Question: Pro Forma Balance Sheet: Just need Common Stock & Retained Earnings, External Funds required, and Total liabilities and stockholders equity, and the multiple choice question

Pro Forma Balance Sheet:

Just need Common Stock & Retained Earnings, External Funds required, and Total liabilities and stockholders equity, and the multiple choice question

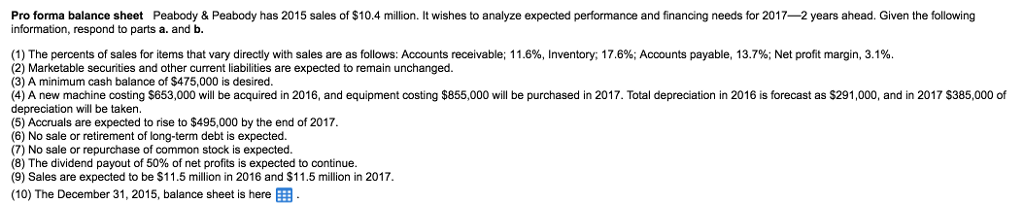

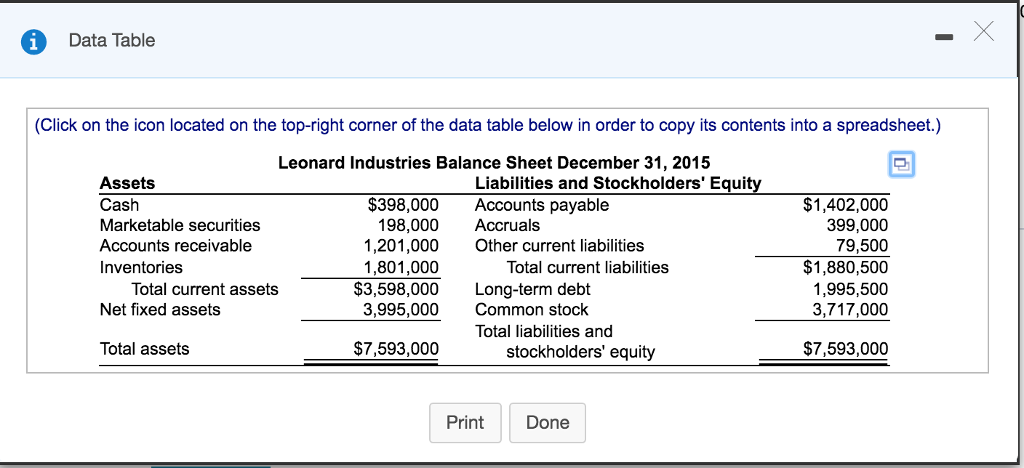

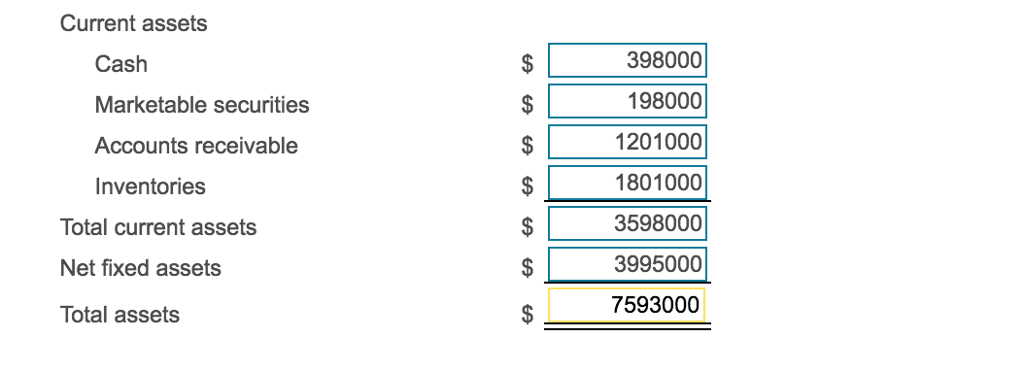

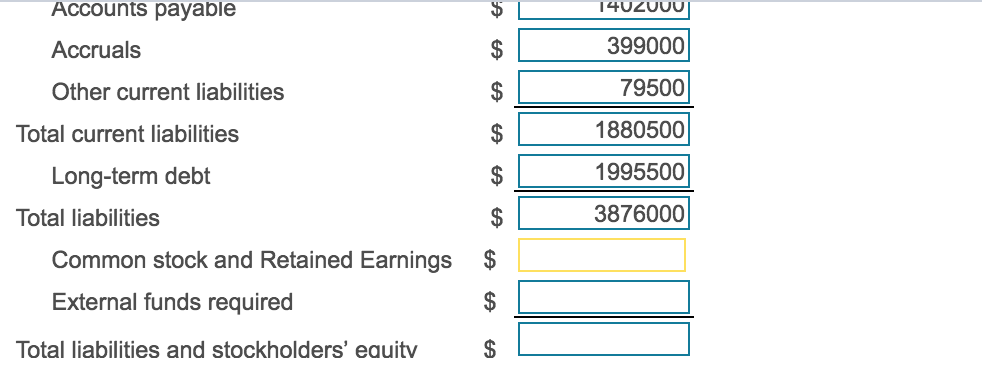

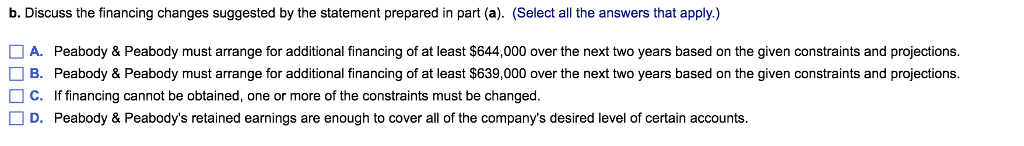

Pro forma balance sheet Peabody & Peabody has 2015 sales of $10.4 million. It wishes to analyze expected performance and financing needs for 2017-2 years ahead. Given the following information, respond to parts a. and b 1) The percents of sales for items that vary directly with sales are as follows Accounts rece able: 11.6%, Inventory: 17.6% Accounts payable 13.7% Net profit margin, a (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $475,000 is desired. (4) A new machine costing $653,000 will be acquired in 2016, and equipment costing $855,000 will be purchased in 2017. Total depreciation in 2016 is forecast as $291,000, and in 2017 $385,000 of depreciation will be taken. (5) Accruals are expected to rise to $495,000 by the end of 2017. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profits is expected to continue. (9) Sales are expected to be S11.5 million in 2016 and $11.5 million in 2017 1% (10) The December 31, 2015, balance sheet is here EEB Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Leonard Industries Balance Sheet December 31, 2015 $398,000 Accounts payable Assets Cash Marketable securities Accounts receivable Inventories Liabilities and Stockholders' Equity $1,402,000 399,000 79,500 $1,880,500 1,995,500 3,717,000 198,000 Accruals 1,201,000 Other current liabilities 1,801,000 Total current liabilities Total current assets $3,598,000 Long-term debt Net fixed assets 3,995,000 Common stock Total liabilities and Total assets $7,593,000 stockholders' equity $7,593,000 Print Done Current assets Cash Marketable securities Accounts receivable Inventories 398000 198000 1201000 1801000 3598000 3995000 7593000 Total current assets Net fixed assets Total assets Accounts payable Accruals Other current liabilities 399000 79500 1880500 1995500 3876000 Total current liabilities Long-term debt Total liabilities Common stock and Retained Earnings External funds required $ Total liabilities and stockholders' eauitv S b. Discuss the financing changes suggested by the statement prepared in part (a). (Select all the answers that apply.) A. Peabody & Peabody must arrange for additional financing of at least $644,000 over the next two years based on the given constraints and projections. B. Peabody & Peabody must arrange for additional financing of at least $639,000 over the next two years based on the given constraints and projections. C. If financing cannot be obtained, one or more of the constraints must be changed. D. Peabody & Peabody's retained earnings are enough to cover all of the company's desired level of certain accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts