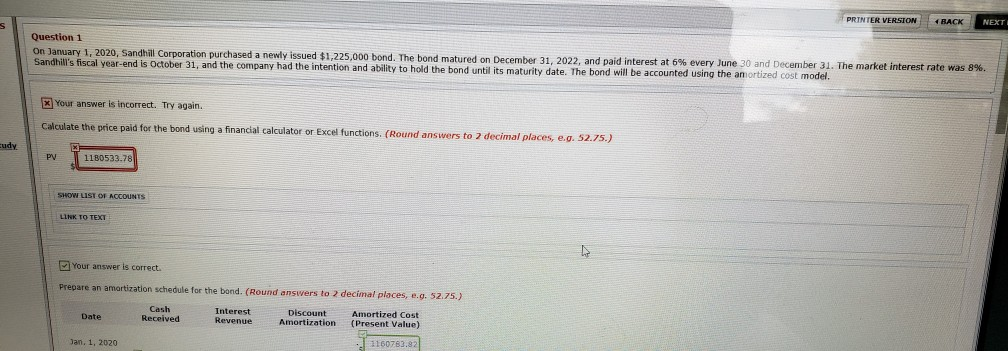

Question: PRINTER VERSION BACK Question 1 On January 1, 2020, Sandhill Corporation purchased a newly issued $1,225,000 bond. The bond matured on December 31, 2022, and

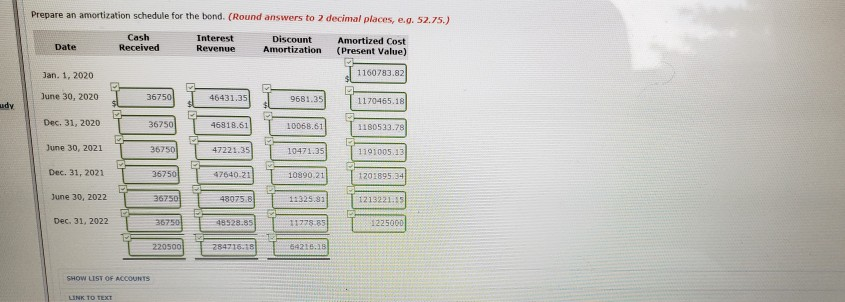

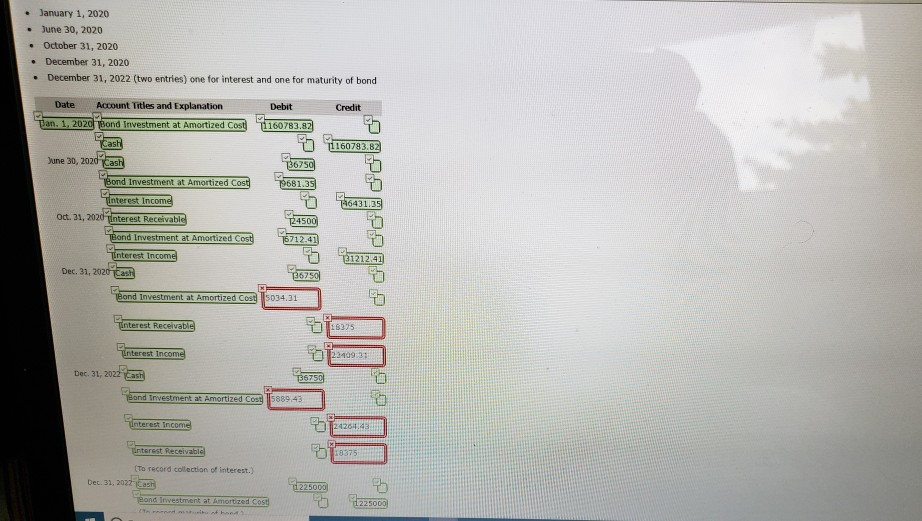

PRINTER VERSION BACK Question 1 On January 1, 2020, Sandhill Corporation purchased a newly issued $1,225,000 bond. The bond matured on December 31, 2022, and paid interest at 6% every June 30 and December 31. The market interest rate was 8%. Sandhill's fiscal year-end is October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortized cost model. x Your answer is incorrect. Try again. Calculate the price paid for the bond using a financial calculator or Excel functions. (Round answers to 2 decimal places, e.g. 52.75.) dy PV 1180533.76 SHOW LIST OF ACCOUNTS LINK TO TEXT your answer is correct. Prepare an amortization schedule for the bond. (Round answers to 2 decimal places, e.o. 52.75.) Date Cash Received Interest Revenue Discount Amortization Amortized Cost (Present Value) 11607632 Prepare an amortization schedule for the bond. (Round answers to 2 decimal places, e.g. 52.75.) Date Cash Received Interest Revenue Discount Amortization Amortized Cost (Present Value) Jan. 1, 2020 1160783.82 June 30, 2020 1170465 wdy. Dec 31, 2020 45818.61 10058.60 1130523.75 June 30, 2021 Dec. 31, 2021 97640 June 30, 20221 Dec 31, 2022 74715.15 SHOW LIST OF ACCOUNTS January 1, 2020 June 30, 2020 October 31, 2020 December 31, 2020 December 31, 2022 (two entries) one for interest and one for maturity of bond Date Account Titles and Explanation Debit an. 1.2020 Bond Investment at Amortized Cost 41160783.82 0681.35 June 30, 2020 Cash Bond Investment at Amortized Cost interest Income Oct. 21, 2020 interest Receivable Bond Investment at Amortized Cost interest Income Dec 31, 2020-Cash 15712.41 36750 Bond Investment at Amortized Cod 5034.31 1.00.00.dll interest Receivable T Interest Income Dec 31, 2022 Cash Bond Tnvestment at Amortized Cost 16750 interest Income interest Receivable (To record collection of Interest. Dec 31, 20271Cash Fond Investment at Amortized Cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts