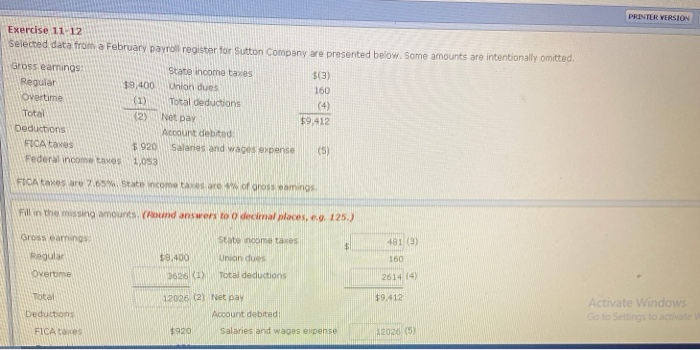

Question: PRINTER VERSION Exercise 11 12 Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted. Gross earnings:

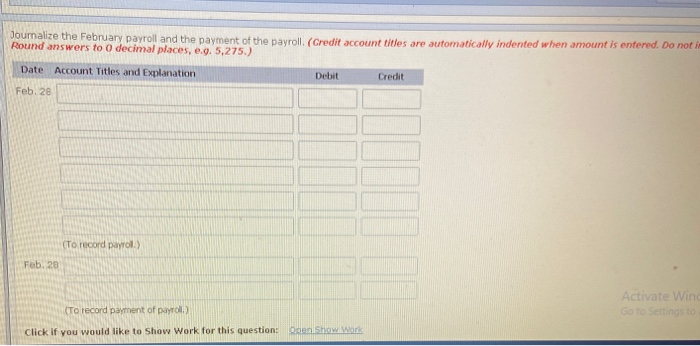

PRINTER VERSION Exercise 11 12 Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted. Gross earnings: State income taxes Regular 19,400 Union dues Overtime (1) Total deductions Total 2 Net Day $9.412 Deductions Account debited FICA taxes $920 Salaries and wages expense (5) Federal income tax 1,053 FICA taxes are 2.65% State income taxes are of gross emings Fill in the missing amounts (round answers to decimal places, eg. 125.) Gross caminos State income taxes Union du Regular $8.400 Overtime (1) Total deductions 2614 19 Total 19.412 Activate Windows Go to Settings to activate Deductor 12028 (2) Net pay Account debited 1920 Salaries and wages expense FICA taxe Journalize the February payroll and the payment of the payroll. (Credit account titles are automatically indented when amount is entered. Do not in Round answers to o decimal places, .9. 5,275.) Date Account Titles and Explanation Feb. 28 Debit Credit To record payrol.) Feb. 28 Activate Wing (To record payment of payroll) Click if you would like to show Work for this question: Coen Show wa

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts