Question: prior problem need answer to #9 i have #8 filled in. Using the information from the prior problem, how much would the bank need to

prior problem

need answer to #9 i have #8 filled in.

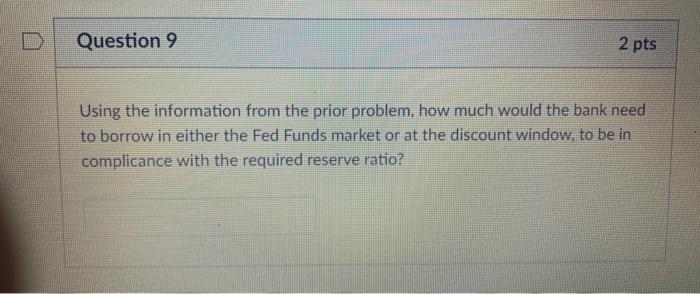

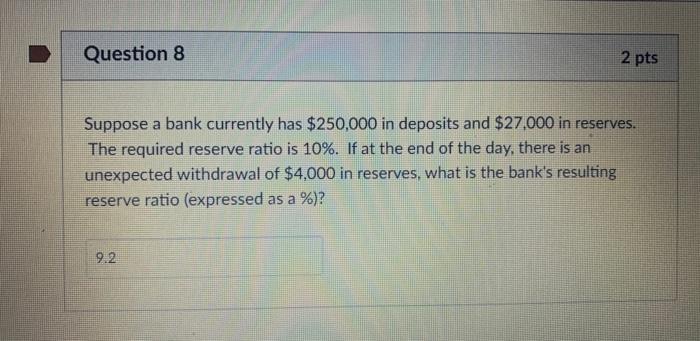

Using the information from the prior problem, how much would the bank need to borrow in either the Fed Funds market or at the discount window, to be in complicance with the required reserve ratio? Suppose a bank currently has $250,000 in deposits and $27,000 in reserves. The required reserve ratio is 10%. If at the end of the day, there is an unexpected withdrawal of $4,000 in reserves, what is the bank's resulting reserve ratio (expressed as a \%)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock