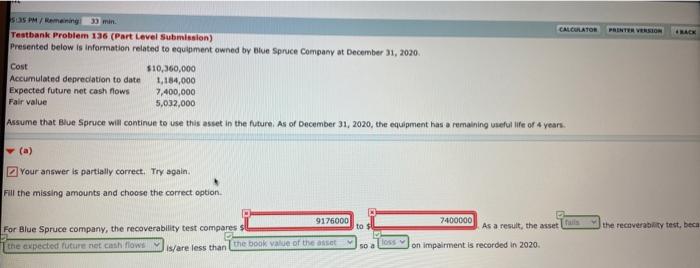

Question: PRINTER VERSION SUSPM/Remening CALCULATOR Testbank Problem 136 (Part Level Submission) Presented below is information related to equipment owned by Blue Spruce Company at December 31,

PRINTER VERSION SUSPM/Remening CALCULATOR Testbank Problem 136 (Part Level Submission) Presented below is information related to equipment owned by Blue Spruce Company at December 31, 2020 Cost $10,360,000 Accumulated depreciation to date 1,184,000 Expected future net cash flows 7,400,000 Fair value 5,032,000 Assume that Blue Spruce will continue to use this asset in the future. As of December 31, 2020, the equipment has a remaining elife of years. (a) Your answer is partially correct. Try again. Fill the missing amounts and choose the correct option ta the recoverability test, beca For Blue Spruce company, the recoverability test compares 9176000 the expected future net cash flow Mis/are less than the book value of the asset 7400000 As a result, the asset on impairment is recorded in 2020. so a Toss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts