Question: Pro Limited own an office block. The office block had cost N$1,000,000.00 on 1 January 2014. Its residual value is estimated to be nil and

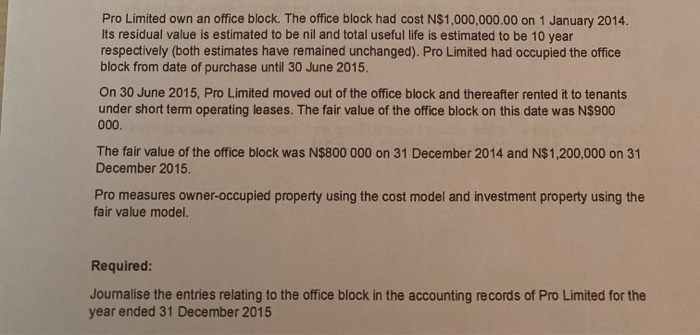

Pro Limited own an office block. The office block had cost N$1,000,000.00 on 1 January 2014. Its residual value is estimated to be nil and total useful life is estimated to be 10 year respectively (both estimates have remained unchanged). Pro Limited had occupied the office block from date of purchase until 30 June 2015. On 30 June 2015, Pro Limited moved out of the office block and thereafter rented it to tenants under short term operating leases. The fair value of the office block on this date was N$900 000. The fair value of the office block was N$800 000 on 31 December 2014 and N$1,200,000 on 31 December 2015 Pro measures owner-occupied property using the cost model and investment property using the fair value model Required: Journalise the entries relating to the office block in the accounting records of Pro Limited for the year ended 31 December 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts