Question: Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total

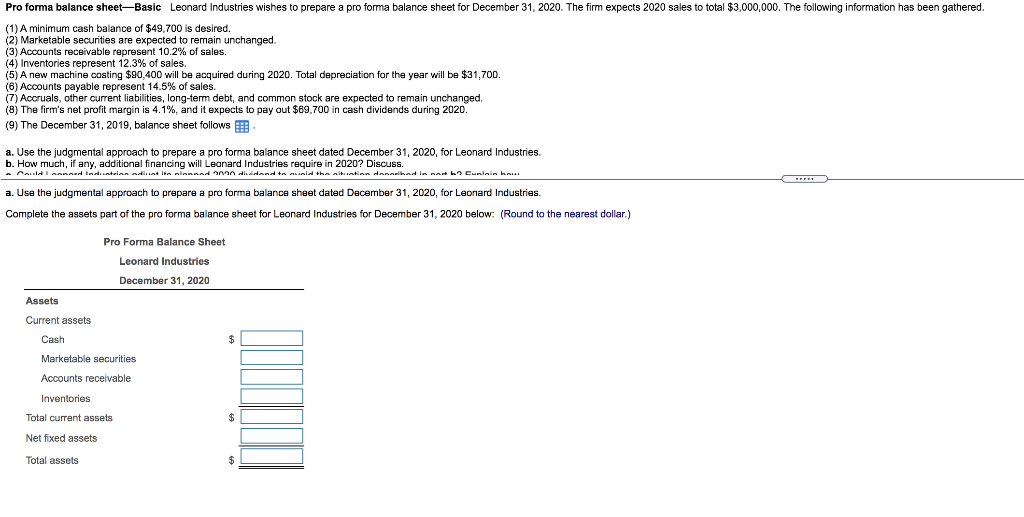

Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total $3,000,000. The following information has been gathered. (1) A minimum cash balance of $49.700 is desired. (2) Marketable securities are expected to remain unchanged. (3) Accounts receivable represent 10.2% of sales. (4) Inventories represent 12.3% of sales (5) A new machine costing $90,400 will be acquired during 2020. Total depreciation for the year will be $31,700. (6) Accounts payable represent 14.5% of sales. (7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged. (8) The firm's net profit margin is 4.1%, and it expects to pay out $69,700 in cash dividends during 2020. (9) The December 31, 2019, balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries b. How much, if any, additional financing will Leonard Industries require in 2020? Discuss. dlanned indentelan edilist le ninnned aan die didend te sild the station denselbad in na 12 Cuntain he... a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries. Complete the assets part of the pro forma balance sheet for Leonard Industries for December 31, 2020 below: (Round to the nearest dollar.) Pro Forma Balance Sheet Leonard Industries December 31, 2020 Assets Current assets Cash $ Marketable securities Accounts receivable Inventories Total current assets $ Net fixed assets Total assets $ Pro forma balance sheet-Basic Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total $3,000,000. The following information has been gathered. (1) A minimum cash balance of $49.700 is desired. (2) Marketable securities are expected to remain unchanged. (3) Accounts receivable represent 10.2% of sales. (4) Inventories represent 12.3% of sales (5) A new machine costing $90,400 will be acquired during 2020. Total depreciation for the year will be $31,700. (6) Accounts payable represent 14.5% of sales. (7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged. (8) The firm's net profit margin is 4.1%, and it expects to pay out $69,700 in cash dividends during 2020. (9) The December 31, 2019, balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries b. How much, if any, additional financing will Leonard Industries require in 2020? Discuss. dlanned indentelan edilist le ninnned aan die didend te sild the station denselbad in na 12 Cuntain he... a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries. Complete the assets part of the pro forma balance sheet for Leonard Industries for December 31, 2020 below: (Round to the nearest dollar.) Pro Forma Balance Sheet Leonard Industries December 31, 2020 Assets Current assets Cash $ Marketable securities Accounts receivable Inventories Total current assets $ Net fixed assets Total assets $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts