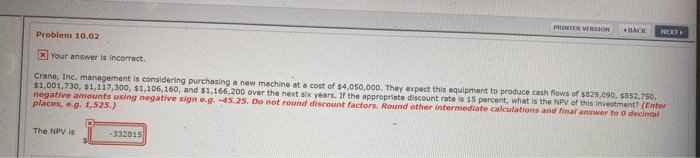

Question: PRINTER VERSION HACK NEXT Problem 10.02 Your answer is incorrect. Crane, Inc. management is considering purchasing a new machine at a cost of $4.050.000. They

PRINTER VERSION HACK NEXT Problem 10.02 Your answer is incorrect. Crane, Inc. management is considering purchasing a new machine at a cost of $4.050.000. They expect this equipment to produce cash flows of 5829,090, 052.750 $1,001,730, $1.117,300, 51,106,160, and $1,166,200 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative signe.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to decimal places, e.g. 1.525.) The NPV is -332815

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts