickson Company, the amount of employees' gross pay in

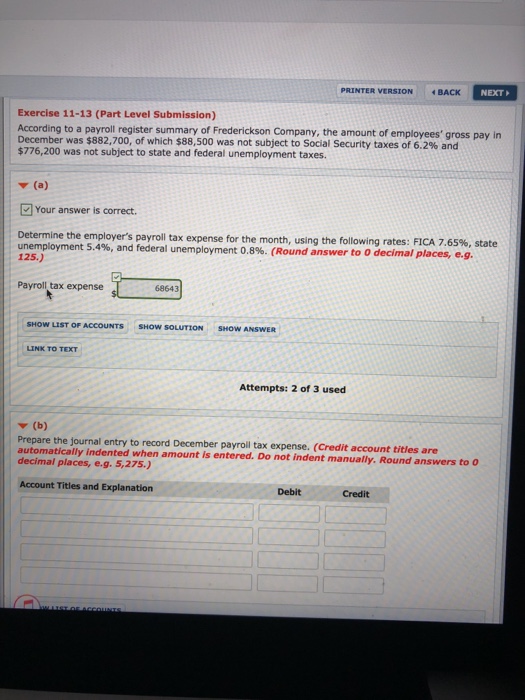

PRINTER VERSION BACK NEXT Exercise 11-13 (Part Level Submission) According to a payroll register summary of Frederickson Company, the amount of employees' gross pay in December was $882,700, of which $88,500 was not subject to Social Security taxes of 6.2% and 776,200 was not subject to state and federal unemployment taxes. Your answer is correct. Determine the employer's payroll tax expense for the month, using the following rates: FICA 7.65%, state unemployment 5.4%, and federal unemployment 0.8%, (Round answer to 0 decimal places, eg, 125 Payroll tax expenses SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER LINK TO TEXT Attempts: 2 of 3 used Prepare the journal entry to record December payroll tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,275 Account Titles and Explanation Debit Credit rt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts