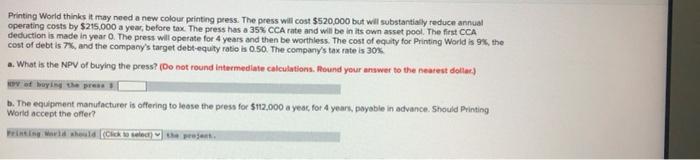

Question: Printing World thinks it may need a new colour printing press. The press will cost $520,000 but wil substantially reduce annual operating costs by $215.000

Printing World thinks it may need a new colour printing press. The press will cost $520,000 but wil substantially reduce annual operating costs by $215.000 a year, before tax. The press has a 35% CCA rate and will be in its own asset pool. The first CCA deduction is made in year . The press will operate for 4 years and then be worthless. The cost of equity for Printing World is 9%, the cost of debt is 7%, and the company's target debt-equity ratio is 0.50. The company's tax rate is 30% .. What is the NPV of buying the press? (Do not round Intermediate calculations. Round your answer to the nearest dollar) v bare b. The equipment manufacturer is offering to loose the press for $112.000 a year, for 4 years, poyable in advance. Should Printing World accept the offer? Click to elect) y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts