Question: Pro Engineering, Inc. had the following transactions during the first month of business as a proprietorship. Journalize the transactions. (Credit account titles are automatically indented

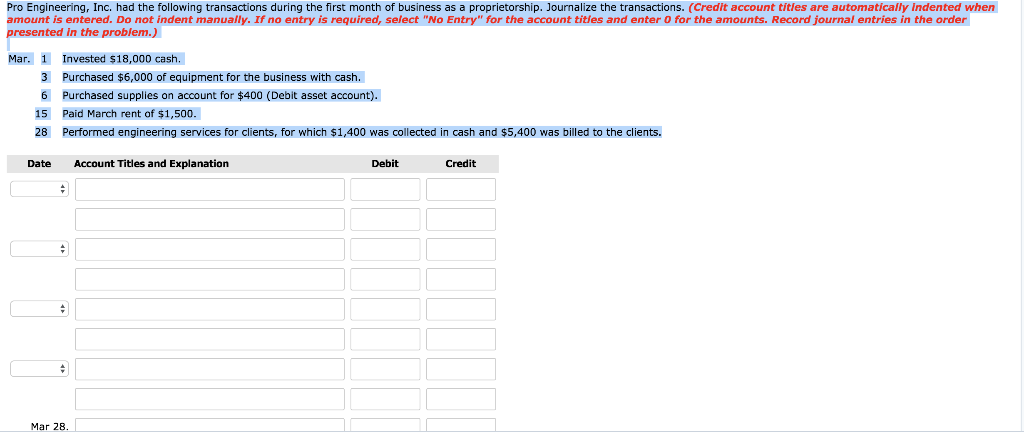

Pro Engineering, Inc. had the following transactions during the first month of business as a proprietorship. Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Mar. 1 Invested $18,000 cash. 3 Purchased $6,000 of equipment for the business with cash. 6 Purchased supplies on account for $400 (Debit asset account). 15 Paid March rent of $1,500. 28 Performed engineering services for clients, for which $1,400 was collected in cash and $5,400 was billed to the clients.

Pro Engineering, Inc. had the following transactions during the first month of business as a proprietorship. Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Mar. 1 Invested $18,000 cash. 3 Purchased $6,000 of equipment for the business with cash. 6 Purchased supplies on account for $400 (Debit asset account). 15 Paid March rent of $1,500. 28 Performed engineering services for clients, for which $1,400 was collected in cash and $5,400 was billed to the clients.

Pro Engineering, Inc. had the following transactions during the first month of business as a proprietorship. Journalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Mar. 1 3 6 15 28 Invested $18,000 cash. Purchased $6,000 of equipment for the business with cash. Purchased supplies on account for $400 (Debit asset account). Paid March rent of $1,500. Performed engineering services for clients, for which $1,400 was collected in cash and $5,400 was billed to the clients. Date Account Titles and Explanation Debit Credit Mar 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts