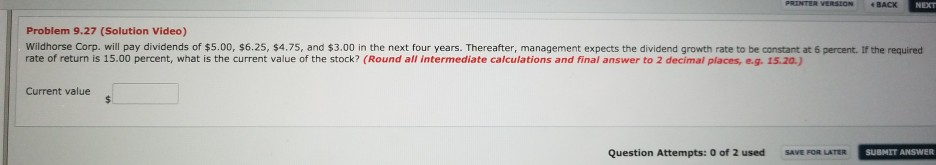

Question: PRINTER VERSION BACK NEXT Problem 9.27 (Solution Video) Wildhorse Corp. will pay dividends of $5.00, $6.25, $4.75, and $3.00 in the next four years. Thereafter,

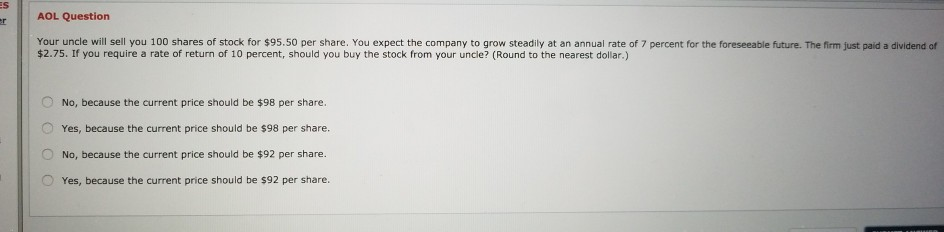

PRINTER VERSION BACK NEXT Problem 9.27 (Solution Video) Wildhorse Corp. will pay dividends of $5.00, $6.25, $4.75, and $3.00 in the next four years. Thereafter, management expects the dividend growth rate to be constant at 6 percent. If the required rate of return is 15.00 percent, what is the current value of the stock? (Round all intermediate calculations and final answer to 2 decimal places, e.g. 15.20.) Current value Question Attempts: 0 of 2 used SAVE FOR LATER SUBMIT ANSWER ES AOL Question Your uncle will sell you 100 shares of stock for $95.50 per share. You expect the company to grow steadily at an annual rate of 7 percent for the foreseeable future. The firm just paid a dividend of $2.75. If you require a rate of return of 10 percent, should you buy the stock from your uncle? (Round to the nearest dollar.) No, because the current price should be $98 per share O Yes, because the current price should be $98 per share. O No, because the current price should be $92 per share Yes, because the current price should be $92 per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts