Question: Pro forma. You are a financial analyst that has been hired to forecast the possible funding need for a company based on its financial information

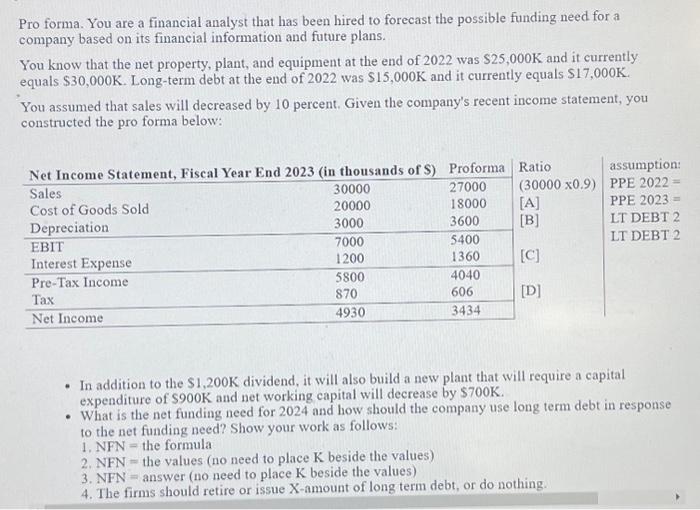

Pro forma. You are a financial analyst that has been hired to forecast the possible funding need for a company based on its financial information and future plans. You know that the net property, plant, and equipment at the end of 2022 was $25,000K and it currently equals $30,000K. Long-term debt at the end of 2022 was $15,000K and it currently equals $17,000K. You assumed that sales will decreased by 10 percent. Given the company's recent income statement, you constructed the pro forma below: - In addition to the $1,200K dividend, it will also build a new plant that will require a capital expenditure of $900K and net working capital will decrease by $700K. - What is the net funding need for 2024 and how should the company use long term debt in response to the net funding need? Show your work as follows: 1. NFN = the formula 2. NFN= the values (no need to place K beside the values) 3. NFN = answer (no need to place K beside the values) 4. The firms should retire or issue X-amount of long term debt, or do nothing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts